darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

Ah I just thoughtHi dt,

Forgive me if I'm being spectacularly dim, but I'm not too sure what it is that you're trying to show with the charts? My guess is that it's possible to be short in an uptrend and come out on top without using stops?

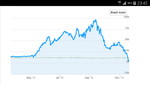

As much as I've tried to free myself from the 'prison of my own false thoughts', there's one thought that keeps coming back and biting me in the butt. Whichever way I slice 'n dice it, it appears to me to be very, very true. Namely, that sooner or later there's a ferociously strong move that's sustained for much longer than one expects or that one's account can withstand. True, they don't happen very often but, when they do then, potentially, it's bye bye account time. Been there, bought the T shirt. If you can explain clearly and simply how to get around this problem, then the circular nature of the discussion referred to by 'beastwork' might be broken.

Tim.

was a bit of a funny thing to say, so I posted a long example of a trader being 'right' yet losing money.And it certainly won't turn a losing strategy into a winning one

Cut size, stop expecting and seek value Tim. Imagine your worst case 1 tick scenario then double it, and maybe double again. Dax -2000 in tick. Where would I be? -10% -40% -500%. Its one of the few aspects we have control over.