Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

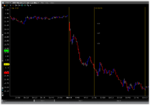

LUV was a nice one from my pre-market list today, producing a profit of 77c per share. I then traded it again shortly afterwards and lost 4c on the second trade. They don't always work but I always keep the losers small.

This is the first trade.

I exited as it looked like it was reversing, which is obvious from the chart.

This is the first trade.

I exited as it looked like it was reversing, which is obvious from the chart.