lurkerlurker

Senior member

- Messages

- 2,482

- Likes

- 150

Hi guys,

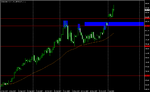

Nice pin on gold daily, ticks all the boxes.

FYIO.

Yeah, we saw that earlier. Not a bad pos by the looks of it. Lets see where we close. What "time" does a daily gold bar close anyway (no pun intended)?

9PM? Midnight?

The order is in. I am risking 230 pips on this trade, so I will use 1 unit. This keeps the risk within 10%.

I will sell a break below 870 with a stop at 890. The entry stop is 16 ticks below the low of the day to avoid shakeouts, and the stop is 9 ticks above the high of day. The spread is also included.

At £1pp, the trade will be managed on the daily timeframe. Exposure, but not enough to panic me I would think. First problem area will be ~852 which is the support following the last breakout and consolidation. The stop will be moved to BE at this stage.

The next problem area will be the zone between 830 and 840. If price breaks below that I will trail the stop to just above the new resistance around 852 and will wait for further downside price action to develop.

If I am filled short, Bernanke better not tell us he will be destroying the dollar further tomorrow. I do want another really really aggressive rate cut so I can buy the Dow, wait, then sell it back down again.

Anyways, this gold trade is risky because there is hardly any confluence up here. This is "picking a top". The other day I wanted to buy the upside break of the inside bar, but TD reminded me it wasn't a pin bar setup and that is what I trade at the moment.

Now I have my pin bar setup. I'm looking for 250 pips out of this net of spread. Best of luck to all others taking the trade.

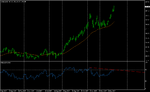

Also, please find attached TD's example of RSI divergence (and I accidentally deleted all the zones and lines off my chart to make this).

I've just done the actual divergence, but this could count as a 3 peak if you call a higher high on the price with a double top on the RSI a divergence. If so this has two - a class B then a class A divergence, for a 3 peak.

Attachments

Last edited: