You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I Stopped Using Stops

- Thread starter Wicked_Daddy

- Start date

- Watchers 48

Hi, I would like to get in touch with this guy Marius. Are you able to help me please? Thanks

good luck with that happening 😆

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Re Flylife comment - that's now disappeared

His name was Marius Ghisea - he's based in Stockholm Sweden and his company was MS Capital consulting

By all means check him out if you have a few hundred thousands to invest

Regards

F

His name was Marius Ghisea - he's based in Stockholm Sweden and his company was MS Capital consulting

By all means check him out if you have a few hundred thousands to invest

Regards

F

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Re Flylife comment - that's now disappeared

His name was Marius Ghisea - he's based in Stockholm Sweden and his company was MS Capital consulting

By all means check him out if you have a few hundred thousands to invest

Regards

F

Does he supply statements?

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Does he supply statements?

He was very proud of his really high win rate ( ie over 92% + ) - Maybe because trades last anything from a few days to 4+ years ( lol) and I can imagine if 1000 pips is 1% of a client's capital he needs to hit some big pip numbers to earn them money.

All the members on another forum used to thinks he we brilliant - he's got a few million in the fund to control - so I would not think he would get away with paint shop - lol 🙂

Good Trading

Regards

F

Wicked_Daddy

Active member

- Messages

- 128

- Likes

- 48

Im certainly no flame thrower Mr WD, but am always interested in what other traders do. What I would like to know ( but completely understand if you dont want to say) is that you say profitability is 100% (but I think by that you mean your strike rate?) but how much has your account grown by in percentage terms since you started this thread in June?

Obviously you have had no losers thus far, so how many trades have been taken in this period to achieve your percentage return on the account.

This will give other traders of all levels a better vision of the pros/cons and restrictions that apply to using an approach such as this.

Many thanks

WSW

Good question and I'm happy to clarify. And you are correct, the 100% is the strike rate, not the account growth.

As of Friday, Dec 11, I have closed 106 consecutive profitable trades since employing this strategy on May 21, 2015, resulting in growth of 242%.

Wicked_Daddy

Active member

- Messages

- 128

- Likes

- 48

WD is new to forex and he trades the Euro which has been in a range for a while now , so taking the Euro in this particular period - as a case study - is hardly relevant to the topic ...

I trade EUR, NZD, AUD, GBP, CAD and sometimes JPY - mainly against the USD but cross pairs as well. I especially like the EURGBP. The pip rate to margin ratio is excellent and it's the most predictable pair I have traded thus far.

New to Forex, relatively speaking. Been trading equity options for 15 years - 10 of those seriously. I trade Forex now exclusively as my living income and equity options in my long term (retirement) account.

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Good question and I'm happy to clarify. And you are correct, the 100% is the strike rate, not the account growth.

As of Friday, Dec 11, I have closed 106 consecutive profitable trades since employing this strategy on May 21, 2015, resulting in growth of 242%.

Then maybe its about time to open a live trading journal thread ....

Wicked_Daddy

Active member

- Messages

- 128

- Likes

- 48

Then maybe its about time to open a live trading journal thread ....

Perhaps. I've thought about it but it seems just another thing to manage. I keep a journal of trades in a spreadsheet and even then, I'm not that good at keeping up with it. Especially when the reporting the broker provides is already very good.

Honestly, when I started this thread I thought I'd get some feedback from others that are doing the same thing and maybe some ideas as well. It really hasn't gone that way and I'm even more surprised it keeps getting resurrected. As you probably noticed, I don't post often.

timsk

Legendary member

- Messages

- 8,834

- Likes

- 3,538

Hi W_D,Perhaps. I've thought about it but it seems just another thing to manage. I keep a journal of trades in a spreadsheet and even then, I'm not that good at keeping up with it. Especially when the reporting the broker provides is already very good.

Honestly, when I started this thread I thought I'd get some feedback from others that are doing the same thing and maybe some ideas as well. It really hasn't gone that way and I'm even more surprised it keeps getting resurrected. As you probably noticed, I don't post often.

Like tar, I'd welcome a thread from you - although it doesn't need to be a live trading journal in my view - just one that outlines how you achieve your most impressive results. In fact, you could do that here if you're so inclined. I've traded without stops myself - on demo accounts for fun - by averaging down and simply waiting for offside positions to come good. Almost always, they do that eventually, although the maximum adverse excursion in the interim can be huge and waaay beyond what would be advisable or even tolerable trading a live account. So, as things stand, I admire you, darktone and others who manage to trade successfully without using stops, but I confess I don't really understand how it can be dome without incurring massive risk which will, almost certainly, result in ruin sooner or later. So, if you'd be prepared to shed some light on your methodology, I for one would be extremely interested.

