You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mike Kshemaraja

Established member

- Messages

- 852

- Likes

- 63

Hi Dealer

Currently on our webiress platform we do not allow API trading. But we are in the final stages of development on allowing our DMA Spread Betting feed throught a MT4 platform. This has mainy been at request from high frequency currency traders. I will keep everyone posted and when this does become avaliable.

What is the spread for eurusd? Is commission also involved? Does your platform supply 70 tick charts? Thank you.

FP Markets

Member

- Messages

- 79

- Likes

- 0

FP,

What contracts do you offer to trade gold? I can't find any.

Hi Catt

For gold we have the spot price against both USD and EUR

The codes are XAUEUR and XAUUSD - The minimum lot amount you can trade is 100

For silver XAGEUR and XAGUSD - The minimum lot size is 500

We are currently mapping the comex exchange so we will soon also have all all mini gold and silver contracts aswell.

FP Markets

Member

- Messages

- 79

- Likes

- 0

What is the spread for eurusd? Is commission also involved? Does your platform supply 70 tick charts? Thank you.

Hi Mike

Due to being DMA we can not gaurentee a specific market spread. When there are instances of high volatility then spreads can widen. We also have to different charges depending on the size of volume. If you go to Market Fees and Charges | Direct Market Access | CFDs | FP Markets at the bottom of the page it has two tables with the typical spreads you will see. There is either a spread based pricing where all costs are included in the spread and there is no commission. For larger traders we have a clean based pricing where no spread has been added and we charge a seperate commission of 50 per million of basis currency.e.g. £1,000,000 traded would cost £50

Please can you elaborate on what you mean by a 70 tick chart

Mike Kshemaraja

Established member

- Messages

- 852

- Likes

- 63

Hi Mike

Due to being DMA we can not gaurentee a specific market spread. When there are instances of high volatility then spreads can widen. We also have to different charges depending on the size of volume. If you go to Market Fees and Charges | Direct Market Access | CFDs | FP Markets at the bottom of the page it has two tables with the typical spreads you will see. There is either a spread based pricing where all costs are included in the spread and there is no commission. For larger traders we have a clean based pricing where no spread has been added and we charge a seperate commission of 50 per million of basis currency.e.g. £1,000,000 traded would cost £50

Please can you elaborate on what you mean by a 70 tick chart

Each bar is made of 70 ticks, is not based on time like 1 minutes or 5 minutes.

What is the spread now? Is it below one pip?

FP Markets

Member

- Messages

- 79

- Likes

- 0

Each bar is made of 70 ticks, is not based on time like 1 minutes or 5 minutes.

What is the spread now? Is it below one pip?

Hi Mike

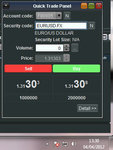

I have attached a few screen shots to give you an idea. Usually between 0.4 - 0.8 pips. I have seen it go as low as 0.1, but it will only happen for a fraction of a second.

With our charts we do not have 70 ticks, you are able to create charts that show, in the short term intra 10 minutes over a 10 day period down to per trade charts plotting each trade that gets placed

Attachments

FP Markets

Member

- Messages

- 79

- Likes

- 0

Each bar is made of 70 ticks, is not based on time like 1 minutes or 5 minutes.

What is the spread now? Is it below one pip?

Hi

Just realised that you would like to know EURUSD

Attachments

Mike Kshemaraja

Established member

- Messages

- 852

- Likes

- 63

Hi

Just realised that you would like to know EURUSD

Do we pay commission above the spread?

FP Markets

Member

- Messages

- 79

- Likes

- 0

Do we pay commission above the spread?

That is the spread on our clean based pricing so the commission would be 50 per million. So trading EUR to USD, €1,000,000 to USD would cost you €50

Mike Kshemaraja

Established member

- Messages

- 852

- Likes

- 63

That is the spread on our clean based pricing so the commission would be 50 per million. So trading EUR to USD, €1,000,000 to USD would cost you €50

plus commission, not good for me. Thanks for your help.

M

mkultra

gotta say, fp markets looks very competitive & enticing, as an overall product and platform.

FP Markets

Member

- Messages

- 79

- Likes

- 0

Hi

I know a few people have been having an issue with watching our online webinars. We have recently uploaded our webinars at a higher quality on youtube for anyone who has missed our live platform webinars.

to view please go to Beginners Guide to FP Markets Trading Platform - YouTube

or enter FP Markets into the youtube search engine.

I know a few people have been having an issue with watching our online webinars. We have recently uploaded our webinars at a higher quality on youtube for anyone who has missed our live platform webinars.

to view please go to Beginners Guide to FP Markets Trading Platform - YouTube

or enter FP Markets into the youtube search engine.

I assume you can't buy at the bid and sell at the ask for FX?

Spread based pricing on fx pairs is not competitive enough. Is the clean based, interbank spread? What are your liquidity providers? What are the conditions for using clean based? Not sure why you have conditions? Is minimum for clean based 10,000? Commission is pretty high because 0.5 pip mark up. Interactive Brokers is 0.2. I assume data feed for fx is free?

Have only trades indices with spread betting companies so not sure on your table. In the contracts per month bit, are they the spread you charge on top of the underlying?

Would like to avoid data fees. Don't want to promote IG Markets but they offer level2 free with their MTF facility. Is this something you could think about introducing? Free data with joining bid/ask would be great. What put me off IG Markets is their 10pound minimum. Is this possible to reduce so beginners can taste the equity markets gently? Prospreads minimum trade size is 100 shares so I think they are less than 10pounds. I understand you hedge every trade so futures have large minimums but the same principle doesn't apply to equities do they?

Spread based pricing on fx pairs is not competitive enough. Is the clean based, interbank spread? What are your liquidity providers? What are the conditions for using clean based? Not sure why you have conditions? Is minimum for clean based 10,000? Commission is pretty high because 0.5 pip mark up. Interactive Brokers is 0.2. I assume data feed for fx is free?

Have only trades indices with spread betting companies so not sure on your table. In the contracts per month bit, are they the spread you charge on top of the underlying?

Would like to avoid data fees. Don't want to promote IG Markets but they offer level2 free with their MTF facility. Is this something you could think about introducing? Free data with joining bid/ask would be great. What put me off IG Markets is their 10pound minimum. Is this possible to reduce so beginners can taste the equity markets gently? Prospreads minimum trade size is 100 shares so I think they are less than 10pounds. I understand you hedge every trade so futures have large minimums but the same principle doesn't apply to equities do they?

The Leopard

Experienced member

- Messages

- 1,877

- Likes

- 1,021

FP Markets,

I would be grateful if you could confirm a few things:

1. You do not and cannot profit from client losses. Is this correct?

2. You are subject to betting duty, which is 3% of net client losses each quarter. Is this correct?

3. You charge losing accounts 1.8% of net losses quarterly as a contribution to this. Is this correct?

4. How does this model work in that case? Would clients who suffered huge losses not imperil your business since you cannot profit from these losses but must pay ever increasing amounts of tax as a result? Or are you saying that increased commissions take care of this and allow you to make a profit?

I am trying to understand how this actually works in practice. Assume a very large client who trades a substantial amount. He places a large trade for which you collect a set commission. The trade goes against him, but as he keeps posting margin, he is able to keep his position open. Eventually, the loss becomes so great he is forced to close out. This could potentially cause a huge liability for you in terms of tax, which presumably would not be covered by the commission you've charged. Is that right?

Out of interest, why did you not simply make your 'losing' charge 3%? Then your betting duty would be covered by those who had caused the liability to arise, and you could presumably offer improved terms to profitable clients who do not create the tax liability for you?

Thank you in advance for any response.

