Oraclefusions

Junior member

- Messages

- 47

- Likes

- 3

Thanks to ISATrader, am going through the lessons on the website pointed by him. As I am learning thru the PF analysis, I have the following questions aimed ONLY to assess the credibility of the double top buy signal.

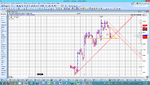

In the chart for 8280-SAU, I have plotted the 5EMA and 21MA

So I will refer them as Red and Green line.

Every double top is NOT to be taken as a buy signal.

I am talking for long positions below.

-----------------------

Consider Chart 1%X2

--------------------------

Rule 1:

Red line acts as Resistance and Green As support.

If the Red crosses the Green , and a double top is created afterwards, then that double stop is more tradable.

Rule 2:

45 Angle Support and Resistance is valid for 3 box reversals and if using 2 bix reversal, then we should also draw an angled trend manually.

The Double top should created under such manual resistance or close to it should be treated in the same precaution as if that res was a 45 line resistance and we wait to enter when the X column past that Resistance.

Rule 3:

The two tops of the Double top and the double top itself if created just on the resistance should be avoided.

In the chart above:

Double top created at Point A IS NOT TO BE taken although it fulfills Red crossing over Green but it is taken ONLY when it crosses the manual resistance drawn -orange color. Now this orange color resistance can not be drawn with updata as it

is not a 45 line (the chart is 2 rev boxes). Violate Rule 2

Double top at B IS TO BE taken because it is created long after the ma cross over and also the orange res line is broken.

Double top at C is NOT to be taken because it violates Rule 3.

Double top at D IS TO BE TAKEN obviously.

Now interestingly I changed the chart to 3 box reversal.

Noticed the following.

At point B there is an automated 45 resistance and even manual 45 angle res can be easily created. So the rule that 45 trend is valid for 3 box reversal is more true.

And we would have avoided that double unless it crosses the resistance.

What do you think about these rules.

In the chart for 8280-SAU, I have plotted the 5EMA and 21MA

So I will refer them as Red and Green line.

Every double top is NOT to be taken as a buy signal.

I am talking for long positions below.

-----------------------

Consider Chart 1%X2

--------------------------

Rule 1:

Red line acts as Resistance and Green As support.

If the Red crosses the Green , and a double top is created afterwards, then that double stop is more tradable.

Rule 2:

45 Angle Support and Resistance is valid for 3 box reversals and if using 2 bix reversal, then we should also draw an angled trend manually.

The Double top should created under such manual resistance or close to it should be treated in the same precaution as if that res was a 45 line resistance and we wait to enter when the X column past that Resistance.

Rule 3:

The two tops of the Double top and the double top itself if created just on the resistance should be avoided.

In the chart above:

Double top created at Point A IS NOT TO BE taken although it fulfills Red crossing over Green but it is taken ONLY when it crosses the manual resistance drawn -orange color. Now this orange color resistance can not be drawn with updata as it

is not a 45 line (the chart is 2 rev boxes). Violate Rule 2

Double top at B IS TO BE taken because it is created long after the ma cross over and also the orange res line is broken.

Double top at C is NOT to be taken because it violates Rule 3.

Double top at D IS TO BE TAKEN obviously.

Now interestingly I changed the chart to 3 box reversal.

Noticed the following.

At point B there is an automated 45 resistance and even manual 45 angle res can be easily created. So the rule that 45 trend is valid for 3 box reversal is more true.

And we would have avoided that double unless it crosses the resistance.

What do you think about these rules.