With the journal around the first 100 point mark I thought it would be interesting to reveiw the trades.

It always feels hard to be short. I've said repeatedly that I don't like doing short trades. And I have had a losing short today.

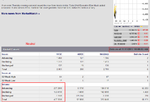

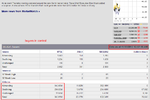

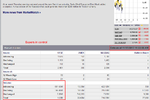

Leaving aside one B/E trade on the short side, these are the stats:

LONG

28 trades

22 wins

6 losses

78.6%

SHORT

23 trades

15 wins

8 losses

65.2%

Largest winning long trade= 10 points

Largest winning short trade= 18 points

Largest losing long trade= 7 points

Largest losing short trade= 16 points

Draw your own conclusions. For me, longs have the edge in this sample but short performance is not so poor that I would always avoid shorting

Also if I take into consideration that the great majority of the short trades were from the start of the journal (Aug 22) and that I switched mainly to the long side at the start of Sept, where the market took off sharply after a retracement in August.

This shows that I was reading the market correctly in it's general direction.

But I am still under performing in terms of points gain on the long trades. I need to improve in that area.

Neither have I added to a winning trade. I've added to losers.

The next 100 points need to get done far quicker.

And I also want to keep trying to make the journal as easy to follow as possible.