You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

70 pips on any standard morning was just fine for me over 6-8am trading period .........today its just another single half decent trade ............

what a day .......what a day

N

wife keeps popping head round and reminding me to keep a level head and don't do anything stupid

no chance - i'll leave that to the British general public - correction English General public

N

what a day .......what a day

N

wife keeps popping head round and reminding me to keep a level head and don't do anything stupid

no chance - i'll leave that to the British general public - correction English General public

N

be-positive

Veteren member

- Messages

- 4,969

- Likes

- 488

pips ? - yes I must confess I am in the thousands now for some time today since trading from early Asian

1 off event so make the most of it

afternoon N ------- so can I ask will your 2017 s/webinars be FREE now to the first 50 eager to learn clients 😈😈😈

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

i'm done ............truly done for today .......nothing left in the tank .....

going to grab a hot drink and chill out ...........steam coming out the head

have a great weekend everyone ........I need to digest all the news fully now instead of just trading it

no doubt i'll be posting over weekend ........would love to hear from you all if you made some decent pips and the stories .........theres plenty going around at moment re whos made what money and where fortunes have been made ..........they'll be a few beers tonight and a few hangovers tomorrow

but not from me as I don't drink alcohol anymore .....stopped in January and cant be bothered to start again at moment

cheers

N

going to grab a hot drink and chill out ...........steam coming out the head

have a great weekend everyone ........I need to digest all the news fully now instead of just trading it

no doubt i'll be posting over weekend ........would love to hear from you all if you made some decent pips and the stories .........theres plenty going around at moment re whos made what money and where fortunes have been made ..........they'll be a few beers tonight and a few hangovers tomorrow

but not from me as I don't drink alcohol anymore .....stopped in January and cant be bothered to start again at moment

cheers

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

afternoon N ------- so can I ask will your 2017 s/webinars be FREE now to the first 50 eager to learn clients 😈😈😈

nice try ........I earned every damn pip in last 18 hours ..🙂

but remember the spreads got considerably widened so people would be crazy trading normal levels of £ per pip and also stops have to be widened .....I was probably at 33% stake most of the time vs normal levels of staking as it was too risky otherwise ...........

always reduce stakes and widen stops on high volatility days guys ..........sorry didn't mention that but most traders will recommend that

still made a few quid though 🙂

i'll be running a pilot so lets see re some free invites .........reminds me I need to start laying out some draft courses on my website

let me think over the weekend ...after about 200 hours sleep 🙂

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hey all

Jees what a week.......seems like a dream ......but as a learning curve for me I was much much better prepared than when I was trading the 2008 crash and did pretty well so no complaints from this trader

Anyway I've been getting a lot of emails and contacts asking questions about my free systems , fxcorrelator , PDF trading guides and a lot of other stuff

I will try to respond as soon as I can but I have limited time to do so at present ...so please be patient 🙂

what I propose to do is put another video on youtube this weekend and explain the links to,where this stuff is.........

ok - most people are saying they havnt got the time to trawl through my t2win mega thread.....it is a beast with a lot of posts over a few years with 1.3m views ........I do sympathise guys 🙂

but then again ...........how do,you think I researched and learned my business and found my edge ?.......have you seen the size of some of the threads at FF on strengthmeters and basket trading ?......I have scoured every forum over the last 16 years learning about strengthmeters ......the responses I got sometimes regarding simple clarification I needed were not polite from correspondents involved.... if they bothered to respond at all to me ( I will not mention names but there are sure some surly people at FF)

every worthy journey requires effort and time ......and shortcuts sometimes are not available so I would urge anyone interested in strengthmeters and the development of my ideas and indeed some of the other traders and programmers who contributed along the way take a stroll through that big thread over a few weeks .........I cant remember myself whats on there but I know there are lots and lots of areas covered , discussed

I literally cannot remember all th areas and questions its covered over the years ..but I can assure you it has 🙂

anyway ...video on its way guys .....happy to help

N

Jees what a week.......seems like a dream ......but as a learning curve for me I was much much better prepared than when I was trading the 2008 crash and did pretty well so no complaints from this trader

Anyway I've been getting a lot of emails and contacts asking questions about my free systems , fxcorrelator , PDF trading guides and a lot of other stuff

I will try to respond as soon as I can but I have limited time to do so at present ...so please be patient 🙂

what I propose to do is put another video on youtube this weekend and explain the links to,where this stuff is.........

ok - most people are saying they havnt got the time to trawl through my t2win mega thread.....it is a beast with a lot of posts over a few years with 1.3m views ........I do sympathise guys 🙂

but then again ...........how do,you think I researched and learned my business and found my edge ?.......have you seen the size of some of the threads at FF on strengthmeters and basket trading ?......I have scoured every forum over the last 16 years learning about strengthmeters ......the responses I got sometimes regarding simple clarification I needed were not polite from correspondents involved.... if they bothered to respond at all to me ( I will not mention names but there are sure some surly people at FF)

every worthy journey requires effort and time ......and shortcuts sometimes are not available so I would urge anyone interested in strengthmeters and the development of my ideas and indeed some of the other traders and programmers who contributed along the way take a stroll through that big thread over a few weeks .........I cant remember myself whats on there but I know there are lots and lots of areas covered , discussed

I literally cannot remember all th areas and questions its covered over the years ..but I can assure you it has 🙂

anyway ...video on its way guys .....happy to help

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

there are literally thousand of pages here from post 1 where I and others have discussed potential ways to use the FXCorrelator indicator

below here in this post I show the main ones as requested by many people recently as they cant find them

1) the FXcorrelator indicator

2) the FXcorrelator YEN / USD /DOW system ..my original lead here in the thread and it combined positive correlation with the yen and the USD that then had to be negatively correlated to the US Dow........I have to say that I don't use this guys ...I used it as a training platform for people and to also show the correlation between those markets ..that's not to say it doesn't work .......I just don't use it as personally I use more advanced systems

anyway its all in the attachment below .........how to load it and how to use it

3) the 3 Duck Corrie system , or just plain Triple Corrie if you want to call it what it is .......its 3 FXCorrelators on the same setting on 3 different TF's ....the idea is if all 3 TF's show a currency on same side of Zero it is worth trading in a pair ! ...I will be elaborating on these rules in the future but heres the video below

and I have attached the Triple Corrie indicator below as a bonus.........load it on a 5min TF and the arrows will tell you when all 3 of the TF's are aligned .........you are watching the 5min TF on the screen anyway

nice eh ? ..and you can change the MA and all the TF settings to different if you want but the ma must stay the same on all 3 TF's ..Try it 🙂

PS..... you can remove the chart completely to just keep the arrows ......its in ShowChart in settings (I couldn't find it in the video below !!)

heres the 3 duck system video

heres a Triple corrie video

have a good weekend

N

below here in this post I show the main ones as requested by many people recently as they cant find them

1) the FXcorrelator indicator

2) the FXcorrelator YEN / USD /DOW system ..my original lead here in the thread and it combined positive correlation with the yen and the USD that then had to be negatively correlated to the US Dow........I have to say that I don't use this guys ...I used it as a training platform for people and to also show the correlation between those markets ..that's not to say it doesn't work .......I just don't use it as personally I use more advanced systems

anyway its all in the attachment below .........how to load it and how to use it

3) the 3 Duck Corrie system , or just plain Triple Corrie if you want to call it what it is .......its 3 FXCorrelators on the same setting on 3 different TF's ....the idea is if all 3 TF's show a currency on same side of Zero it is worth trading in a pair ! ...I will be elaborating on these rules in the future but heres the video below

and I have attached the Triple Corrie indicator below as a bonus.........load it on a 5min TF and the arrows will tell you when all 3 of the TF's are aligned .........you are watching the 5min TF on the screen anyway

nice eh ? ..and you can change the MA and all the TF settings to different if you want but the ma must stay the same on all 3 TF's ..Try it 🙂

