Mistake

I just made a mistake.

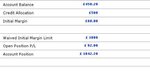

Instead of realising half of my profit with the two long positions on the FTSE, I added one more long position by pressing buy. It cost me 7 pounds.

Still long the DOW with the aim of making at least a hundred quids from the two long positions.

I just made a mistake.

Instead of realising half of my profit with the two long positions on the FTSE, I added one more long position by pressing buy. It cost me 7 pounds.

Still long the DOW with the aim of making at least a hundred quids from the two long positions.