Pipmaster1

Well-known member

- Messages

- 291

- Likes

- 3

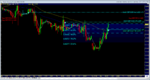

Well this is how the trade is setting up so far. Price didn't do much, but has started dropping a little since the London Open. This a snapshot of the 3 hour chart with basic fib retrace measurement drawn on the big move up last month. Also showing my limits and exit plan.

Attachments

Last edited: