You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

jtrader1001

Junior member

- Messages

- 26

- Likes

- 0

Is this for short term trades?

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Is this for short term trades?

Fundamentals seem to have their own time periods of affecting the markets

Hows about you hosting the Fundamental thread ?

No problem SC

someone - anyone ????

😱

Last edited:

TradeTheEasyWay

Well-known member

- Messages

- 478

- Likes

- 4

Is this for short term trades?

it's for trades you think will make the best return in one full trading week.#

Mike

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

A quick update on the open positions. VOD.L is down 2.85% from Pats entry and is currently at 175.65 and Mikes position in the GBPUSD is currently up 0.21% at 1.6209

SlipperyC currently leads this week with his 0.56% ATR adjusted gain from Mondays DAX short.

SlipperyC currently leads this week with his 0.56% ATR adjusted gain from Mondays DAX short.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Trading Update

Welcome alloy, I'll be interested to see what you trade. Ok, a quick update. The markets continue to edge lower, but this weeks remaining players are in for another day. Pats Vodafone trade got very close to his stop loss, but it survived and the US market recovered a bit near the close tonight. So we should have a positive start in the morning with any luck. Mike trade in GBPUSD is still trading around breakeven, so we'll see what tomorrow brings.

Open positions

Pat494

VOD.L

Entry: 180.8

Current Price: 173.25

Stop: 171

Target: 191

TradeTheEasyWay

Entry: 1.6175

Current Price: 1.6140

Stop: 1.6040

Target: 1.6500

Welcome alloy, I'll be interested to see what you trade. Ok, a quick update. The markets continue to edge lower, but this weeks remaining players are in for another day. Pats Vodafone trade got very close to his stop loss, but it survived and the US market recovered a bit near the close tonight. So we should have a positive start in the morning with any luck. Mike trade in GBPUSD is still trading around breakeven, so we'll see what tomorrow brings.

Open positions

Pat494

VOD.L

Entry: 180.8

Current Price: 173.25

Stop: 171

Target: 191

TradeTheEasyWay

Entry: 1.6175

Current Price: 1.6140

Stop: 1.6040

Target: 1.6500

TradeTheEasyWay

Well-known member

- Messages

- 478

- Likes

- 4

OK, GBPUSD looked bullish last weekend, it drfited under the highs all week and now the GDP is revised lower. I've closed the trade at 1.61. Not sure if I can do that in these rules so over to you on this ISA.

I went short in my day trading account early thos morning - so I'm +40 i that account and looking for GBP to retest 1.60, maybe even lower today; it's possible GBP could crash today if the US data is strong the weeks US$ lows are rejected. My Gold and oil stocks are doing wwell. Solf PFD for 38% profit in 2 weeks.

Let's see how we close today. Oddly enough the ftse is holding so far. But prelim US gdp is later today, that wiull really set the tone for next week.

Trade of the week is oil!.

Mike Hamilton

I went short in my day trading account early thos morning - so I'm +40 i that account and looking for GBP to retest 1.60, maybe even lower today; it's possible GBP could crash today if the US data is strong the weeks US$ lows are rejected. My Gold and oil stocks are doing wwell. Solf PFD for 38% profit in 2 weeks.

Let's see how we close today. Oddly enough the ftse is holding so far. But prelim US gdp is later today, that wiull really set the tone for next week.

Trade of the week is oil!.

Mike Hamilton

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Oddly enough the ftse is holding so far.Mike Hamilton

The LSE and therefore most of the FTSE has run into technical problems

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

OK, GBPUSD looked bullish last weekend, it drfited under the highs all week and now the GDP is revised lower. I've closed the trade at 1.61. Not sure if I can do that in these rules so over to you on this ISA.

The rules are that you get the exit time when you post on the thread that you want to exit, using the T2W time on the post. A simple post saying "exit" is all that is needed for speed.

So your post to exit was at 10.07 on the thread, so the closing price of GBPUSD at 10.07am was 1.6104

Closing Trade

GBPUSD

Long

Entry: 1.6175

Exit: 1.6104

Percentage Gain: -0.44%

ATR Adjusted Percentage Gain: -0.61%

Thanks for actively managing your trade Mike. Looks like SlipperyC is going to take the win this week as Pats VOD.L trade is currently down near his stop loss and would need a big move today to win it this week.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

I got a notepad full of entrie here, going to struggle to find a best pick....

That's why I do this thread, as it makes you filter down all your watchlist to the one that you think will move the most in the next week relative to its average true range. A good target to aim for is between 1 and 2 times the daily ATR(200)

It really helps me to focus and means I put the work in, so that I'm not trading on a whim, but on a well researched idea with clear entry and exit points.

Good luck

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

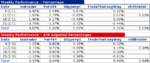

Week 4 Results

Well done to SlipperyC whose trade in the DAX took the win this week with a 0.56% ATR adjusted gain. The others trades ended up negative so we had down week overall by -3.37% (ATR Adjusted). Considering the week the broad markets had, this wasn't too bad.

So our first month is over. I've attached a full list of all the trades during the month. Performance for the group in February was a +10.45% gain or +2.09% ATR Adjusted, so well done everyone. That's really good. 👍

Relative Performance

One trade a week group

Week: -3.37% (ATR Adjusted)

Cumulative: +2.09% (ATR Adjusted)

S&P 500

Week: -1.42%

Cumulative: +3.66%

FTSE 100

Week: -1.34%

Cumulative: +2.05%

League Table

Name_________Points

Pat494_____________3

isatrader___________3

TradeTheEasyWay____2

SlipperyC___________1

chilltrader__________1

Name_________ATR Adjusted Percentage

isatrader___________0.93%

TradeTheEasyWay____0.65%

Pat494_____________0.44%

chilltrader__________0.04%

SlipperyC___________0.02%

As always, get your pick in for next week by the end of Sunday.

Cheers

David

Well done to SlipperyC whose trade in the DAX took the win this week with a 0.56% ATR adjusted gain. The others trades ended up negative so we had down week overall by -3.37% (ATR Adjusted). Considering the week the broad markets had, this wasn't too bad.

So our first month is over. I've attached a full list of all the trades during the month. Performance for the group in February was a +10.45% gain or +2.09% ATR Adjusted, so well done everyone. That's really good. 👍

Relative Performance

One trade a week group

Week: -3.37% (ATR Adjusted)

Cumulative: +2.09% (ATR Adjusted)

S&P 500

Week: -1.42%

Cumulative: +3.66%

FTSE 100

Week: -1.34%

Cumulative: +2.05%

League Table

Name_________Points

Pat494_____________3

isatrader___________3

TradeTheEasyWay____2

SlipperyC___________1

chilltrader__________1

Name_________ATR Adjusted Percentage

isatrader___________0.93%

TradeTheEasyWay____0.65%

Pat494_____________0.44%

chilltrader__________0.04%

SlipperyC___________0.02%

As always, get your pick in for next week by the end of Sunday.

Cheers

David

Attachments

Last edited:

chilltrader

Experienced member

- Messages

- 1,296

- Likes

- 115

GBP/USD

Buy Limit : 16102

Stop : 16020

Target : 16280

Buy Limit : 16102

Stop : 16020

Target : 16280

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Hi isa thanks for running this - interesting reading, mind if I join in this week?

cheers

Wig

Yep, no worries. Anyone can join in. Rules are in the first post of how to play. I will be interested to see what you trade.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Great thanks 👍

Right first league trade as follows:

F. (Ford motor company) - BUY

Long 1515

Stop 1445

Risk 70pts

Fill at 1620

Order set 😴

Wig

I like it, I'll definitely be watching with interest. Here's the ATR targets

It's priced on ADVFN as 15.15 not 1515, so I'll give you the targets with the decimal.

FORD

Daily ATR(200) = 0.43 (2.84%)

Weekly ATR(200) = 1.09 (7.19%)

ATR Targets

1x ATR: 15.58

1.5x ATR: 15.795

2x ATR: 16.01

Good luck and welcome to the group.

Similar threads

- Replies

- 3

- Views

- 3K

- Replies

- 44

- Views

- 13K

- Replies

- 3

- Views

- 2K