Cheers,

Tim.

Wicked_Daddy

Active member

- Messages

- 128

- Likes

- 48

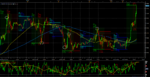

I change my use of indicators (I use indicators) from time to time as I experiment but here is what I've been using for the last month or so.

- I use 3, 3 period RSIs overlapped on each other on a 15 minute chart. The RSIs are: current TF (Green), H1 (Red) and H4 (Yellow). I have marked with dotted lines 90 and 10 on the RSI chart.

- 2 SMAs : 100 (Yellow) and 200 (Blue)

I trade the extremes. I have provided a EURGBP chart and have circled previous trades with white circles. Some of them were spot on, others needed a little breathing room.

When the current period RSI closes above or below 90 /10, I am looking for H1 RSI to be close to that extreme as well and I will most likely wait for the H1 to close to confirm the extremity. The H4 also provides support if the market is choppy or slow and if all them are peaked, it's a very strong trade. I also am looking for divergence, primarily in the current TF RSI but also in the H1. If current TF RSI is see-sawing away from an extreme while the H1 is strengthening, I'll enter the trade on the 2nd or 3rd peak of the current TF RSI. At that point the H1 is most likely extreme while the current TF RSI is above/below it. The MAs are used to provide context to the trade. In a trend (100 above/below 200) I am looking for temporary reversals in which the retrace momentum has reached its extreme and will revert back. Notice I did not say "overbought/sold". Wrong terminology and mindset - IMO. For every buyer there is a seller so how can anything be over bought or over sold? I think in terms of momentum. When the RSI is peaking, momentum will exhaust. My timing is wrong when I take a trade at a peak but the momentum only takes a small break and then continues. This condition results in divergence that I just need to be patient with and I may even add to the trade at a 2nd, lower peak. Or, just leave it alone and let it mature.

At the time I posted this, EURGBP made a run to .7295 and met my conditions when the 10am CST candle closed.

- I use 3, 3 period RSIs overlapped on each other on a 15 minute chart. The RSIs are: current TF (Green), H1 (Red) and H4 (Yellow). I have marked with dotted lines 90 and 10 on the RSI chart.

- 2 SMAs : 100 (Yellow) and 200 (Blue)

I trade the extremes. I have provided a EURGBP chart and have circled previous trades with white circles. Some of them were spot on, others needed a little breathing room.

When the current period RSI closes above or below 90 /10, I am looking for H1 RSI to be close to that extreme as well and I will most likely wait for the H1 to close to confirm the extremity. The H4 also provides support if the market is choppy or slow and if all them are peaked, it's a very strong trade. I also am looking for divergence, primarily in the current TF RSI but also in the H1. If current TF RSI is see-sawing away from an extreme while the H1 is strengthening, I'll enter the trade on the 2nd or 3rd peak of the current TF RSI. At that point the H1 is most likely extreme while the current TF RSI is above/below it. The MAs are used to provide context to the trade. In a trend (100 above/below 200) I am looking for temporary reversals in which the retrace momentum has reached its extreme and will revert back. Notice I did not say "overbought/sold". Wrong terminology and mindset - IMO. For every buyer there is a seller so how can anything be over bought or over sold? I think in terms of momentum. When the RSI is peaking, momentum will exhaust. My timing is wrong when I take a trade at a peak but the momentum only takes a small break and then continues. This condition results in divergence that I just need to be patient with and I may even add to the trade at a 2nd, lower peak. Or, just leave it alone and let it mature.

At the time I posted this, EURGBP made a run to .7295 and met my conditions when the 10am CST candle closed.

Attachments

timsk

Legendary member

- Messages

- 8,834

- Likes

- 3,538

Hi W_D,. . . My timing is wrong when I take a trade at a peak but the momentum only takes a small break and then continues. This condition results in divergence that I just need to be patient with and I may even add to the trade at a 2nd, lower peak. Or, just leave it alone and let it mature.

Many thanks for the explanation and chart. Very illuminating. I'm clear about your methodology and reasoning for taking trades which, on the face of it, looks pretty sound. Indeed, your results indicate that it works very well.

