You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I Stopped Using Stops

- Thread starter Wicked_Daddy

- Start date

- Watchers 48

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

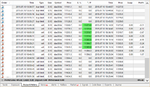

Yeaaaaaaah, not such a great day today: :whistlingThey didn't take the balance from zero to 75k/25k , these are just pips counts with infinite balances .

Price on tars ego please / all time high at 150 / ill buy all you got!

Scaling-in with no clear stops , its always ends the same way ...

-845.82

-32%

Attachments

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

What a heavy thread 😆

I think we could benefit from some of this !

I think we could benefit from some of this !

Yeaaaaaaah, not such a great day today: :whistling

-845.82

-32%

Dark

Thank you for your honest post.

Fug

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

Making 32% in one day is as bad as losing -32% in a single day ...

I guess it would be the same as the low risk trader making long money in short oil. Just unprofessional.

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

Dark

Thank you for your honest post.

Fug

Sorry Fug, but your mind has tricked you.

Sorry Fug, but your mind has tricked you.

ok.

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

0.50 in a 200 pt market.

Not taking any profits on the shorts all day. This was a 'get into position play re D1'

Hedges in the morning bringing it initial loses on the first scratches down from -25 to -6. Didnt bother from there, Including the lucrative chop mid day.

Final stiff run up missing scratches by fractions (nightmare right!). Even bailed out the last at market, other things to do. Final ave pos around 11365.

Sorry guys but dispite all of that, the most I managed to lose was:

-45.82

-1.6%

Not taking any profits on the shorts all day. This was a 'get into position play re D1'

Hedges in the morning bringing it initial loses on the first scratches down from -25 to -6. Didnt bother from there, Including the lucrative chop mid day.

Final stiff run up missing scratches by fractions (nightmare right!). Even bailed out the last at market, other things to do. Final ave pos around 11365.

Sorry guys but dispite all of that, the most I managed to lose was:

-45.82

-1.6%

Attachments

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Morning Darktone

I have got to admit when I first saw you comment about your massive loss of 845 pips loss and 32% down on your account I was very suspicious.

Most traders are always suspicious of any Broker statement - their first thought is - its a demo - and then the second logical one if the results just look far too good - or in your case far too bad - its been doctored / fiddled / paint shopped / changed etc etc.

I would say the majority of traders and certainly members here on T2W who think they are "streetwise" would say every fantastic trading performance showing massive pip hauls and no losses is fake and then every really bad statement like the one you originally shown - that's got to be 100% Kosher.

But the facts are - as you have shown - that's NOT always the case.

You must be the first member here to pull the trick you did - lol - that shows really how clever you are - because 8 or 9 out of 10 other members here would say - well we knew it - its bound to happen - serves him right etc etc

Instead you initially caught us all out - ie misleading us etc - but made it clear it the statement you had faked it by using the words "Loiss and tarde" instead loss and trade.

Then you show your proper statement - with no changes and its only a 45 pip loss and minus 1 6% capital loss - that sounds more like it

BUT

Here's the real crux of the matter - you need not have had that approx 45 pip loss and approx 1.6% negative.

First question - how long did it take you to manage your loss down to only approx 45 pips - was it all within 1 hr or was it over 4 or 6 or 8 hrs ??

Next point - and this is important - if you were to contact McKinsey & Co - a world renown business management consultancy group and had access to their Risk division - they would quite openly tell you in a brief summary -

"Studies have shown that trading in the world's stock markets - traders who trade with stops - make more money than traders who do not use stops at all"

With "Risk" being such an important component of trading - trade management is ultra important - scaling in more into already winning positions using then "risk free" new profits managed correctly is simply the best way possible.

Its not the stops the real big problem - its the timing and your entry price that is even more important for intraday/ swing traders and that Darktone is the area you need to really work on.

I reckon you are so nearly there to becoming a really excellent trader - you have shown you are "smart" - you have a traders mentality - ie you think out of the box - who you understand the continual "trickery" that is all part of the "game" - you know how to scale in and out - you are experienced - now the real "key" the last part of your "jigsaw" - entries / timing / ultra tight stops - 👍

GL

Regards

F

I have got to admit when I first saw you comment about your massive loss of 845 pips loss and 32% down on your account I was very suspicious.

Most traders are always suspicious of any Broker statement - their first thought is - its a demo - and then the second logical one if the results just look far too good - or in your case far too bad - its been doctored / fiddled / paint shopped / changed etc etc.

