Huge numbers of posts tend to happen. This thread is about pin bar trades, so it seems legitimate to post them. Looks like you have been stopped out TD. It also looks like price could be rejecting the 70. I'm going to move my stop in to breakeven due to the wide range of this bar - it should not be coming back to that level any time soon if it is to go further.

Tempted to take half off as well...but I'll resist. Moving the stop up so quickly was enough. I'll be back at 2 to review this trade, and move the stops if necessary if I am still in. Thanks for showing us all the way TD!

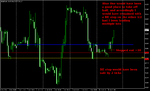

trade update

Hitting triple top resistance on the hourly. Moving the stop mechanically in 4 minutes would dictate that I put it at 48, or +6 on my entry. However, I may exercise discretion if we do not go through this level, taking half off initially and moving the remaining stop to +6.

Half off at 80 for +38, remainder set to +6 stop. Checking in again in an hour.

edit 2 - we went straight through that resistance, but price could still stall. The benefit of having multiple lots is that I've taken my profit on half at a very sensible target / resistance level, and have the opportunity to make more profit should the move go further than expected.

Anyway, I'm up +10 on CLF8, +38 on USDCAD, and have a stop on the remainder which should give me +6 unless there is slippage. I can therefore pencil in a 54 pip gain over 2 trades.

3PM update

Closed bar made a higher high by 1 tick, therefore stop moved to close of bar at 66 which is +24 on the entry. I can now pencil in a 72 pip gain overall. Reading the chart, the S/R pivot which price is stalling against seems fairly robust, and was a key reversal around 26/9/7. Price has more recently been supported well by this level. In my view the next target is a "gap fill" from Fridays NFP move, but otherwise if price pulls back and breaks the low of the previous bar, I am right to be stopped out.

4PM update

Price hasn't made a new high this bar, and it looks as if I will be stopped out. I'm not covering at the market for the sake of a few pips, but the potential of this trade is greatly diminished. I'm holding until my stop is hit - we could well have another inside bar, or indeed another break north, so I'm glad to still have a position on. There are no other signals at the turn of the hour.

Something TD said once - and I'll paraphrase roughly. If price keeps testing a level, it wants to go through. This is what I am thinking looking at USDCAD. It wants to break above resistance at 100, and I think there is a good enough chance that it will. Again, I'm glad I'm still in the trade.

Crude Oil Review

This looks like it could have been the trade of the day (+200 at one point), which is partially what I was expecting when I put the position on. If things go to plan, I will soon be able to trade multiple units of crude oil as my account balance grows, so it will be easier to avoid shakeouts like this in the future.