I would be grateful if you could confirm a few things:

1. You do not and cannot profit from client losses. Is this correct?

2. You are subject to betting duty, which is 3% of net client losses each quarter. Is this correct?

3. You charge losing accounts 1.8% of net losses quarterly as a contribution to this. Is this correct?

4. How does this model work in that case? Would clients who suffered huge losses not imperil your business since you cannot profit from these losses but must pay ever increasing amounts of tax as a result? Or are you saying that increased commissions take care of this and allow you to make a profit?

I am trying to understand how this actually works in practice. Assume a very large client who trades a substantial amount. He places a large trade for which you collect a set commission. The trade goes against him, but as he keeps posting margin, he is able to keep his position open. Eventually, the loss becomes so great he is forced to close out. This could potentially cause a huge liability for you in terms of tax, which presumably would not be covered by the commission you've charged. Is that right?

Out of interest, why did you not simply make your 'losing' charge 3%? Then your betting duty would be covered by those who had caused the liability to arise, and you could presumably offer improved terms to profitable clients who do not create the tax liability for you?

Thank you in advance for any response.

As fas as I understand they pay on total loss accross all accounts. I.e. one client lost, another won the same amount, tax to pay = 0. If clients won in one period more then they lost they not only pay no tax, they can also offset this amount against the next period.

Here is more info.

HM Revenue & Customs

Here is more info.

HM Revenue & Customs

FP Markets

Member

- Messages

- 79

- Likes

- 0

FP Markets,

I would be grateful if you could confirm a few things:

1. You do not and cannot profit from client losses. Is this correct?

2. You are subject to betting duty, which is 3% of net client losses each quarter. Is this correct?

3. You charge losing accounts 1.8% of net losses quarterly as a contribution to this. Is this correct?

4. How does this model work in that case? Would clients who suffered huge losses not imperil your business since you cannot profit from these losses but must pay ever increasing amounts of tax as a result? Or are you saying that increased commissions take care of this and allow you to make a profit?

I am trying to understand how this actually works in practice. Assume a very large client who trades a substantial amount. He places a large trade for which you collect a set commission. The trade goes against him, but as he keeps posting margin, he is able to keep his position open. Eventually, the loss becomes so great he is forced to close out. This could potentially cause a huge liability for you in terms of tax, which presumably would not be covered by the commission you've charged. Is that right?

Out of interest, why did you not simply make your 'losing' charge 3%? Then your betting duty would be covered by those who had caused the liability to arise, and you could presumably offer improved terms to profitable clients who do not create the tax liability for you?

Thank you in advance for any response.

Hi Leopard

Sorry for the late response but I have been away for the past few days.

In answer to your questions:

1. That is correct FP Markets do not profit from clients losses. All trades are hedged in the Underlying exchange.

2. Yes of course we are liable to HMRC’s 3% betting duty as are all spread bet company’s who are based in the UK.

3. Yes the 1.8% of net losses over the quarter is to help contribute to the 3% betting duty.

4. DMA is always going to be more expensive than a Market Maker model in general. Because trades are being hedged in the underlying and you are seeing live prices direct from the exchange then fees and charges the broker pays will mean they have to pass this on to clients unlike a market maker and that’s why we are more expensive.

Yes the 1.8% is charged because as you mentioned we do not profit from client losses so as a company we personally have to pay the betting duty from our own cash. This is why we charge the 1.8% in case some clients have big losses. The reason we do not pass on the whole charge is because unlike a market maker which banks on 80% of clients losing the DMA model attracts larger more professional traders who actually see the benefit and value of trading DMA and are mostly profitable. Over 75% of our traders are profitable each quarter. Yes that is correct FP does have the ability to offer returns of this 1.8% if they are very profitable. Having said that if they are profitable they usually never pay the duty in the first place. Hence when you mention offering better terms for the clients who do not create the liability of the duty well it’s a null and void comment because those clients never paid anything to us in the first place because they did not lose. FP Markets has set it up exactly the way you are trying to convey. Clients who are profitable and therefore do not create the liability we have to pay to HMRC are not charged. Those that do create the liability for FP Markets then pay 1.8%. What you are asking for is exactly the setup we have if you think about it carefully.

