You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Hmmm. DAX has bounced nicely this morning.

Disappointed with myself - again!

Am way too jumpy with myself regarding these weekly trades - all because I want to try and build / maintain a winning streak!! Must give trades time to 'breathe'!

You do seem to find it hard to stick to your initial stop loss. I've been experimenting with when to move mine using the ATR for distance. I trying to limit my stop moves to once a day and only when the daily is moving in my favour, but trying to keep it at just over an average days range. So for example if I'm up 0.5% ATR adjusted at the end of day one then I would be able to move my stop to just below -0.5% ATR adjusted.

Thanks isa. I may give it a try.

Down to my poor discipline at the root of it.

Doubly disappointed because DAX is close to where I estimated!! 😏

Down to my poor discipline at the root of it.

Doubly disappointed because DAX is close to where I estimated!! 😏

You do seem to find it hard to stick to your initial stop loss. I've been experimenting with when to move mine using the ATR for distance. I trying to limit my stop moves to once a day and only when the daily is moving in my favour, but trying to keep it at just over an average days range. So for example if I'm up 0.5% ATR adjusted at the end of day one then I would be able to move my stop to just below -0.5% ATR adjusted.

tradeAweek

Member

- Messages

- 52

- Likes

- 0

@isa:

Continuing on our conversation on TLT/Yields. I believe the yields may be ready to take off (implying a bonds crash). See attached chart on a possible Right shoulder of a head and shoulder formation in progress. The opposing views is what makes the market.

Continuing on our conversation on TLT/Yields. I believe the yields may be ready to take off (implying a bonds crash). See attached chart on a possible Right shoulder of a head and shoulder formation in progress. The opposing views is what makes the market.

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

@isa:

Continuing on our conversation on TLT/Yields. I believe the yields may be ready to take off (implying a bonds crash). See attached chart on a possible Right shoulder of a head and shoulder formation in progress. The opposing views is what makes the market.

I like the simplicity of point and figure charts for looking at this. The SPY/TLT ratio is in a column of Os so the S&P 500 needs to rally 6% relative to the TLT to change my opinion at the moment. And the NYSE Bullish Percent Chart needs to reverse back to Xs as well. Both look like they've got further to go to downside yet IMO judging from the last 10 years.

Attachments

tradeAweek

Member

- Messages

- 52

- Likes

- 0

@isa: I'd like to change my entry price and stop on Silver trade.

Sell stop @ 35.07

Stop Loss @ 35.97

Thanks.

Sell stop @ 35.07

Stop Loss @ 35.97

Thanks.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

@isa: I'd like to change my entry price and stop on Silver trade.

Sell stop @ 35.07

Stop Loss @ 35.97

Thanks.

Ok, no problem I will update the spreadsheet for you.

tradeAweek

Member

- Messages

- 52

- Likes

- 0

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Positions Update

A small bounce near the end of the session today with the S&P 500 very near to the 200 day moving average. collin2985 position in BTM stormed into the lead today and closed up 2.92% ATR adjusted so should be an interesting close to the week tomorrow.

A small bounce near the end of the session today with the S&P 500 very near to the 200 day moving average. collin2985 position in BTM stormed into the lead today and closed up 2.92% ATR adjusted so should be an interesting close to the week tomorrow.

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Hi traeAweek, your sell stop order was filled for silver at 35.07

Here's the full entry details:

Trade Details:

Silver (July Contract)

Direction: Short

Entry: 35.07

Stop: 35.97

Target: 32

Percentage Risk: 2.57% (-0.73% ATR Adjusted)

Target Gain: 9.59% (2.79% ATR Adjusted)

Risk Ratio: 3.74

Daily ATR(200): 1.2055 (3.44%)

Weekly ATR(52): 2.6237 (7.48%)

ATR Targets

-1x ATR: 36.28

1x ATR: 33.86

1.5x ATR: 33.26

2x ATR: 32.66

Good luck and remember it will be closed at the end of the day today if you don't exit manually during the day today.

Here's the full entry details:

Trade Details:

Silver (July Contract)

Direction: Short

Entry: 35.07

Stop: 35.97

Target: 32

Percentage Risk: 2.57% (-0.73% ATR Adjusted)

Target Gain: 9.59% (2.79% ATR Adjusted)

Risk Ratio: 3.74

Daily ATR(200): 1.2055 (3.44%)

Weekly ATR(52): 2.6237 (7.48%)

ATR Targets

-1x ATR: 36.28

1x ATR: 33.86

1.5x ATR: 33.26

2x ATR: 32.66

Good luck and remember it will be closed at the end of the day today if you don't exit manually during the day today.

TradeTheEasyWay

Well-known member

- Messages

- 478

- Likes

- 4

nzdchf _- better close here, markets like the greek news - its 6845 as i speak but over to you dave

Mike

Mike

tradeAweek

Member

- Messages

- 52

- Likes

- 0

EXIT.

No momentum and not enough time for the trade to work.

