I like your graphs DT, as for the others just let them be, for you are correct when you say that all that matters is trading. We will let them be and carry on.

Now, it is not how the graph is obtained that matters, but what the graph tells us. One can use Excel, Trading Software, Com, C+, API or any other means of data gathering. The key lies in understanding the data and using it to assist us in making better trading decisions.

If anyone had bothered to post their next trade for C, which I will not be asking again BTW, then they would more than likely be sitting on their butt today staring at a very boring screen.

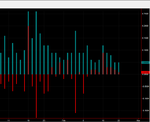

Let us move on to the next set of graphs, and the symbol is HPQ.

By now, it should be obvious what we need to do as daytraders, if not then I suggest you start asking some serious questions before you really get left behind.

Well done DT, you are the first sensible to step forward and speak your mind. You are now on your way to becoming an Expert, so do not fall into the usual trap and become an amateur, as nearly all do.