MR, you amaze me. I'm being serious. I have to put up with many of your nonsense posts, and then you post something that makes total sense.

That is one of the main points I'm trying to make. Even my nuggets must be intuitive. The trader must use and develop his own methodology. The methodological approach and margin management are all personal. The nuggets are designed to help the trader to realize when a trend or a correction has, more or less, hits it limit, then jump in and maximize the gains.

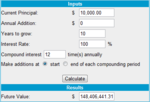

I make 100% per month quite consistently. 100% per week is the exception.

If no one is really paying attention, then I quit. I don't think that is the case which is why I am continuing.

When I made the threat, then got hammered by e-mails, a couple of PM's, and the few posts in here, it told me there are a few paying attention. That is why I stuck around.

Here's a margin nugget for everyone. I said I would avoid it, but this is information that has not been covered:

It is all stereotypes as far as risk per trade, Sharpe ratios, etc are concerned. The EUR/AUD (S) I am in is a very low risk trade, because of the TA's involved-- Close to sigma +3, under the daily cloud, the trend's range stretched to the max, etc. That's my version of low risk. Also, I can afford high DD, just in case it does happen. I have more than 100% of my equity lurking in the background ready to back me up. I have a high-risk tolerance, which is not needed most of the time. And I have ice in my veins.

MR, if you use the Sharpe ratio, that's fine. I'm not knocking it, because it is personal. Get your portion of the nuggets, and you willm kae your 100% per month.

But, you're right, "no one strategy is universally better than any other". This is because it is up to the inidividual in running that strategy. We're diverse. Admittedly, I'm diverse from most. My methodology has netted me 36 consecutive winning months. Mine would probably net you 36 the opposite. I guess you do well with yours. I couldn't using yours. It's that simple

Excellent post.. I would go a little further and say that no one strategy is universally better than any other, which is why each trader needs to find the system best suited to them, in terms or % win rate, drawdown, risk per trade, frequency of trades, Sharpe ratio and so on.

I doubt anyone is really paying attention though.

Show me how to make 100% in a month!!!! (or was it in a week, I forget)