WklyOptions

Well-known member

- Messages

- 269

- Likes

- 24

Hi, T2W,

WklyOptions here on my 1st post on this Home Trader thread. I just wanted to introduce and share with you my trading background and biases.

1. Home-Based trading career: 10+ yrs full-time solo trading career.

2. Trading products: (a) US-listed Weekly Options on ETFs, Equities; (b) FX options using the NADEX products & platforms.

3. Trading platforms:

a. Weekly Options - primarily use ThinkOrSwim (TOS) with TradeStation backup.

b. FX Options & Binaries - use the NADEX platform with FXCM TWS as backup.

4. Weekly Options strategies:

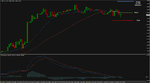

a. Use multiple time-frame analysis (MACD, EMA(20)). M/W/D/H/M30/M15/M5.

b. Trade duration usually < 8 trading days.

c. Trade strategies: trend reversal & trend continuation setups.

d. Trading Edge: income-strategies w/ selling At-The-Money fattest premiums.

5. FX Options & Binaries strategies:

a. FX asset correlation & comparative relative strength analytics.

b. Multiple time-frame analysis (MACD, EMA(20)). M/W/D/H4/H1/M30/M15/M5.

c. Trading Edge: trend & momentum directional setups on pull-backs.

6. Bet Size: 1st "bet" at 0.5% of acct balance. May attack 2nd time w 1% bet.

7. Max # of open positions at any one time: up to 20 open campaigns maximum. Maximum acct capital "at risk" at any point is (25%).

Well, I hope the above very brief "summary" is clear enough to give you a basic background/organization of my trading procedures.

I look forward to sharing and exchanging of trading & technical analysis topics, ideas, results! I will also post my trades at times to give T2W a real-time "flavor" of how the above approach is applied.

Thank you for your time and attention - please feel free to post here on this thread or PM me (if T2W allows PM?) with your constructive input & questions!

Best regards,

WklyOptions

WklyOptions here on my 1st post on this Home Trader thread. I just wanted to introduce and share with you my trading background and biases.

1. Home-Based trading career: 10+ yrs full-time solo trading career.

2. Trading products: (a) US-listed Weekly Options on ETFs, Equities; (b) FX options using the NADEX products & platforms.

3. Trading platforms:

a. Weekly Options - primarily use ThinkOrSwim (TOS) with TradeStation backup.

b. FX Options & Binaries - use the NADEX platform with FXCM TWS as backup.

4. Weekly Options strategies:

a. Use multiple time-frame analysis (MACD, EMA(20)). M/W/D/H/M30/M15/M5.

b. Trade duration usually < 8 trading days.

c. Trade strategies: trend reversal & trend continuation setups.

d. Trading Edge: income-strategies w/ selling At-The-Money fattest premiums.

5. FX Options & Binaries strategies:

a. FX asset correlation & comparative relative strength analytics.

b. Multiple time-frame analysis (MACD, EMA(20)). M/W/D/H4/H1/M30/M15/M5.

c. Trading Edge: trend & momentum directional setups on pull-backs.

6. Bet Size: 1st "bet" at 0.5% of acct balance. May attack 2nd time w 1% bet.

7. Max # of open positions at any one time: up to 20 open campaigns maximum. Maximum acct capital "at risk" at any point is (25%).

Well, I hope the above very brief "summary" is clear enough to give you a basic background/organization of my trading procedures.

I look forward to sharing and exchanging of trading & technical analysis topics, ideas, results! I will also post my trades at times to give T2W a real-time "flavor" of how the above approach is applied.

Thank you for your time and attention - please feel free to post here on this thread or PM me (if T2W allows PM?) with your constructive input & questions!

Best regards,

WklyOptions