strategist

Active member

- Messages

- 153

- Likes

- 3

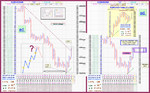

EUR/USD forecast

H4 graph

The pair is trading along an uptrend, but today it made a rather huge leap down which contradicted the tendency of further upside. Drop below level 1.5095 and especially 1.5040 will state the pair’s serious intention to begin the trend’s turn.

In case the pair gets under level 1.5005, it will try to drop below level 1.4955 then. If that happens, the next drop target will be set to level 1.4865 – a key support (the lower bound of “F-F+” weekly uptrend).

I’m not seeing any signals of trend’s continuation so far.

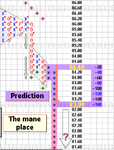

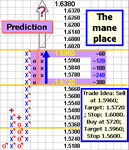

GBP/USD forecast

H4 graph

Having broken the “L-L+” channel the pair went for developing a downtrend. After retreating under level 1.6590 the market has formed a figure of (down)trend’s continuation and headed for testing of level 1.6465 (the lower bound of “B-B+” daily sideways trend).

If the pair eventually drops below level 1.6465, it will get to key support 1.6325 (K trendline). Otherwise, if the market goes for correction from the current level, it will find resistance at level 1.6590, from which we should expect repeated testing of 1.6465.

H4 graph

The pair is trading along an uptrend, but today it made a rather huge leap down which contradicted the tendency of further upside. Drop below level 1.5095 and especially 1.5040 will state the pair’s serious intention to begin the trend’s turn.

In case the pair gets under level 1.5005, it will try to drop below level 1.4955 then. If that happens, the next drop target will be set to level 1.4865 – a key support (the lower bound of “F-F+” weekly uptrend).

I’m not seeing any signals of trend’s continuation so far.

GBP/USD forecast

H4 graph

Having broken the “L-L+” channel the pair went for developing a downtrend. After retreating under level 1.6590 the market has formed a figure of (down)trend’s continuation and headed for testing of level 1.6465 (the lower bound of “B-B+” daily sideways trend).

If the pair eventually drops below level 1.6465, it will get to key support 1.6325 (K trendline). Otherwise, if the market goes for correction from the current level, it will find resistance at level 1.6590, from which we should expect repeated testing of 1.6465.