iwantu2brich

Member

- Messages

- 73

- Likes

- 0

What can I say..

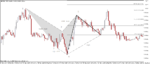

Beautiful! I expect this, but even that it was still surprise how quick usdjpy go up. First, big gap, and then was Bat pattern witch finally crush (because of gap and my formation)! It is like birthday, you know, you get present, but you don't know how big it will be...

Uploaded with ImageShack.us

Beautiful! I expect this, but even that it was still surprise how quick usdjpy go up. First, big gap, and then was Bat pattern witch finally crush (because of gap and my formation)! It is like birthday, you know, you get present, but you don't know how big it will be...

Uploaded with ImageShack.us