You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

'No indicators' revisited

- Thread starter ford

- Start date

- Watchers 53

Trader333

Moderator

- Messages

- 8,766

- Likes

- 1,030

a320,

I am not sure we are talking of the same thing (with regard to price balance points). So I have attached a chart and I am interested to know where you would determine the price balance to be between points A and B. There are 2 possible prices (for the method I am aware of), depending upon whether you are a more or a less aggressive trader.

Paul

I am not sure we are talking of the same thing (with regard to price balance points). So I have attached a chart and I am interested to know where you would determine the price balance to be between points A and B. There are 2 possible prices (for the method I am aware of), depending upon whether you are a more or a less aggressive trader.

Paul

Attachments

Hi Paul..

I think I can see where your coming from..as you say its a different technique 😉

The Balance point I used in the examples.. is a basic 3 day swing reference point for determining trade biasing..

Cheers

Merry Christmas to everyone 😎

CJ

I think I can see where your coming from..as you say its a different technique 😉

The Balance point I used in the examples.. is a basic 3 day swing reference point for determining trade biasing..

Cheers

Merry Christmas to everyone 😎

CJ

Last edited:

a320 said:This is 5min es04h I'll try and make the open bar sup at bit more clearer.... one of crable's gems 😎

CJ

CJ

there was an identical sup on 17th. and similar on 16th.

On the 23rd...........do you place your buy at 90.25 or do you wait for supp to be confirmed before entering a few ticks higher

I've not read any of Crable's stuff but find the opening range levels a big help in day trading

Zader...the charts just show some basic sup/resistance stuff with fib retracements, the individual length of the legs (wave movements)are shown by the blue numbers to give a general idea of the moves and their subsequent dimensions.

qaza..I can't really advise on order placements as there are a range of options available depending on your style ect...

There was a number of factors that pointed to a long position ..the opening price support/low added weight.. but it must be taken in-context with the other signals the market gives 😎

Take it easy

CJ

qaza..I can't really advise on order placements as there are a range of options available depending on your style ect...

There was a number of factors that pointed to a long position ..the opening price support/low added weight.. but it must be taken in-context with the other signals the market gives 😎

Take it easy

CJ

Last edited:

F

ford

Hi,

I only took one trade today, which was short ( 🙄 ) off the doji in the morning and covered on the first positive bar, on the premise that the pull back was simply that, a pull back. Of course I didnt reverse and go long after, still battling with the psycholgical part of trading.

I'm just wondering if we can touch upon volume, as it seems like there has been no discussion on how to integrate volume effectively into trading. There are quite a few interesting volume bars today like the one which coincided with the morning top and the morning bottom (what the heck was 11 AM EST all about?) but the follow bars at 1:20 and 2:10 PM EST are misleading as they dont coincide with any significant tops that one would want to exit a long at. I marked in red what looked to me as 3 pushes, 3 drives, 3 little indians whatever you want to call it, theres far too much jargon! but the 3rd peak decided to roar along. 😱

Is it just me or is there too much focus upon catching the up coming, or rather what we *anticipate* as a top or bottom and forget to catch on the trend that is already taking place? I get that feeling and I feel 'lost' when we're in a trend because I dont know where to enter and almost always focus upon trying to catch the next swing, which means I miss the boat half the time .. i.e. I caught 1.25 pts going short, but missed about 8 if I had followed the trend.. See what I mean?

Is it possible to be in the market at all times, is that something we should aim for?

When I think about it logically, If enter a position and then close it out, it must be upon the assumption that the trend in my favour is changing, so not only can I get off but it makes sense to reverse the trade and go in the opposite direction, otherwise it made no sense getting off in the first place. (this obviously doesnt apply if you exit at the end of the day)

Comments or is it just waffle?

Hope you all have a good one tommorow..

I only took one trade today, which was short ( 🙄 ) off the doji in the morning and covered on the first positive bar, on the premise that the pull back was simply that, a pull back. Of course I didnt reverse and go long after, still battling with the psycholgical part of trading.

