WklyOptions

Well-known member

- Messages

- 269

- Likes

- 24

training eyes to "see" poor T1 setup

Hi, T2W traders,

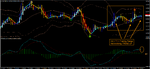

This is a quick post on the attached H4 chart on GBPUSD.

I posted this chart to help those traders that have downloaded the free ePDF "Tracking Big Money Trends" - and able to understand and apply the concepts of T1 and T3 rules/criteria for multiple time frame analysis.

OK - lesson on GBPUSD chart (H4 as the T1 chart):

1. At the right edge - it appears as if the H4 chart shows a bearish trend & momentum.

2. The H4-T1 chart showed MACD < 0, and MACD Fast Line sloping downwards, and the Fast Line < Slow Line.

So on a word-for-word basis, it appears that the H4 chart would have a qualified T1 bearish trading setup.

However - ALERT! :!:

Traders would do best to grasp the essential concept ---> the strategy is to find a Dominant Trend on the T1 chart - and then attack/exploit Pullbacks against that Dominant Trend.

If you zoom out of the H4 chart - you can clearly see there is NO DOMINANT TREND to the downside. If fact the GBPUSD is in a trading range on the H4 chart.

Understand?

The absence of a strongly trending bearish T1 chart pattern = NO DOMINANT TREND. :idea:

Especially important for new traders - it is often much easier to trade in strongly trending chart patterns - and to avoid chart patterns that are in "congestion" (or "indigestion" as many of my trading colleagues call it).

Learning to avoid weak/inappropriate trading setups (even if rules/criteria "ok") is an important skill-set for the profit-oriented highly focused/selective trader! 👍

Hope it helps some here. Please feel free to post your questions or chart setups.

Thank you.

WklyOptions

Hi, T2W traders,

This is a quick post on the attached H4 chart on GBPUSD.

I posted this chart to help those traders that have downloaded the free ePDF "Tracking Big Money Trends" - and able to understand and apply the concepts of T1 and T3 rules/criteria for multiple time frame analysis.

OK - lesson on GBPUSD chart (H4 as the T1 chart):

1. At the right edge - it appears as if the H4 chart shows a bearish trend & momentum.

2. The H4-T1 chart showed MACD < 0, and MACD Fast Line sloping downwards, and the Fast Line < Slow Line.

So on a word-for-word basis, it appears that the H4 chart would have a qualified T1 bearish trading setup.

However - ALERT! :!:

Traders would do best to grasp the essential concept ---> the strategy is to find a Dominant Trend on the T1 chart - and then attack/exploit Pullbacks against that Dominant Trend.

If you zoom out of the H4 chart - you can clearly see there is NO DOMINANT TREND to the downside. If fact the GBPUSD is in a trading range on the H4 chart.

Understand?

The absence of a strongly trending bearish T1 chart pattern = NO DOMINANT TREND. :idea:

Especially important for new traders - it is often much easier to trade in strongly trending chart patterns - and to avoid chart patterns that are in "congestion" (or "indigestion" as many of my trading colleagues call it).

Learning to avoid weak/inappropriate trading setups (even if rules/criteria "ok") is an important skill-set for the profit-oriented highly focused/selective trader! 👍

Hope it helps some here. Please feel free to post your questions or chart setups.

Thank you.

WklyOptions