B

Black Swan

Good points made by Thomas Long of FXCM over on FXCM forums..

Nonfarm Payrolls

--------------------------------------------------------------------------------

I will be leaving soon for a well deserved long weekend (if I say so myself) in Northern California to get as much wine tasting in as humanly possible before returning for Tuesday's session, but there are two things I would like to point out before I head to the airport. First, we always use a designated driver on our wine trips so its all good. Yes...I realize that more than a few of you don't care about this, but I have complete control of my keyboard right now and I can write whatever I want.

Second and more importantly, I would once again like to remind traders of what is happening this Friday, April 2nd at about 830AM Eastern, which is when the US Department of Labor will release the most anticipated news report of the month, the US Nonfarm Payrolls. This report can result in increased volatility and a chance to profit handsomely in a short period of time.

However, more often than not, new traders are not the one’s profiting but rather losing. The main reason is slippage, which is when your order is filled away from the price you wanted. The reason for slippage is simple, big traders stay away from these events and new traders all try to do the same thing at the same time. If the release is bullish for the EUR/USD, everybody wants to buy at the same time. However, most find that there is nobody willing to sell to them at their price. But eventually your order is filled, but at the seller’s price. Soon you find the market moving against you and you exit to keep your losses from getting too big. But what about those who were selling to you? As the market continues to fall, you start to wonder about these traders who sold to you and the fact that they are now making money. What did they do differently?

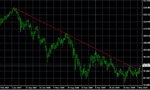

These traders were playing the reversal and taking advantage of the fact that the first move after a release is often based on emotions and wrong. Here is a 5-minute chart and an example of a reversal after the release of the Nonfarm Payrolls. We can see that just before the release, the EUR/USD was trading at 1.4892. After the release, the market started to rally up to near the 1.4940 level. The market then started to reverse and traders who were playing the reverse sold at the price the market was trading just before the release. The assumption here is that all traders who bought after the release are now in a losing trade and are selling to get out. So these new traders sell at 1.4892 to get in and use a 50 pip stop with a 100 pip limit order to take profit, which is what we recommend in our DailyFX Courses. This is our 1:2 risk:reward ratio and allows us to be profitable if only winning 40% of these setups. The market soon moved down 100 pips from the 1.4892 entry and rewarded those who were patient and reacted to the market environment rather than the emotional first response to the release. These reversal traders will also use the EUR/USD as much as possible in these situations because of the increased volume and better fills. But you don’t have to be first to get into the trade to be right, you just have to be patient and react to the market and not the news release. The EUR/USD doesn’t act like this on every release, but it does frequently enough to make this a valuable strategy.

Good luck with your trading, have a great weekend, and I'll be back Tuesday!

http://forexforums.dailyfx.com/dailyfx-course-instructor-trading-tips/57450-chart-day-56.html

Nonfarm Payrolls

--------------------------------------------------------------------------------

I will be leaving soon for a well deserved long weekend (if I say so myself) in Northern California to get as much wine tasting in as humanly possible before returning for Tuesday's session, but there are two things I would like to point out before I head to the airport. First, we always use a designated driver on our wine trips so its all good. Yes...I realize that more than a few of you don't care about this, but I have complete control of my keyboard right now and I can write whatever I want.

Second and more importantly, I would once again like to remind traders of what is happening this Friday, April 2nd at about 830AM Eastern, which is when the US Department of Labor will release the most anticipated news report of the month, the US Nonfarm Payrolls. This report can result in increased volatility and a chance to profit handsomely in a short period of time.

However, more often than not, new traders are not the one’s profiting but rather losing. The main reason is slippage, which is when your order is filled away from the price you wanted. The reason for slippage is simple, big traders stay away from these events and new traders all try to do the same thing at the same time. If the release is bullish for the EUR/USD, everybody wants to buy at the same time. However, most find that there is nobody willing to sell to them at their price. But eventually your order is filled, but at the seller’s price. Soon you find the market moving against you and you exit to keep your losses from getting too big. But what about those who were selling to you? As the market continues to fall, you start to wonder about these traders who sold to you and the fact that they are now making money. What did they do differently?

These traders were playing the reversal and taking advantage of the fact that the first move after a release is often based on emotions and wrong. Here is a 5-minute chart and an example of a reversal after the release of the Nonfarm Payrolls. We can see that just before the release, the EUR/USD was trading at 1.4892. After the release, the market started to rally up to near the 1.4940 level. The market then started to reverse and traders who were playing the reverse sold at the price the market was trading just before the release. The assumption here is that all traders who bought after the release are now in a losing trade and are selling to get out. So these new traders sell at 1.4892 to get in and use a 50 pip stop with a 100 pip limit order to take profit, which is what we recommend in our DailyFX Courses. This is our 1:2 risk:reward ratio and allows us to be profitable if only winning 40% of these setups. The market soon moved down 100 pips from the 1.4892 entry and rewarded those who were patient and reacted to the market environment rather than the emotional first response to the release. These reversal traders will also use the EUR/USD as much as possible in these situations because of the increased volume and better fills. But you don’t have to be first to get into the trade to be right, you just have to be patient and react to the market and not the news release. The EUR/USD doesn’t act like this on every release, but it does frequently enough to make this a valuable strategy.

Good luck with your trading, have a great weekend, and I'll be back Tuesday!

http://forexforums.dailyfx.com/dailyfx-course-instructor-trading-tips/57450-chart-day-56.html