You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

my gut is telling me it doesn't feel like an up day, it might open strong, but the sellside volume should dwindle gains down as the session progresses. Indian capital flow restrictions, should weigh in on Asian markets tonight.

this is the drawback of living in the northeast USA, even though you will have a sense or feel for what the financial district is experiencing in terms of climate, it can also alter your expectations. The expectations have to confirm with price action. If they don't then your expectations are wrong and are being unduly influenced by the climate.

long DJZ07 @ 14040

I expect to see magic number of 14444

I'm gona shelve downside target for post FOMC, till then will look for entries. That bottom trendline around 53, will be my next long.

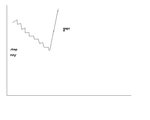

woohoo..53

schematic. During entrainment process, price action is engineered to give a sense of where the market is going in the short term/intraday versus a longer term timeframe. This entrainment gathers small money pools and large money pools in the direction of the price action, as the shorts build up, rapid harvesting in times of news events or FOMC meetings is undertaken, without giving the entrained people of capital an exit, but an exit only at a significant premium.

Attachments

stock markets love war, and conflict, Turkey sabre rattling, making things there more interesting. Lets not forget the Russian special forces. 🙂

http://www.globalsecurity.org/wmd/library/news/iran/1996/960816-452798.htm

http://www.globalsecurity.org/wmd/library/news/iran/1996/960816-452798.htm

markets still looking for liquidity...spurts..signifies stops being hit. Next few hours more data, could go lower, but will keep adding into FOMC...timetable.

next add points

43

33

23

expansive add principle. first add point is minimal, and its 100% at every add point, so the 3rd add point will be 3 times the quantity of the first.

53:1

43:2

33:4

23:8

13:16

03:32

ratios

don't try this at home... 🙂

price ladder confirmation

full position at

63

half full 73

half of preceding at 83

another half of previous at 93

till position size limit is hit for equity.

next add points

43

33

23

expansive add principle. first add point is minimal, and its 100% at every add point, so the 3rd add point will be 3 times the quantity of the first.

53:1

43:2

33:4

23:8

13:16

03:32

ratios

don't try this at home... 🙂

price ladder confirmation

full position at

63

half full 73

half of preceding at 83

another half of previous at 93

till position size limit is hit for equity.

Last edited:

Similar threads

- Replies

- 16

- Views

- 6K