PS..... you can remove the chart completely to just keep the arrows ......its in ShowChart in settings (I couldn't find it in the video below !!)

heres the 3 duck system video

heres a Triple corrie video

have a good weekend

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

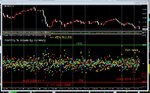

wanna see pain ?......its on this chart

this is my X men version of the FXCorrelator on a 1ma setting .....so its on a monthly chart so you see the move in the month per currency (open-close prices)

remember 2008 ?...........if you dont then you just re-lived it a little in last 2 days !

in 2008 the GBP index got in and around a 5% fall against the basket of G8 currencies in 3 of those months !! ..dark times for the british pound

well we are nudging it again now in June ......and there are 4 days left this week to crack it

see the main winner in those periods ?........always the yellow Yen with green usd generally ok as well........

because its classic carry trade pattern in fear mode ........and it plays out in mini form every single day in the market as a pattern ........but this is the real deal guys ........Friday was full Armageddon in daytrading terms

have a good week ...........i'm raring to go now and had some sleep over weekend ...........hundereds of pips will be available over next week .and I figure they will be offered from Asian open so may play that early tonight ..............have to see how I feel

N

this is my X men version of the FXCorrelator on a 1ma setting .....so its on a monthly chart so you see the move in the month per currency (open-close prices)

remember 2008 ?...........if you dont then you just re-lived it a little in last 2 days !

in 2008 the GBP index got in and around a 5% fall against the basket of G8 currencies in 3 of those months !! ..dark times for the british pound

well we are nudging it again now in June ......and there are 4 days left this week to crack it

see the main winner in those periods ?........always the yellow Yen with green usd generally ok as well........

because its classic carry trade pattern in fear mode ........and it plays out in mini form every single day in the market as a pattern ........but this is the real deal guys ........Friday was full Armageddon in daytrading terms

have a good week ...........i'm raring to go now and had some sleep over weekend ...........hundereds of pips will be available over next week .and I figure they will be offered from Asian open so may play that early tonight ..............have to see how I feel

N

Attachments

Hy, NVP.

First of all, congratulations for your job about strenght correlation trading.

I am a big fan of this analysis.

I'd like to know whats the last and best indicator to analysis that u have been used?

Is there a good strenght correlation dashboard that u could indicate?

I mean... There's a lot of stuff in forexfactory and here since 2008... but in 2016 i dont know whats working or not... Is there some compiled information or post about these sistematics?

Thanks for everythin

🙂

First of all, congratulations for your job about strenght correlation trading.

I am a big fan of this analysis.

I'd like to know whats the last and best indicator to analysis that u have been used?

Is there a good strenght correlation dashboard that u could indicate?

I mean... There's a lot of stuff in forexfactory and here since 2008... but in 2016 i dont know whats working or not... Is there some compiled information or post about these sistematics?

Thanks for everythin

🙂

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hy, NVP.

First of all, congratulations for your job about strenght correlation trading.

I am a big fan of this analysis.

I'd like to know whats the last and best indicator to analysis that u have been used?

Is there a good strenght correlation dashboard that u could indicate?

I mean... There's a lot of stuff in forexfactory and here since 2008... but in 2016 i dont know whats working or not... Is there some compiled information or post about these sistematics?

Thanks for everythin

🙂

hi there ........

in terms of free and available content for people subscribed to me and on the other big forums I have shared all I can mainly at my T2win threads .........

so the 80/20 system (2 corries)

the Dow vs USD/JPY system (word doc)

The 3 duck (or triple corrie) system (recent)

most things stem from these....and apologies but I do not offer any detailed information on my customised scalping system apart from the calls and comments shared here everyday on my scalping thread ....

however I will confirm 100% that everything I still use to make consistent money scalping is based around the original concepts and principles of my free FXCorrelator indicator

