In the meanwhile, if anyone cared to know, here's how it ended, as far as my discretionary EUR trade and my automated GBP trade. I lost on the automated one and made money on the discretionary one, just like last Friday, but listen carefully: this would seem great, but it doesn't always work like this.

What we saw is wins by me, and losses by the system. This shows partly the problem, if you look carefully. We saw small wins by me, and small losses by the system. Wait till you see the size of my losses and the size the system's wins, because only then you will see the whole picture.

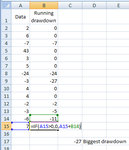

What screws me is that automated trading has limited losses, whereas discretionary trading has limited wins. Then, conversely, automated trading is capable of huge wins, whereas (my) discretionary trading is only capable of huge losses (no small losses, simply because I cannot take losses, and I'd rather blow out my account). So you see why I end up blowing out my account with discretionary trading.

Once again: my discretionary has small wins, and huge losses. (My) automated has small losses and huge wins. And we've seen it happening both on Friday and today. What we didn't see (we did but on other, separate, days) is the big wins by auto and big losses by discretionary.

And why do I get small wins with my discretionary trading? My personal style of trading is simply not profitable. And why? Many reasons, among which: without being backed by statistics (since I can't compute them in my mind), I don't have the guts to stay in a positioin for as long as it's convenient. And I don't have the guts to get out of a position as soon as it stops being convenient. In other words, like many other traders, I can't let profits run, and I can't cut my losses (and this, I'll admit, it's all psychological, because I have agreed that discretionary trading is largely psychological - which doesn't mean that you can ever learn to become profitable by working on your psychology, but rather by finding a profitable method that you will follow, despite what your psychology tells you to do, because you know that method is profitable, and therefore trading is always about having a profitable method: but you might have problems developing it if your psychology is wrong... I still have not figured out and I can't possibly synthesize the nature of the profitability problem in discretionary trading).