Plan Demo Account including my new findings:

1) Deciding whether to trade or not

-before deciding to trade look if any major economic events are up in the current trading day if yes then we DO NOT TRADE unless after 1 hour of occurence

-before deciding to trade: check yahoo finances whether something big is up or not. If it is DO NOT TRADE

2) Find potential trades

- Wait at LEAST 1 hour after trading has opened before taking up a position

- Wait at LEAST 1 hour after the occurence of a major economical event or indicator (1)

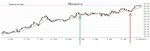

- Look at the S&P500 and the stocks in your watchlist. Watch if most of them are in the plus or in the min. Dont go long if in the min and dont go short if in the plus.

- scan american stocks and look for clean charts (up or down determinded in previous point). Clean is a steady rise or decline for at least 3 trading days on a 2 hour chart (2)

- do not include stocks that gapped in those 3 trading days

- do not include stocks that require me to take stop losses wider than 2% of my equity

- the last three bars (2h) should go with the trendline, else dont take it

3) Taking positions

- look for the trend and 66% of the highest difference in opposite direction of the entire trend is where I place my stop loss

- I am not going to risk more than 2 % on each trade

4) Once in a position

- Make it a trailing stop loss

- Exit only if stop loss hits

- document every trade carefully in journal (with charts) saying what you did and what I should have done

Since the system changed again I will evaluate after 40 trades (or sooner if it seems totally worthless like I did many times already)

(1) If this is the case I am allowed to look at the 15min charts to check whether trend continues or not

(2) how can I quantify this? I looked into this but cant find anything suitable at the moment. For now Ill leave this at my discretion but of course it is visible if a chart goes up or down in a steady fashion, the more it resembles a straight line the better, only need to measure that objectively and put a number on it

1) Deciding whether to trade or not

-before deciding to trade look if any major economic events are up in the current trading day if yes then we DO NOT TRADE unless after 1 hour of occurence

-before deciding to trade: check yahoo finances whether something big is up or not. If it is DO NOT TRADE

2) Find potential trades

- Wait at LEAST 1 hour after trading has opened before taking up a position

- Wait at LEAST 1 hour after the occurence of a major economical event or indicator (1)

- Look at the S&P500 and the stocks in your watchlist. Watch if most of them are in the plus or in the min. Dont go long if in the min and dont go short if in the plus.

- scan american stocks and look for clean charts (up or down determinded in previous point). Clean is a steady rise or decline for at least 3 trading days on a 2 hour chart (2)

- do not include stocks that gapped in those 3 trading days

- do not include stocks that require me to take stop losses wider than 2% of my equity

- the last three bars (2h) should go with the trendline, else dont take it

3) Taking positions

- look for the trend and 66% of the highest difference in opposite direction of the entire trend is where I place my stop loss

- I am not going to risk more than 2 % on each trade

4) Once in a position

- Make it a trailing stop loss

- Exit only if stop loss hits

- document every trade carefully in journal (with charts) saying what you did and what I should have done

Since the system changed again I will evaluate after 40 trades (or sooner if it seems totally worthless like I did many times already)

(1) If this is the case I am allowed to look at the 15min charts to check whether trend continues or not

(2) how can I quantify this? I looked into this but cant find anything suitable at the moment. For now Ill leave this at my discretion but of course it is visible if a chart goes up or down in a steady fashion, the more it resembles a straight line the better, only need to measure that objectively and put a number on it