Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Welcome to the thread portora.

Not the only one to lose a bit on recent shorts I expect.

Folks seem to be forgetting all those lovely billions of petro-dollars have to be invested somewhere. Space under the bed is probably a bit limited by now. Into the markets it goes !

I dont think the so-called housing bubble in the USA is going to pop anytime soon. The estimate of 11 million illegal immegrants is probably way short of the reality and they can't all camp out in Central Park.

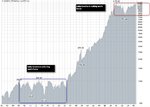

So onwards and upwards 13000 look out

Not the only one to lose a bit on recent shorts I expect.

Folks seem to be forgetting all those lovely billions of petro-dollars have to be invested somewhere. Space under the bed is probably a bit limited by now. Into the markets it goes !

I dont think the so-called housing bubble in the USA is going to pop anytime soon. The estimate of 11 million illegal immegrants is probably way short of the reality and they can't all camp out in Central Park.

So onwards and upwards 13000 look out