I have always been a big fan of giving people the basic tools then letting them create their own ideas and strategies from it ..........you cannot clone a trader 100% from another successful one.........you give them the tools and a few pointers and let them grow from there ......its the only way to allow a trader to become successful in the long term

my approach is simple ...identify and buy bull currencies, identify and sell bear currencies ...that's it

sure theres mountains of detail you can get into (see my 7p's video on youtube)

but that's the basics ...........🙂

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

I love these guys

cant understand a word normally ....so it must be good 🙂

http://www.blackswantrading.com/blog/2016/6/27/abandon-ship-brexit-implications

cant understand a word normally ....so it must be good 🙂

http://www.blackswantrading.com/blog/2016/6/27/abandon-ship-brexit-implications

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

back again for a look...........

jees the gbp is warming up eh ? .........big swing north there......and it breached the 3415 i was watching ...........

osbournes speech at 7am was pretty lupewarm in my opinon..........jees the guy looked like he was being held up by a peg as he talked about his commitment to managing the finances of this country

market wont buy it ..........they know we have been plunged into stormy waters with a leadership team that has been mutinied by the people and pirate Boris ...and that lukewarm speech wont hold them off ......

jees the markets are going to fly so i will hang in for 8am action

N

jees the gbp is warming up eh ? .........big swing north there......and it breached the 3415 i was watching ...........

osbournes speech at 7am was pretty lupewarm in my opinon..........jees the guy looked like he was being held up by a peg as he talked about his commitment to managing the finances of this country

market wont buy it ..........they know we have been plunged into stormy waters with a leadership team that has been mutinied by the people and pirate Boris ...and that lukewarm speech wont hold them off ......

jees the markets are going to fly so i will hang in for 8am action

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

strategy ? .............well generally i don't figure more than 2-3 minutes ahead for scalping and go with he flow

most people assume the Ftse will open gap down (Durrr)

but the question is how deep will be the hit and how much/quickly will it come back

my strategy will be as follows

1) let the market settle on bell.........

assuming we see the Ftse hit = GBP +EUR fall and Yen+USD rise

then trade the fade as the market comes back over th next 30 mins

with spreads widening i wont get to risky on plays .........no need to gamble ......if it looks safe i will trade the retrce

ok game on ................if you are a trainee trader and this doesn't get you excited ...then nothing ever will in this business ....so walk now

N

most people assume the Ftse will open gap down (Durrr)

but the question is how deep will be the hit and how much/quickly will it come back

my strategy will be as follows

1) let the market settle on bell.........

assuming we see the Ftse hit = GBP +EUR fall and Yen+USD rise

then trade the fade as the market comes back over th next 30 mins

with spreads widening i wont get to risky on plays .........no need to gamble ......if it looks safe i will trade the retrce

ok game on ................if you are a trainee trader and this doesn't get you excited ...then nothing ever will in this business ....so walk now

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

ok i will keep half an eye out but no fireworks

i made my normal pip quota already so cant be fussed staying in if its not as volatile as i was expecting 🙂

my EJ (despite my attempts to disprespect it re Ftse Bell ) has got to + 100 pips now from 6am so as the old saying goes

trade what you see........

and not what you want to see 🙂

cheers

N

i made my normal pip quota already so cant be fussed staying in if its not as volatile as i was expecting 🙂

my EJ (despite my attempts to disprespect it re Ftse Bell ) has got to + 100 pips now from 6am so as the old saying goes

trade what you see........

and not what you want to see 🙂

cheers

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

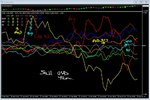

heres the 3 duck corrie today .......

AUD and CAD and now NZD all pushing the buy buttons

GBP clearly is a sell each time we can get the Red line below that Zero on the 5 min chart shown

for these pairs I would generally be looking for USD as a foil .as it has been most of the morning as a sell .....Yen as well if you can handle the spreads

N

AUD and CAD and now NZD all pushing the buy buttons

GBP clearly is a sell each time we can get the Red line below that Zero on the 5 min chart shown

for these pairs I would generally be looking for USD as a foil .as it has been most of the morning as a sell .....Yen as well if you can handle the spreads

N

Attachments

Similar threads

- Replies

- 0

- Views

- 3K