What I'm not clear about is your risk management strategy and non use of stops. In the piece I've quoted, you've said that you may average down or "just leave it alone and let it mature". This begs the question: what happens if and when price just continues to go against you and simply fails to 'mature'? Do you have an emergency stop loss which, if hit, would wipe out all or most of your gains? Or more? Failing that, what alternative provisions have you made to deal with the time that the market remains irrational longer than you can remain solvent? (Sadly, I know this to be true as I speak from bitter experience!)

Tim.

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

but I confess I don't really understand how it can be dome without incurring massive risk which will, almost certainly, result in ruin sooner or later. So, if you'd be prepared to shed some light on your methodology, I for one would be extremely interested.

Cheers,

Tim.

Easy Tim , just trade very very small size like 1 share or 10 forex units - with Oanda - and scale in sparingly but even then we will face two problems :

1- We wont make a living anytime soon or maybe never - waste of time - .

2- And at some point one bad trade will wipe out all the profits , yes you wont get bankrupt because you are trading small but still a bad trade will take all the profits .

I am looking to put food on the table and make a serious good living from trading , i am not going to treat it like a hobby otherwise i will be the first one to average down without a stop - small size - .

Wicked_Daddy

Active member

- Messages

- 128

- Likes

- 48

Tim,

I have had some occasions where my patience was certainly tested. That said, I yet to manually close a trade at a loss. Sometimes it takes iron nerves and then the lesson is that I entered a trade against one or more of my criteria. Most often this happens when I enter counter to the trend. I occasionally do this if I think an over trend reversal is due and although my assumption is correct, my timing may be way off. I've had to endure a 200 pip continuance that had me really scratching my head and questioning my position. But I hung in there and it only took a couple days to get back to profit. To ad insult to injury, I exited the trade with about 10 pips profit, just because I wanted out and to regroup. As soon as I exited, the price did exactly what I had originally anticipated and I left a ton of money on the table.

My risk management is discretionary. If/when I get to a certain loss that is unproductive and I feel is too far to recover within a reasonable amount of time, I would close the trade. To avoid this, I place a BE stop as soon as the trade is profitable. I'll move it deeper into profitability as I see fit. Often this has resulted in small wins and then frustration as price takes off after hitting my profitable stop, but... a win is a win. Most of my trades are around 20 pips. Some have done really well. I also extract profits from my account on a regular basis. At this point I could have a full crash and still be ahead. So I guess my real stop is my account balance.

I have had some occasions where my patience was certainly tested. That said, I yet to manually close a trade at a loss. Sometimes it takes iron nerves and then the lesson is that I entered a trade against one or more of my criteria. Most often this happens when I enter counter to the trend. I occasionally do this if I think an over trend reversal is due and although my assumption is correct, my timing may be way off. I've had to endure a 200 pip continuance that had me really scratching my head and questioning my position. But I hung in there and it only took a couple days to get back to profit. To ad insult to injury, I exited the trade with about 10 pips profit, just because I wanted out and to regroup. As soon as I exited, the price did exactly what I had originally anticipated and I left a ton of money on the table.

My risk management is discretionary. If/when I get to a certain loss that is unproductive and I feel is too far to recover within a reasonable amount of time, I would close the trade. To avoid this, I place a BE stop as soon as the trade is profitable. I'll move it deeper into profitability as I see fit. Often this has resulted in small wins and then frustration as price takes off after hitting my profitable stop, but... a win is a win. Most of my trades are around 20 pips. Some have done really well. I also extract profits from my account on a regular basis. At this point I could have a full crash and still be ahead. So I guess my real stop is my account balance.

wallstreetwarrior87

Senior member

- Messages

- 2,068

- Likes

- 389

Easy Tim , just trade very very small size like 1 share or 10 forex units - with Oanda - and scale in sparingly but even then we will face two problems :

1- We wont make a living anytime soon or maybe never - waste of time - .

2- And at some point one bad trade will wipe out all the profits , yes you wont get bankrupt because you are trading small but still a bad trade will take all the profits .

I am looking to put food on the table and make a serious good living from trading , i am not going to treat it like a hobby otherwise i will be the first one to average down without a stop - small size - .

This is what I was getting at, for the wealthy its a way to pass time, be in the game, have a reason to exist :cheesy:.

But to get wealthy, well I think the above observation is spot on.

