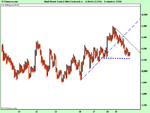

a few thoughts from the alst chart i posted.this was intaday/hourly data

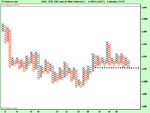

so,a minor uptrend started on approx 23 jan from 3950 rea.his stalled and we went into trendless chop.the only thing we can learn is that 4100 area is the main support area.3 minor rallies stopped at 4220 area and oe went to 4340 area.so these are the res area to watch next week.although the last signal was bearish.this is a choppy market and some tolerance should be given .hence,i am watching for a sgnal below 4100.ie a break below 4100 with a retrace and 4100 holding as the resistance.uneless,i see tha then i will look to go long from the 4100 pivot area

please can someone let us know if there is any news next week that could break the 4100 pivot...????

many thanks

please post if you disagree