You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

hungvir said:I hadn't been counting them either, Split 🙂 I wonder why Rols knew 🙂

Cheers,

H

Hi Hung,

Lesson 1. You should have been! 🙂

By the way, I'm no guru, just trying to earn a crust. 😢

I'm glad you had a restful time in London, yesterday. Have a good night's sleep- back to business tomorrow.

Split

chindl

Well-known member

- Messages

- 348

- Likes

- 5

Elefteros said:Chris your record keeping is an example i will try to match, would like to know if you record any other details for the trade and when you record it all.

I will expand on this - yes, I keep detailed records of everything I do in this game, including any fundamental information that may have made a trade possible so I can keep an eye on that particular piece of information moving the market against me at any point in the future.

I have a log of 95% of all trades taken since I started this game, the missing 5% being trades taken within the first few months of trading, I did not record all those, I just jumped in and out. The log I have includes:

the reason for a certain trade size

when I scaled in if I did

the placement of the stops

the reason for taking a trade, such as the technicals that supported the trade.

The reason for exit and whether that was a controlled or rushed due to a move or a retracement (allows to look at any potential psychological factors that could possibly be improved on)

When daytrading, I do this by taking a snapshot of the daily action as you can see in my posts.

At the end of the week I will go through each day to check where improvements could have been made, whether a position is still acceptable to stay open if carried over and, since taking on day trading the Dow, I have checked the daily chart records each Monday a) to check as above, where could I have improved and b) just as importantly, to get my mind focused on the week ahead, it allows me to have some sort of understanding within the chaos of the price as to why we are were we actually are.

I have a breakdown of my P&L, including any purchases made on books etc. This will all act effectivelty as Op Ex and will be taken off the P&L. Likewise, any additonal funding is treated in just the same way, it does not affect my equity curve.

Hope all this helps. I will try and expand a little as the week goes on, but forgive me if I forget to in the chaos of an open market.

All the best

Chris

BTW - England not worldbeaters by any stretch of the imagination.

Do you have any accountancy qualification, Chris?! 🙂 Your record keeping is admirable.

The Netherland - Portugal game is a mess, isn't it?! 15 yellows, six of which translated into three sendding off. England may not be happy to see this but they don't mind it either. Their next game will surely be much easier.

Later,

Hung

The Netherland - Portugal game is a mess, isn't it?! 15 yellows, six of which translated into three sendding off. England may not be happy to see this but they don't mind it either. Their next game will surely be much easier.

Later,

Hung

chindl

Well-known member

- Messages

- 348

- Likes

- 5

hungvir said:Do you have any accountancy qualification, Chris?! 🙂 Your record keeping is admirable.

Similar - Compliance qualifications.

I actually see this type of record keeping as a pre requisite to doing business. If you had a business you would have to keep records for accounting purposes, you would do stock checks if you were selling items to see what sold well, what did not, whether the stock you held was profitable vs the possible cost of storage over the course of the time that you held it before the sale and whether that stock holding could be replaced with a more profitable holding that sold more quickly therefore increasing efficiency within your business model. You would also have bills to pay in relation to your business, invoices, business rates, tax etc. Finally, not forgetting that on top of the analytic skills required to maintain optimum efficiency within your business, you would be required to have your accounts certified annually for tax and other accounting purposes.

As I have always maintained, this is a business that we are involved in and we should manage it as such. Failing to prepare is preparing to fail in my opinion. Preperation and good management are what make businesses thrive, if you do not have the information to hand to quickly backtrack and analyse see why you carried out certain action then you will not succeed. In the business I am in I have to present a monthly report to the business by way of risk management support on compliance activity that may cause the business and brand risk of exposure at some point in the future due to a potential weakness in management, system or procedural controls. We also have similar individuals responsible for managing our exposure to SOX Act. We would all do well to ensure our records allow us to quickly chart our success in terms of trades taken in a similar way and to mitigate future risk to our capital.

Have a good week.

Chris

JillyB

Established member

- Messages

- 791

- Likes

- 38

hungvir said:That's it. It will be England - Portugal next. And another yellow card was shown during extra time to make it 16. What an inflation!

I bet that Rooney will have his moment in the next game so let's think about England 1- 0 Portugal.

That's going to be a real grudge match here on the Island. We have a high percentage of Portugese living here and the last time England played them (European Cup 2 years ago) it was hell in town - especially as they beat us.

Here's hoping we even the score this time. 😀

observer MM

Junior member

- Messages

- 20

- Likes

- 0

rols said:The basis of trading in any time frame is so simple. Buy low and sell high. So why is it so difficult to get it right?

Perception is still the number one factor in trading successfully IMO. This is all in the mind not in the charts. I cannot change your perceptions for you, only you can do this. I sense my words are falling onto deaf ears which only serves to emphasise that the personal journey of a trader should in the main be kept personal.

Perceiving the market as a living breathing entity rather than a video game is a good perception for example. How you perceive yourself will be reflected onto how you see the charts. This is why I consider it pointless to say buy when line A crosses line B only on a Wednesday.

Good trading to all!

No deaf ears here Rols .......... so ......

Sell high .... and share goes more higher.... explain ......

buy low .... .and shre goes more lower ...... explain.........

or cut loses and try again ..................... till you get it right ???????

Thanks Rols in advance ......

JillyB said:That's going to be a real grudge match here on the Island. We have a high percentage of Portugese living here and the last time England played them (European Cup 2 years ago) it was hell in town - especially as they beat us.

Here's hoping we even the score this time. 😀

That's an interesting thing to know. I meant the number of Portugese not the incident.

So make sure you stay in and watch England's next game indoor then.

Cheers,

Hung

A bit of preparation that I think will delight Chris 🙂

On the 30 min chart, relatively strong support can be found at 10990. But on the other hand the 45 degree trend line that lasted for seven days has been broken to the down side. We may see the slide continue later today.

On Friday, we have a Doji with quite a narrow range. It was another inside day as well. If either Friday's high or low is breached, it's a fair bet that it will stay in the direction it breaks for a while.

Later,

Hung

On the 30 min chart, relatively strong support can be found at 10990. But on the other hand the 45 degree trend line that lasted for seven days has been broken to the down side. We may see the slide continue later today.

On Friday, we have a Doji with quite a narrow range. It was another inside day as well. If either Friday's high or low is breached, it's a fair bet that it will stay in the direction it breaks for a while.

Later,

Hung

Just went short the DOW. All conditions were perfectly satisfied but will it be a perfect short?!

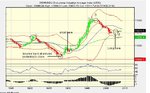

The market had the same trick today. Lower high was made at A and lower low was made at B but it then went to C which was supposedly a higher high. It was and it was the one to trick inexperienced hands. I could have seen it coming though.

The market had the same trick today. Lower high was made at A and lower low was made at B but it then went to C which was supposedly a higher high. It was and it was the one to trick inexperienced hands. I could have seen it coming though.

Attachments

Last edited:

Vaco

Senior member

- Messages

- 2,134

- Likes

- 269

Hung, this tip may help your trading results if you choose to follow it.

Take a look at the bigger picture

Make a decision on which way you think the market is heading (u can use the same entry rules you apply to your trades for this if you like)

If market is heading up- only take the entry signals that will see you go long.

If market is heading down- only take short trades.

Continue untill market direction changes.

This will reduce the no of trades you place in a day (handy for days like last friday)

Keep you more in tune with the market.

Hope this helps. 😀

Take a look at the bigger picture

Make a decision on which way you think the market is heading (u can use the same entry rules you apply to your trades for this if you like)

If market is heading up- only take the entry signals that will see you go long.

If market is heading down- only take short trades.

Continue untill market direction changes.

This will reduce the no of trades you place in a day (handy for days like last friday)

Keep you more in tune with the market.

Hope this helps. 😀

Elefteros said:Hung, this tip may help your trading results if you choose to follow it.

Take a look at the bigger picture

Make a decision on which way you think the market is heading (u can use the same entry rules you apply to your trades for this if you like)

If market is heading up- only take the entry signals that will see you go long.

If market is heading down- only take short trades.

Continue untill market direction changes.

This will reduce the no of trades you place in a day (handy for days like last friday)

Keep you more in tune with the market.

Hope this helps. 😀

Very sound, mate! The thing is I don't know which way the market is going at the moment 🙁 I can choose to stay out of it altogether or trade-to-learn with minimum stake and I chose the later.

Later,

Hung

Similar threads

- Replies

- 7

- Views

- 8K

- Replies

- 20

- Views

- 12K