This is not a criticism of the OP, each to their own, but its simply just a question of efficiency.

timsk

Legendary member

- Messages

- 8,834

- Likes

- 3,538

Hi W_D,. . . At this point I could have a full crash and still be ahead. So I guess my real stop is my account balance.

Thanks for the reply and for being so candid.

If I've understood you correctly, you're in a strong position whereby you're trading with profits which enables you to follow your convictions rather more fearlessly than most traders who would be in a dark place in the event of an account blow up.

Unfortunately, your explanation of what you're doing rather confirms my suspicions, as I've done exactly as you outline in days gone by. Inevitably, sooner or later, the market keeps going against you until you can't take it any more and bail out, or you get a margin call. In both cases, you'll exit your positions at the exact tick the market reverses and sails past your entry point and into profit! I guess that as long as you're aware that this scenario will almost certainly happen one day, and you accept that risk and are happy trading the way you do - then fair play to you. In some respects, it's akin to trading Martingale which, as I'm sure you know, can work well for quite a long time. However, the day it fails - and that day always comes - it can spell financial armageddon.

Therefore, all I would say is:

1. Keep making regular withdrawals of profits, and . . .

2. Have some sort of safeguard in place to ensure you don't ever find yourself in a position like those poor traders caught on the wrong side of the SNB interest rate fiasco last January and end up owing your broker much more than you have in your account. That's the stuff of nightmares.

Good luck and thanks for sharing.

Tim.

Wicked_Daddy

Active member

- Messages

- 128

- Likes

- 48

This is what I was getting at, for the wealthy its a way to pass time, be in the game, have a reason to exist :cheesy:.

But to get wealthy, well I think the above observation is spot on.

This is not a criticism of the OP, each to their own, but its simply just a question of efficiency.

Trading forex is my only source of income. I trade 1, 1.5, 2, 2.5 OR 3 lots, depending on the pair (margin requirement) and my comfort with the position. My maximums are based on the total percentage of leverage and margin I have dedicated to the trade(s). I typically allow an 80+% cushion in the account and, being in the U.S., 50:1 is the maximum leverage, although I am averaging 30:1 with 15% of the account in a trade.

I'm not rich. But I make a decent living, own my home, cars, and don't have a boss.

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Perhaps. I've thought about it but it seems just another thing to manage. I keep a journal of trades in a spreadsheet and even then, I'm not that good at keeping up with it. Especially when the reporting the broker provides is already very good.

Honestly, when I started this thread I thought I'd get some feedback from others that are doing the same thing and maybe some ideas as well. It really hasn't gone that way and I'm even more surprised it keeps getting resurrected. As you probably noticed, I don't post often.

There are a few doing similar things, but the majority are not and I very much doubt they can get their heads around it !

As for advice....I would keep on doing what you do. The only thing you may want to explore to enhance the strat, in times of drawdown, would be some form of hedging to negate any potential fat tail acct busting moves.

Good luck.🙂

Wicked_Daddy

Active member

- Messages

- 128

- Likes

- 48

Thanks Tim.

I'm not so naive to think I couldn't possibly be creamed. Many times I ask myself, "Is this the one?" But as you say, I'm no longer trading with my original money. I suppose I could view it that way but I actually see it as mine. I still get upset when I mis-time an entry. I still have doubts when the price goes against me and seems to keep going. Hell, I get pissed when I'm 10 pips negative. But mainly because my focus is on timing and I like nailing the timing.

I appreciate your advice and I'm, always thinking of going back to stops - maybe really deep. Maybe in line with some formula I'll create to exit a trade so I won't tie up my account waiting for the inevitable reversal. We'll see.

All the best.

I'm not so naive to think I couldn't possibly be creamed. Many times I ask myself, "Is this the one?" But as you say, I'm no longer trading with my original money. I suppose I could view it that way but I actually see it as mine. I still get upset when I mis-time an entry. I still have doubts when the price goes against me and seems to keep going. Hell, I get pissed when I'm 10 pips negative. But mainly because my focus is on timing and I like nailing the timing.

I appreciate your advice and I'm, always thinking of going back to stops - maybe really deep. Maybe in line with some formula I'll create to exit a trade so I won't tie up my account waiting for the inevitable reversal. We'll see.

All the best.

Similar threads

- Replies

- 26

- Views

- 6K

- Replies

- 6

- Views

- 55K

- Replies

- 51

- Views

- 14K