trader_dante

Veteren member

- Messages

- 4,535

- Likes

- 1,704

Looking at Exits *Part 5*

PRICE ACTION (and risk reduction)

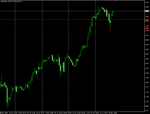

Lets look at the GBP/JPY trade I took on Friday. This pin came at a daily S/R level and close to the 50 fib of the last swing down (these factors are not shown on this chart).

Although this looked like a high probability trade, the risk that was at the forefront of my mind was that I was taking this Friday evening with the possibility of a large gap against me over the weekend.

In my opinion it is far more important to minimise losses than play for potential large gains so the only way I wanted to hold this over the weekend was if it moved significantly into profit before the close.

After the first hour in this trade the market had created an opposing pin bar. The second hour showed another pin with an identical low. (see circled area) This showed me that ALTHOUGH MY REASON FOR BEING IN THE TRADE WAS STILL VALID (the pin had not been broken) there was buying coming in that was acting as a support to the price and it was simply not following through on any move down.

Seeing this coming so close into the close, I moved my stop to a little better than breakeven and was stopped out for +3.

Finding out that this would have made over 300 pips if I had held it does not bother me at all although not so long ago it would have done.

Now, however, I realise that cutting this (at least for me) was the right thing to do as the market gave me a clear sign that it didn't want to go any lower in the short term and exiting meant I had no risk exposure over the weekend.

PRICE ACTION (and risk reduction)

Lets look at the GBP/JPY trade I took on Friday. This pin came at a daily S/R level and close to the 50 fib of the last swing down (these factors are not shown on this chart).

Although this looked like a high probability trade, the risk that was at the forefront of my mind was that I was taking this Friday evening with the possibility of a large gap against me over the weekend.

In my opinion it is far more important to minimise losses than play for potential large gains so the only way I wanted to hold this over the weekend was if it moved significantly into profit before the close.

After the first hour in this trade the market had created an opposing pin bar. The second hour showed another pin with an identical low. (see circled area) This showed me that ALTHOUGH MY REASON FOR BEING IN THE TRADE WAS STILL VALID (the pin had not been broken) there was buying coming in that was acting as a support to the price and it was simply not following through on any move down.

Seeing this coming so close into the close, I moved my stop to a little better than breakeven and was stopped out for +3.

Finding out that this would have made over 300 pips if I had held it does not bother me at all although not so long ago it would have done.

Now, however, I realise that cutting this (at least for me) was the right thing to do as the market gave me a clear sign that it didn't want to go any lower in the short term and exiting meant I had no risk exposure over the weekend.

Attachments

Last edited: