You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

tradeAweek

Member

- Messages

- 52

- Likes

- 0

EXIT. 1532.5 on my trade.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

EXIT. 1532.5 on my trade.

Hi tradeAweek. Your exit time on the thread was 11.45am so the closing price on the one minute bar I have is 1532.6

Here's the closing trade details:

Closing Trade

Gold

Direction: Short

Entry: 1553.5

Exit: 1532.6

Percentage Gain: 1.36%

ATR Adjusted Percentage Gain: 1.02%

Trade Grade: B

Well done tradeAweek. A nice B grade trade, and puts you in the lead so far. 👍

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

exit

My closing time on the thread was 5.56pm so the closing price was 96.4501

Closing Trade

Ishares Barclays 20+ Year Treasury Bond Fund (NYSE:TLT)

Direction: Long

Entry: 95.58

Exit: 96.4501

Percentage Gain: 0.91%

ATR Adjusted Percentage Gain: 0.73%

Trade Grade: C

My exit was a bit premature but it has put me back into positive territory for this quarter overall. So am happy with that.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Hi Mike, unfortunately your stop loss on the EURJPY was hit this afternoon when it dipped below 115.9

Here's the closing trade details:

Closing Trade

EURJPY (FX:EURJPY)

Direction: Long

Entry: 117.6

Exit: 115.9

Points Loss: 170

ATR Adjusted Percentage Loss: -1.49%

Trade Grade: F

Here's the closing trade details:

Closing Trade

EURJPY (FX:EURJPY)

Direction: Long

Entry: 117.6

Exit: 115.9

Points Loss: 170

ATR Adjusted Percentage Loss: -1.49%

Trade Grade: F

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Week 19 Results

A positive week for most this week with collin2985 taking the win with a nice 1.72% ATR adjusted gain.

Name______ATR Adjusted Percentage

collin2985__________1.72%

tradeAweek_________1.02%

Canto1922__________0.80%

Pat494_____________0.78%

isatrader___________0.73%

SlipperyC__________-0.44%

TradeTheEasyWay___-1.49%

A positive week for most this week with collin2985 taking the win with a nice 1.72% ATR adjusted gain.

Name______ATR Adjusted Percentage

collin2985__________1.72%

tradeAweek_________1.02%

Canto1922__________0.80%

Pat494_____________0.78%

isatrader___________0.73%

SlipperyC__________-0.44%

TradeTheEasyWay___-1.49%

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

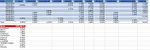

Below is the current league table and performance points for Q2 so far.

tradeAweek takes the overall ATR adjusted percentage lead with 3 weeks to go of this quarters competition :clap:

Name_____ATR Adjusted Percentage

tradeAweek_______3.62%

dmt257___________3.00%

Pat494___________1.86%

Canto1922________1.55%

CityTrader90______1.39%

SlipperyC_________0.54%

isatrader_________0.54%

collin2985________-0.58%

TradeTheEasyWay__-2.30%

A_fr_____________-2.56%

wigtrade_________-4.23%

Name______Performance Points

Pat494_____________3

dmt257____________2

TradeTheEasyWay____1

CityTrader90________1

Canto1922__________1

isatrader___________1

collin2985__________1

Remember to get your picks in by Sunday night as usual

tradeAweek takes the overall ATR adjusted percentage lead with 3 weeks to go of this quarters competition :clap:

Name_____ATR Adjusted Percentage

tradeAweek_______3.62%

dmt257___________3.00%

Pat494___________1.86%

Canto1922________1.55%

CityTrader90______1.39%

SlipperyC_________0.54%

isatrader_________0.54%

collin2985________-0.58%

TradeTheEasyWay__-2.30%

A_fr_____________-2.56%

wigtrade_________-4.23%

Name______Performance Points

Pat494_____________3

dmt257____________2

TradeTheEasyWay____1

CityTrader90________1

Canto1922__________1

isatrader___________1

collin2985__________1

Remember to get your picks in by Sunday night as usual

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Don't want to be picky but Tradeaweek is leading the ATR but has nil point on the Leaderboard. Something strange n'est pas ?

Well he's had less trades overall as only joined in 5 weeks ago, but has had 4 wins and only one small 0.22% loss. But has been consistently second or third each week. It shows you don't have to hold out for the weekly win to do well.

I think what this thread has taught me is to keep losses small and to aim for modest steady weekly gains.

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Well he's had less trades overall as only joined in 5 weeks ago, but has had 4 wins and only one small 0.22% loss. But has been consistently second or third each week. It shows you don't have to hold out for the weekly win to do well.

I think what this thread has taught me is to keep losses small and to aim for modest steady weekly gains.

Fair enough

tradeAweek

Member

- Messages

- 52

- Likes

- 0

Evening all.

My selection this week is;

DAX LIMIT LONG

Entry; 7035

Stop; 6940

Target; 7235

Reason; I think I see a channel up forming (see attached), S&P500 seems to have support at 1270 area and things are quite oversold now.

Note to self; I WILL NOT MOVE MY STOP UP TOO QUICKLY!!! 😱

My selection this week is;

DAX LIMIT LONG

Entry; 7035

Stop; 6940

Target; 7235

Reason; I think I see a channel up forming (see attached), S&P500 seems to have support at 1270 area and things are quite oversold now.

Note to self; I WILL NOT MOVE MY STOP UP TOO QUICKLY!!! 😱

Attachments

TradeTheEasyWay

Well-known member

- Messages

- 478

- Likes

- 4

FTSE has closed below the 200 ema

ES has no support till 1250

US$ has made a very bullish higher low

I see further US$ strength and weaker commodities so I'm going short this one on break of Friday's low.

NZDCHF short.

entry: 68.98

stop: 69.91

target: 65.10

Good luck,

Mike

ES has no support till 1250

US$ has made a very bullish higher low

I see further US$ strength and weaker commodities so I'm going short this one on break of Friday's low.

NZDCHF short.

entry: 68.98

stop: 69.91

target: 65.10

Good luck,

Mike

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

FTSE has closed below the 200 ema

ES has no support till 1250

US$ has made a very bullish higher low

I see further US$ strength and weaker commodities so I'm going short this one on break of Friday's low.

NZDCHF short.

entry: 68.98

stop: 69.91

target: 65.10

Good luck,

Mike

Thanks Mike, attached is you ATR targets for NZDCHF

ATR Targets

Daily ATR(200) = 0.0082 (1.19%)

Weekly ATR(52) = 0.0234 (3.39%)

-1x ATR: 0.6980

1x ATR: 0.6816

1.5x ATR: 0.6775

2x ATR: 0.6734

Good luck

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Trade for the week.

Short Spot Silver

Limit Entry: 36.75

Stop : 37.86

Target: 32

Reason for short. Possibly started a C wave of an A-B-C

Hi tradeAweek, here's the ATR targets for you for Silver

ATR Targets

Daily ATR(200) = 1.2055 (3.28%)

Weekly ATR(52) = 2.6237 (7.14%)

-1x ATR: 37.96

1x ATR: 35.54

1.5x ATR: 34.94

2x ATR: 34.34

Good luck

Similar threads

- Replies

- 3

- Views

- 3K

- Replies

- 44

- Views

- 13K

- Replies

- 3

- Views

- 2K