The Leopard

Experienced member

- Messages

- 1,877

- Likes

- 1,021

Hi Leopard

Sorry for the late response but I have been away for the past few days.

In answer to your questions:

1. That is correct FP Markets do not profit from clients losses. All trades are hedged in the Underlying exchange.

2. Yes of course we are liable to HMRC’s 3% betting duty as are all spread bet company’s who are based in the UK.

3. Yes the 1.8% of net losses over the quarter is to help contribute to the 3% betting duty.

4. DMA is always going to be more expensive than a Market Maker model in general. Because trades are being hedged in the underlying and you are seeing live prices direct from the exchange then fees and charges the broker pays will mean they have to pass this on to clients unlike a market maker and that’s why we are more expensive.

Yes the 1.8% is charged because as you mentioned we do not profit from client losses so as a company we personally have to pay the betting duty from our own cash. This is why we charge the 1.8% in case some clients have big losses. The reason we do not pass on the whole charge is because unlike a market maker which banks on 80% of clients losing the DMA model attracts larger more professional traders who actually see the benefit and value of trading DMA and are mostly profitable. Over 75% of our traders are profitable each quarter. Yes that is correct FP does have the ability to offer returns of this 1.8% if they are very profitable. Having said that if they are profitable they usually never pay the duty in the first place. Hence when you mention offering better terms for the clients who do not create the liability of the duty well it’s a null and void comment because those clients never paid anything to us in the first place because they did not lose. FP Markets has set it up exactly the way you are trying to convey. Clients who are profitable and therefore do not create the liability we have to pay to HMRC are not charged. Those that do create the liability for FP Markets then pay 1.8%. What you are asking for is exactly the setup we have if you think about it carefully.

Thank you for the comprehensive reply.

I think there was a slight misunderstanding - when I said "better terms" I wasn't referring to letting generally profitable clients off the charge when they have the occasional losing quarter. I meant letting the losing clients cover the entire betting duty (charging them 3% instead of 1.8%), meaning you could (presumably) offer everyone lower commissions.

The main thing though is the clarification that you do not profit from losses, which is crucial. I am glad to see it stated unequivocally, and think that the product looks very good now that point has been confirmed.

By been profitable do not they reduce your tax liability? Say for example you have two clients. One lost 1mil, another won 1mil. You will charge one client 1.8% on 1 mil loss, but how much will you pay in return to HMRC? Your overall PL is 0 -> you pay 0 to HMRC. Your winning client reduced your tax liability. Is that how it works?Clients who are profitable and therefore do not create the liability we have to pay to HMRC are not charged.

FP Markets

Member

- Messages

- 79

- Likes

- 0

By been profitable do not they reduce your tax liability? Say for example you have two clients. One lost 1mil, another won 1mil. You will charge one client 1.8% on 1 mil loss, but how much will you pay in return to HMRC? Your overall PL is 0 -> you pay 0 to HMRC. Your winning client reduced your tax liability. Is that how it works?

Hi 6am

Exactly, winning clients reduce the tax liability to HMRC because we do not have to pay anything for profitable clients. But of course we are always going to have a proportion of losing clients. In the situation described above we would have no tax to pay for the combined amount for those two clients. That would be the ideal situation and if this situation continued we would be able to scrap the whole 1.8% but unfortunately looking at the statistics this is never the case. You will always find that with spread betting there is generally a higher loser to winner ratio (up to 85% lose) but we find that our ratios are better than the industry average because we attract the more advanced and professional traders allowing us to offer only the 1.8% charge. So what you will find is one month we may have a small surplus left over from the 1.8% and the next month we may have to pay extra ontop of the 1.8%

Similar threads

- Replies

- 0

- Views

- 2K