I quite enjoy seeing others discuss their trading styles when not sticking strictly to TA etc....I am much the same in that I use a wide variety of information and bring it all together to make an informed decision. I still keep an awareness of TA etc as it is good to know the points at which a large % of traders will jump one way or the other but I then use market info and my opinion of current market feeling to make a decision.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

market direction

- Thread starter N Rothschild

- Start date

- Watchers 34

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

How long have you been trading Mr Rothschild?

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

3 years and im not going to lie, alot of that time was getting spanked by the market. but im glad i did get so many kickings. you only get smarter by playing a smarter opponent, the market

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

I ask because reorientating my trading to a more fundamental view (is this under or overpriced and does it look like value traders are getting in) after my first 12 months shifted my trading significantly. When did you start to hedge positions though - was that as part of the spanking? Did you figure it out yourself? Did your broker suggest it?

I think what I'm trying to ask is when did you make a transition from being a one-dimensional trader to one that then hedges correctly and takes a more holistic perspective on your trade execution rather than the decision making/fundamental reasons for getting in/out?

I think what I'm trying to ask is when did you make a transition from being a one-dimensional trader to one that then hedges correctly and takes a more holistic perspective on your trade execution rather than the decision making/fundamental reasons for getting in/out?

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

3 years and im not going to lie, alot of that time was getting spanked by the market. but im glad i did get so many kickings. you only get smarter by playing a smarter opponent, the market

Good thread. I appreciate you sharing some insights on your trading. After going through a few of the threads here lately this is refreshing to read!

Peter

squall321

Well-known member

- Messages

- 488

- Likes

- 106

3 years and im not going to lie, alot of that time was getting spanked by the market. but im glad i did get so many kickings. you only get smarter by playing a smarter opponent, the market

the more sophisticated the game, the more sophisticated the opponent

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

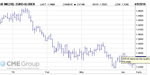

big shake out in corn today, now we have to ask, bear trap or continuation of the down trend? important crop report coming out tomorow so will find out if im very wrong or very right! this is where the hedges come into play and being able to adjust your risk mid trade

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

I ask because reorientating my trading to a more fundamental view (is this under or overpriced and does it look like value traders are getting in) after my first 12 months shifted my trading significantly. When did you start to hedge positions though - was that as part of the spanking? Did you figure it out yourself? Did your broker suggest it?

I think what I'm trying to ask is when did you make a transition from being a one-dimensional trader to one that then hedges correctly and takes a more holistic perspective on your trade execution rather than the decision making/fundamental reasons for getting in/out?

January this year i had the epiphany, and spent a few weeks writing an entirely new set of rules for trading and completely chancing my views on markets and trading. so far so good.

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

Good thread. I appreciate you sharing some insights on your trading. After going through a few of the threads here lately this is refreshing to read!

Peter

this is it mate, anyone who claims to have been trading for a few months and to be proftible on a decent scale is either a liar, delousional, very lucky or the very odd exception. becoming a trader is something that takes years of perfection, its a never ending learning curve, you are a student of the market untill the day you quit/retire

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

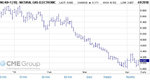

emergancy ECB meeting tonight and the euro has been surging all day, some body knows something lol. guess we will have to wait and see! either they will bailout greece or expell them from the EU if you ask me!

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

Bailout. Won't be an expulsion. Not been naughty enough and looks bad politically which in the grand scheme of things is more important than the financial problems.

Anyway you witnessed my NFP rationale so take the other side of my opinion and you're sure to be right.

Anyway you witnessed my NFP rationale so take the other side of my opinion and you're sure to be right.

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

forgot about that lol, you wanting to buy your contracts back off me yet? 😛

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

forgot about that lol, you wanting to buy your contracts back off me yet? 😛

I never bothered to say but I did well shorting off the high the night before the NFP on the artificially constructed 'spook the retailers' sell off. Wasn't in at all for the NFP, had a couple of false starts/scratch this week long and then got in at the end of the sell-off yesterday and closed out about 10 mins ago taking 14pts before I bugger off to cornwall for a week tomorrow morning.

So all in all, not been a bad week for me despite being publicly wrong in trading opinions with you. 😛

See you the week after - take it easy and keep up the good work 🙂

Last edited:

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

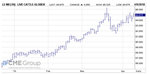

live cattle is a bit of a funny one, the front month (apri) exloded to the upside but there is virtualy no trading volume or open interest there for i would avoid trading april and move into june contract

june is testing the highs but still a solid sell imo!

so a bit down on LC's posistion for the week

june is testing the highs but still a solid sell imo!

so a bit down on LC's posistion for the week

Attachments

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

swiss franc ended the week down 12 points, removing my call for franc

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

yen has traded lower after a pullback to my sell zone (buy zone usd/jpy) and is now hovering around this level, still like yen short long term!

Similar threads

- Replies

- 3

- Views

- 6K