FX4Newbies

Established member

- Messages

- 785

- Likes

- 30

Hello JahDave,

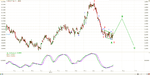

Just thought I would post the chart here that you referred to in case someone wants to see it.

FX4Newbies

Just thought I would post the chart here that you referred to in case someone wants to see it.

FX4Newbies

My friend over at FX4Newbies just posted a triangle pattern that I had not noticed before so I am putting up a Euro 1 hour chart with it on it. In Elliott Wave land a triangle is always the next to last pattern in a wave sequence. For example. If there is an ABC pattern then a triangle will always be the B wave and if there is a 12345 pattern then a triangle will always be wave 4. So with that in mind then the Euro should make one more break down before a partial retracement back up of the down move, and then make another five waves down.