No momentum and not enough time for the trade to work.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

nzdchf _- better close here, markets like the greek news - its 6845 as i speak but over to you dave

Mike

Hi Mike, your exit time was 12.11pm on the thread so I have as 0.6844

Here's the closing trade details

Closing Trade

NZDCHF (FX:NZDCHF)

Direction: Short

Entry: 0.6898

Exit: 0.6844

Points Gain: 54

ATR Adjusted Percentage Gain: 0.66%

Trade Grade: C

That puts you in the lead of the closed positions so far. Colin still leads the open positions but it's lost about 1.5% ATR adjusted today so you could still be the winner with this one if it falls further.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Hi tradeAweek, your exit time on the thread was 12.48 so the price was 35.382

Here's the closing trade details

Closing Trade

Silver (July Contract)

Direction: Short

Entry: 35.07

Exit: 35.382

Percentage loss: -0.88%

ATR Adjusted Percentage loss: -0.26%

Trade Grade: D

Here's the closing trade details

Closing Trade

Silver (July Contract)

Direction: Short

Entry: 35.07

Exit: 35.382

Percentage loss: -0.88%

ATR Adjusted Percentage loss: -0.26%

Trade Grade: D

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Week 20 Results

Name______ATR Adjusted Percentage

collin2985__________2.15%

TradeTheEasyWay____0.66%

SlipperyC___________0.07%

isatrader___________-0.22%

tradeAweek________-0.26%

Pat494_____________scratched

A second win for collin2985 in two weeks with an excellent 2.15% ATR adjusted gain. This could have been much better however, as it was around 3% yesterday. So setting a exit target could have even gotten a better result. But well done on the win 👍

My tightening of my stop loss today cost me a little bit as I got stopped out at the low tick of the day. Sods law eh! But thought I needed to protect overall percentage as it was the last day.

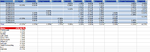

Attached is the trades spreadsheet of all the weeks trades

Name______ATR Adjusted Percentage

collin2985__________2.15%

TradeTheEasyWay____0.66%

SlipperyC___________0.07%

isatrader___________-0.22%

tradeAweek________-0.26%

Pat494_____________scratched

A second win for collin2985 in two weeks with an excellent 2.15% ATR adjusted gain. This could have been much better however, as it was around 3% yesterday. So setting a exit target could have even gotten a better result. But well done on the win 👍

My tightening of my stop loss today cost me a little bit as I got stopped out at the low tick of the day. Sods law eh! But thought I needed to protect overall percentage as it was the last day.

Attached is the trades spreadsheet of all the weeks trades

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Q2 League Table

Name_____ATR Adjusted Percentage

tradeAweek_______3.36%

dmt257___________3.00%

Pat494___________1.86%

collin2985_________1.57%

Canto1922________1.55%

CityTrader90_______1.39%

SlipperyC_________0.61%

isatrader__________0.32%

TradeTheEasyWay___-1.64%

A_fr______________-2.56%

wigtrade__________-4.23%

Name______Performance Points

Pat494_____________3

collin2985__________2

dmt257____________2

TradeTheEasyWay____1

CityTrader90________1

Canto1922__________1

isatrader___________1

tradeAweek still leads overall on a percentage basis with 3.36%, but is going to be a close finish to the quarter.

Attached is the percentage table for the last 11 weeks.

There's only two weeks left this quarter so get your picks in as normal over the weekend.

Name_____ATR Adjusted Percentage

tradeAweek_______3.36%

dmt257___________3.00%

Pat494___________1.86%

collin2985_________1.57%

Canto1922________1.55%

CityTrader90_______1.39%

SlipperyC_________0.61%

isatrader__________0.32%

TradeTheEasyWay___-1.64%

A_fr______________-2.56%

wigtrade__________-4.23%

Name______Performance Points

Pat494_____________3

collin2985__________2

dmt257____________2

TradeTheEasyWay____1

CityTrader90________1

Canto1922__________1

isatrader___________1

tradeAweek still leads overall on a percentage basis with 3.36%, but is going to be a close finish to the quarter.

Attached is the percentage table for the last 11 weeks.

There's only two weeks left this quarter so get your picks in as normal over the weekend.

Attachments

tradeAweek

Member

- Messages

- 52

- Likes

- 0

No change in my pick this week. I've been scouting silver for several weeks for a break down from the consolidation.

Short Spot Silver

Warehoused order.

Short Spot Silver

Warehoused order.

collin2985

Newbie

- Messages

- 7

- Likes

- 0

Bank Nova Scotia Halifax Pfd 3(NYSE: BNS )

Short

Market order

No Stop

No Target

There's some divergence and SPX may try to break lower dragging this one with it.

Short

Market order

No Stop

No Target

There's some divergence and SPX may try to break lower dragging this one with it.

Similar threads

- Replies

- 3

- Views

- 3K

- Replies

- 44

- Views

- 13K

- Replies

- 3

- Views

- 2K