I would say the majority of traders and certainly members here on T2W who think they are "streetwise" would say every fantastic trading performance showing massive pip hauls and no losses is fake and then every really bad statement like the one you originally shown - that's got to be 100% Kosher.

But the facts are - as you have shown - that's NOT always the case.

You must be the first member here to pull the trick you did - lol - that shows really how clever you are - because 8 or 9 out of 10 other members here would say - well we knew it - its bound to happen - serves him right etc etc

Instead you initially caught us all out - ie misleading us etc - but made it clear it the statement you had faked it by using the words "Loiss and tarde" instead loss and trade.

Then you show your proper statement - with no changes and its only a 45 pip loss and minus 1 6% capital loss - that sounds more like it

BUT

Here's the real crux of the matter - you need not have had that approx 45 pip loss and approx 1.6% negative.

First question - how long did it take you to manage your loss down to only approx 45 pips - was it all within 1 hr or was it over 4 or 6 or 8 hrs ??

Next point - and this is important - if you were to contact McKinsey & Co - a world renown business management consultancy group and had access to their Risk division - they would quite openly tell you in a brief summary -

"Studies have shown that trading in the world's stock markets - traders who trade with stops - make more money than traders who do not use stops at all"

With "Risk" being such an important component of trading - trade management is ultra important - scaling in more into already winning positions using then "risk free" new profits managed correctly is simply the best way possible.

Its not the stops the real big problem - its the timing and your entry price that is even more important for intraday/ swing traders and that Darktone is the area you need to really work on.

I reckon you are so nearly there to becoming a really excellent trader - you have shown you are "smart" - you have a traders mentality - ie you think out of the box - who you understand the continual "trickery" that is all part of the "game" - you know how to scale in and out - you are experienced - now the real "key" the last part of your "jigsaw" - entries / timing / ultra tight stops - 👍

GL

Regards

F

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Re the 32% loss i didn't believe it either no one did , i knew he didn't lose that much and he just wanted to make some point .

Re thinking outside the box i disagree , as i said earlier every new trader goes this route : averaging down , no stops . I have shown many real live examples . Even the average Joe on the street will scale in in his stocks holdings .

Re thinking outside the box i disagree , as i said earlier every new trader goes this route : averaging down , no stops . I have shown many real live examples . Even the average Joe on the street will scale in in his stocks holdings .

timsk

Legendary member

- Messages

- 8,834

- Likes

- 3,538

Hi Tar,. . . i said earlier every new trader goes this route : averaging down , no stops . I have shown many real live examples . Even the average Joe on the street will scale in in his stocks holdings.

Please can you explain why you keep posting these screen shots of traders who've blown their accounts by averaging down forever without using stops? How are they relevant to this thread and, in particular, to what darktone is doing? I'm not taking the mickey, I genuinely don't see any connection.

Thanks, Tim.

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Hi Tar,

Please can you explain why you keep posting these screen shots of traders who've blown their accounts by averaging down forever without using stops? How are they relevant to this thread and, in particular, to what darktone is doing? I'm not taking the mickey, I genuinely don't see any connection.

Thanks, Tim.

Hi Tim they don't average down for ever , they scale in up to 30 times max - many of them much less - , most of them have stated that clearly in their strategy description . And they have stops wide stops though - set by zulu by default - or unclear ones , so they do close at a loss occasionally .

timsk

Legendary member

- Messages

- 8,834

- Likes

- 3,538

Okay - sorry, I haven't looked at them closely. I'm more than happy to accept your explanation, so I'll re-phrase my question: How are screen shots of traders who scale in (up to 30 times) using very wide stops relevant to this thread and, in particular, to what darktone is doing?Hi Tim they don't average down for ever , they scale in up to 30 times max , most of them have stated that clearly in their strategy description . And they have stops wide stops though - set by zulu by default - or unclear ones , so they do close at a loss occasionally .

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Okay - sorry, I haven't looked at them closely. I'm more than happy to accept your explanation, so I'll re-phrase my question: How are screen shots of traders who scale in (up to 30 times) using very wide stops relevant to this thread and, in particular, to what darktone is doing?

First of all this thread is not about darktone , second this thread is about trading without stops or very wide ones . And then some of you guys introduced scaling-in to the equation/discussion , so it is very relevant . BTW when i said wide i meant 500 pips - thats the zulu's default - and they did occasionally close before that .

Similar threads

- Replies

- 26

- Views

- 6K

- Replies

- 6

- Views

- 55K

- Replies

- 51

- Views

- 14K