dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

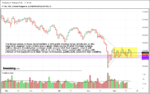

Given that your journal includes Wyckoff, don't overlook the fact that there was a climax low in what looks to be October, followed by a technical rally, then a successful test. The Wyckoff long entry is/was therefore at your "3". That entry is of course long gone. However, we are now back at that entry, which is not a good thing.

I suggest you look at the "Bottom Fishing" appendix that was included with your book. The chief question in a case like this is whether or not anybody really wants this stock. If they don't, then there's no point in taking on the time risk, unless the stock pays a huge dividend.

I suggest you look at the "Bottom Fishing" appendix that was included with your book. The chief question in a case like this is whether or not anybody really wants this stock. If they don't, then there's no point in taking on the time risk, unless the stock pays a huge dividend.