Week 5 Results

Well done to chilltrader whose trade in the GBPUSD took the win this week with an excellent 1.45% ATR adjusted gain. It was a mixed week for the group as a whole with 4 wins and 4 loses, but the loses were greater than the profits so we had a down week with a -1.87% ATR adjusted loss. So after 26 trades we are back down to near the break even point at +0.22% ATR adjusted. The breakdown of that is 15 wins, 9 loses and 2 scratched trades.

Relative Performance

The S&P 500 and FTSE 100 both finished the week slightly negative as we use the open price from Monday morning to the close on Friday so it's a fair comparision with the groups trades.

One trade a week group

Week: -1.87% (ATR Adjusted)

Cumulative: +0.22% (ATR Adjusted)

S&P 500

Week: -0.03%

Cumulative: +3.63%

FTSE 100

Week: -0.14%

Cumulative: +1.91%

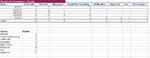

League Table

Name_________ATR Adjusted Percentage

TradeTheEasyWay____2.01%

chilltrader__________1.49%

Pat494_____________0.80%

Black Swan_________0.03%

tar________________-0.51%

isatrader___________-0.68%

SlipperyC___________-0.98%

wigtrade___________-1.95%

Name_________Points

Pat494_____________4

chilltrader__________3

TradeTheEasyWay____3

isatrader___________2

SlipperyC___________0

Black Swan_________1

tar________________-1

wigtrade___________-1

As you can see above on a percentage basis TradeTheEasyWay leads with 2.01% ATR adjusted gain after 4 trades, but on a points basis Pat494 leads with 4 points from 5 trades. The results don't show the whole story though as people have done different amounts of trades so I'm thinking of how best to judge the results over a longer term. It's been suggested that there's a minimum amount of trades before it goes on the league table and some sort of weighting scale. An idea I had was that you could look at each persons best 10 trades and their worst 10 trades over a year and then use the percentage from that to see whose done the best at the end of the year. So any other ideas on this will be appreciated, but it's not too much of a concern yet as we've only been going for 5 weeks.

I look forward to seeing everyone's picks this weekend as always.

Oh, on a final note, please give the thread a rating as some idiot gave it a 1 star rating which will put off new people from looking at it and joining in.

Cheers