CapitalStreetFX

Active member

- Messages

- 138

- Likes

- 0

GOLD STABLIZES, SHRUGGING OFF STRONGER GREENBACK

According to the official data released on Friday, in the first quarter of the year, China’s gross domestic product grew at the rate of 6.7 percent. Other indicators also reported with better-than-forecast readings. New loans, retail sales, industrial output and fixed asset investments all reported higher numbers. In the press conference held in Beijing, the National Bureau of Statistics announced that “downward pressure cannot be underestimated” despite positive changes in the economic indicators.

After positive Chinese economic data, perceived safe-haven assets went down due to improved risk sentiment towards the slowdown in the world’s second largest economy. Buying interest towards the Japanese Yen has also weakened due to comments from government officials on the yen’s recent appreciation.

The dollar gained on Friday, continuing its rise this week, while investors are waiting for the outcome of the G20 meeting in Washington for more information about future currency policies. The dollar index, which measures the strength of the greenback against a basket of major currencies, was up about 0.1 percent to 94.948.

Gold stayed stable today after falling consecutively for 3 days, but generally was still heading for a down week due to the stronger greenback and global equities, which make safe-haven metals less attractive.

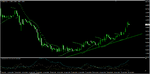

Fig. GOLD H4 Technical Chart

GOLD recovered slightly to as high as $1229.21. The commodity has been moving between the range of 1204.74 and 1285.56. RSI is now hovering around level 48 and seems to be heading up, indicating relatively strong buying power. Despite the pressure from the short-term moving average above, the price is expected to rise and retest the resistance at 1256.56 before dropping back.

Trading suggestion

Sell at $1285.56, Take profit at $1204.74, Stop loss at $1290.98.

According to the official data released on Friday, in the first quarter of the year, China’s gross domestic product grew at the rate of 6.7 percent. Other indicators also reported with better-than-forecast readings. New loans, retail sales, industrial output and fixed asset investments all reported higher numbers. In the press conference held in Beijing, the National Bureau of Statistics announced that “downward pressure cannot be underestimated” despite positive changes in the economic indicators.

After positive Chinese economic data, perceived safe-haven assets went down due to improved risk sentiment towards the slowdown in the world’s second largest economy. Buying interest towards the Japanese Yen has also weakened due to comments from government officials on the yen’s recent appreciation.

The dollar gained on Friday, continuing its rise this week, while investors are waiting for the outcome of the G20 meeting in Washington for more information about future currency policies. The dollar index, which measures the strength of the greenback against a basket of major currencies, was up about 0.1 percent to 94.948.

Gold stayed stable today after falling consecutively for 3 days, but generally was still heading for a down week due to the stronger greenback and global equities, which make safe-haven metals less attractive.

Fig. GOLD H4 Technical Chart

GOLD recovered slightly to as high as $1229.21. The commodity has been moving between the range of 1204.74 and 1285.56. RSI is now hovering around level 48 and seems to be heading up, indicating relatively strong buying power. Despite the pressure from the short-term moving average above, the price is expected to rise and retest the resistance at 1256.56 before dropping back.

Trading suggestion

Sell at $1285.56, Take profit at $1204.74, Stop loss at $1290.98.