Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

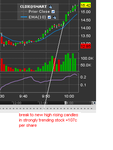

Here are two trades from today in the same stock, CLDX.

There was excellent news pre-market and it was also a gapper so I had it on my alert list an hour before the market even opened.

I read through the news stories and look at the pre-market gappers before open, then repeatedly scan for more possible opportunities after open.

Both of the two trades used the particular set up in this thread (and also one of the other ones I use).

The first produced a profit of 31c per share.

There was excellent news pre-market and it was also a gapper so I had it on my alert list an hour before the market even opened.

I read through the news stories and look at the pre-market gappers before open, then repeatedly scan for more possible opportunities after open.

Both of the two trades used the particular set up in this thread (and also one of the other ones I use).

The first produced a profit of 31c per share.

Attachments

Last edited: