I was almost about to explain how I proceed but I’m backing off, why would I share my secret sauce. All I will admit is that I trade another dimension than price, plus the environnement.

So numbers are not involved but a byproduct. I don’t work to put them into cases surrounded by logic. I also don’t apply a plan but a framework. The task is to land into situations where to catch randomness. Meanwhile, you are trying to shape a substance which is fluid like water, preferring to perform predictions. We don’t play at the same game.

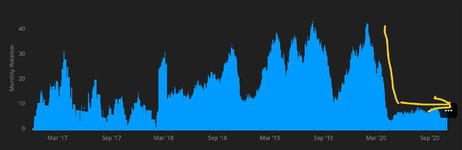

Since I take decisions in sequences, it’s not in my conception of things that SYO can let to happen a drawdown so deep and vertical in a single shot.

Do you see any unusual change in trading behavior of darwin SYO that is different from its past?

So you’re stating that an absence of management is his norm ? that was revealed because it unraveled unexpectedly ? Reason more to be extremely worried.

I consider trading as a deployment of reactions, not about filtering and betting to average net leftovers over a large sample.

Supose you sell coffees, ok every "trade" you make money but there are the expenses and not every day has a profitable number of customers.

If the rule of your shop is to open from 9 to 17 you won't close it at 12 to "cut losses".

From where do you pull out your analogies ? 😅

Another commerce, suppose you’re prostituting yourself from 9 to 17, do you take any customer that want to pass over your body without assessement of when to accept who and when to interrupt the commitment in that case ? Please. You’ll end up bruised, wrecked by a train.

The exchanges and product specifications provide the rules to navigate around. To add extra ones is to brute force or violate the substance.