David Knight

Established member

- Messages

- 946

- Likes

- 213

I have been out today and have just got back

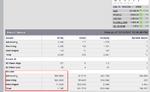

80% chance the high for DOW/SPX are in at 23,002.20/ 2558.53 respectively

So my original 2558 target is resistance. And little chance 2563 (2nd target) gets hit today.

Had I been around I may have closed out on the second attempt to break it.

ADV/DECL about 1 to 2..

I'll stick for now,,

Add a chart in a few minutes- I'm starving!

80% chance the high for DOW/SPX are in at 23,002.20/ 2558.53 respectively

So my original 2558 target is resistance. And little chance 2563 (2nd target) gets hit today.

Had I been around I may have closed out on the second attempt to break it.

ADV/DECL about 1 to 2..

I'll stick for now,,

Add a chart in a few minutes- I'm starving!

Attachments

Last edited: