Friday 5th November 2004

Disappointing finish to a good week - especially as I should have done better today. I got stuck over-trading in the flat middle of the day and missed the runs either end...

Wary of chasing the opening gap so sitting on hands for a while.

Possible entry at 10:21 on bar close having broken above R1 but I wimped out, not wanting to chase a 14 point bar. This was a mistake with hindsight as the trade would eventually have been good for +14, exiting at 10:33 on breaking the low of the previous bar. So I've missed 60 points of up movement since the open so far. No guts, no glory. Actually, there was a much better and lower risk entry three bars earlier at 366 which would have made +34.

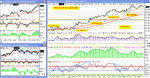

Market has also now broken out of my year long channel on the daily Dow.

Then missed out on the move back (but that's following my rules so I have to live with that).

11:51 1) S 10347 on possible break to downside after consolidation below 34 ema. Entry looks good but price struggling to break to downside.

11:54 EXIT -1. Then immediately breaks down. That's very frustrating - stopped out by 1 tick again.

Do I re-enter after 20 point long bar down? No, I'll have to leave it. I guess one solution in future could be to re-enter if the price breaks the previous bar back in the direction of the trade having first broken the opposite end to stop me out (i.e. forming an engulfing-type bar).

12:03 2) S 10334. Back in but this just doesn't want to go down here. Straight into big loss and full stop threatened.

12:05 EXIT -9.

Red bar, green bar. I've picked a great time to start entering trading here. I sat out two powerful moves - 1 up, 1 down - then started trading in a period of pure chop.

12:48 3) L 10380. OK, trying back on the long side now. Absolutely no follow through from entry. Then finally pops up 5m after entry but no great momentum and quickly drops off again.

12:57 EXIT b/e after all that.

13:24 4) L 10373. Try again but market gone very quiet here. Slowly creeping up.

13:34 EXIT +6. Not really going anywhere.

13:48 5) L 10381. Rubbish.

13:51 EXIT -4.

Frustrating Friday - looks like all the action was in the first two hours while I was sitting on the sidelines.

14:09 6) L 10381. This is getting silly - the market is clearly flat. Why do I keep entering? Smashes straight into loss.

14:15 EXIT -8.

That was one of the more stupid trades I have ever taken in a long time. Up until now I have limited the damage today despite no action since the time I took my first trade - that one trade has now doubled my losses from not bad to unacceptable and was absolutely unnecessary.

One decent long in the last half hour but I decided it was too late in the day/week to take any more entries by that stage.

-16 from 6

-22 for the day after commissions

+48 for November so far after commissions