I'm just wondering if we can touch upon volume, as it seems like there has been no discussion on how to integrate volume effectively into trading. There are quite a few interesting volume bars today like the one which coincided with the morning top and the morning bottom (what the heck was 11 AM EST all about?) but the follow bars at 1:20 and 2:10 PM EST are misleading as they dont coincide with any significant tops that one would want to exit a long at. I marked in red what looked to me as 3 pushes, 3 drives, 3 little indians whatever you want to call it, theres far too much jargon! but the 3rd peak decided to roar along. 😱

Is it just me or is there too much focus upon catching the up coming, or rather what we *anticipate* as a top or bottom and forget to catch on the trend that is already taking place? I get that feeling and I feel 'lost' when we're in a trend because I dont know where to enter and almost always focus upon trying to catch the next swing, which means I miss the boat half the time .. i.e. I caught 1.25 pts going short, but missed about 8 if I had followed the trend.. See what I mean?

Is it possible to be in the market at all times, is that something we should aim for?

When I think about it logically, If enter a position and then close it out, it must be upon the assumption that the trend in my favour is changing, so not only can I get off but it makes sense to reverse the trade and go in the opposite direction, otherwise it made no sense getting off in the first place. (this obviously doesnt apply if you exit at the end of the day)

Comments or is it just waffle?

Hope you all have a good one tommorow..

Attachments

Good topic Ford, and as you know I too traded short today but later on and NOT successfully!

Didn't trade the E-mini but talking about volume, I'm getting the impression that at the moment the volumes are not representative of general trading and thus are not to be trusted! Look at this divergence of vol with a higher high, which I would have thought indicates a poss short - and we know what happened!

Trying to lose all the squiggly things myself, but get withdrawal at times!

Cheers Quercus

Didn't trade the E-mini but talking about volume, I'm getting the impression that at the moment the volumes are not representative of general trading and thus are not to be trusted! Look at this divergence of vol with a higher high, which I would have thought indicates a poss short - and we know what happened!

Trying to lose all the squiggly things myself, but get withdrawal at times!

Cheers Quercus

Attachments

Last edited:

Glenn

Experienced member

- Messages

- 1,040

- Likes

- 118

Just a reminder to anyone who hasn't seen it -

Every day there is a free analysis of the Dow using simple TA, including what to do next, rather than after the event.

There is no volume consideration, just trend lines, support, resistance, a few simple patterns and occasionally a fib retracement. No indicators.

If you want to learn and follow some simple stuff regularly, then try Ed Downs on www.signalwatch.com/markets/markets-dow.asp

He runs profits and cuts losses. All the basic stuff you need imo.

Has archives of previous days too.

Glenn

Every day there is a free analysis of the Dow using simple TA, including what to do next, rather than after the event.

There is no volume consideration, just trend lines, support, resistance, a few simple patterns and occasionally a fib retracement. No indicators.

If you want to learn and follow some simple stuff regularly, then try Ed Downs on www.signalwatch.com/markets/markets-dow.asp

He runs profits and cuts losses. All the basic stuff you need imo.

Has archives of previous days too.

Glenn

Glenn

Experienced member

- Messages

- 1,040

- Likes

- 118

ChartMan said:Nice to see Ed has finally cottoned on to the use of channels. :cheesy:

Hi Martin

As I recall he's always used them from way back when he started in 1998.

However there are periods when he hand over the reins to someone else (Bela Patel ?). You can see the difference in the interpretations.

Seems to have got back to 'normal' recently.

Glenn

- Messages

- 2,325

- Likes

- 17

Quercus said:Look at this divergence of vol with a higher high, which I would

have thought indicates a poss short - and we know what

happened!

Young Quercus, an observation if I may. Never consider using

divergence on volume because this is what they teach in books,

and it's wrong. This is just my opinion, and as I trade using just

price and volume I've seen enough volume bars form to last a

lifetime.

It's not easy to explain, but I'll have a go.

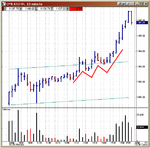

The chart at the bottom of this post is ES, 10 mins.

Yesterday's (Monday 29th December) action was a trend, started

off by a strong double bottom. The 1097 area was stuffed full of

bulls, and on the two occasions the price dropped into that area

it was pushed up higher with a lot of force - you can see that by

the 'fresh air' around the two legs of the double bottom. As you

get double bottoms at the start of a trend, that was the clue that

it was going to be a trending day.

On the volume, A is where the big boys went long. At B the

shorts came in and the market changed direction. C is the point

where those shorts became longs, and you can see how long the

11:00 ET price bar was, indicating that there was huge bull

strength on that 10 min bar.

At D, the bulls added fuel to the trend by adding longs. And the

price continued to rise (so you know they were longs, not

shorts). And at E and F more longs were added, and the price

continued to rise.

So therefore, at this point you know that all the big volume bars

were longs, and so you know that it will take more than the total

contracts of these bars added together to turn the market.

As an easy example (not based on any charts), if there were

15,000 longs to start with, then another 10,000 added, then

another 10,000, and another 5,000 - you would need in the

region of 40,000 short contracts to turn the market.

So the way you trade this, in a nutshell (or perhaps an acorn in

your case - LOL), is to sit tight until you see the massive volume

bars which will indicate the end of the trend. Now, this can be

dangerous if you do not know what you are doing, as the volume

is often drip fed into the market by the big boys over several bars.

So hopefully that explains why divergence doesn't work on

volume - actually, it is a reduction in volume which continues the

trend.

The books and trading courses apply the divergence principle to

volume and they're wrong to do so.

Attachments

- Messages

- 2,325

- Likes

- 17

Forgot to say, but trying to decipher volume will just make your head spin.

If you knew the basics, such as the clear air around the legs of the double bottom, then you would have been able to take in the whole trend, without worrying about what the volume was telling you. 😀

Yes, I know, with hindsight it's always easy. :cheesy:

If you knew the basics, such as the clear air around the legs of the double bottom, then you would have been able to take in the whole trend, without worrying about what the volume was telling you. 😀

Yes, I know, with hindsight it's always easy. :cheesy:

I'm no expert on volume analysis, but I broadly agree with Skim, in as much as the price rises on reducing volume and that the summation of 40K( in the example) is what is required to turn the price around.

One area in which I disagree is in Positive Divergence bottoms on a 1 min chart. Now I don't profess to understand why, but they do appear regularly and they do work by way of confirmation of a bottom on the DOW. Actually, I think I do know why they work, but I'd rather not make a fool of myself by opening my mouth. 🙁

One area in which I disagree is in Positive Divergence bottoms on a 1 min chart. Now I don't profess to understand why, but they do appear regularly and they do work by way of confirmation of a bottom on the DOW. Actually, I think I do know why they work, but I'd rather not make a fool of myself by opening my mouth. 🙁

- Messages

- 2,325

- Likes

- 17

I don't use 1 min charts as they're just too noisy (although I used to in the losing days before I ventured into the dark side).

My statements on the volume are not appropriate for anything less than 5 minutes, and in an ideal world they would be for charts of 10 mins and upwards.

So spill the beans ChartMan! I won't have a clue as I'd make myself dizzy if I had to watch a 1 min chart. :cheesy:

My statements on the volume are not appropriate for anything less than 5 minutes, and in an ideal world they would be for charts of 10 mins and upwards.

So spill the beans ChartMan! I won't have a clue as I'd make myself dizzy if I had to watch a 1 min chart. :cheesy:

Similar threads

- Replies

- 1

- Views

- 5K

- Replies

- 0

- Views

- 2K

- Replies

- 412

- Views

- 93K