There is no problem - it's all good.

do you ever get the feeling you are missing something ?

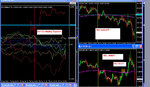

ive talked about a few currencies today....Euro,Yen, swissie and even the USD whilst trying to make a buck or two in this tough old trading world...

Heres what we do tomorrow

take a 5 year old Child (not a 50 year old F*rt)

Explain what nice colours mean on chart

Explain that pointy ups and high ones = buy those lovely colours👍

Explain that pointy downs and low ones = sell those nasty colours👎

then let them look at the chart and tell us what they see..........and perhaps they might

just spot the red GBP kicking butt most of the day ...(unlike me!)😱

childs play !!

N

(note - in all seriousness this is upper stratisphere for the GBP as not much gets above the Blue line that often so perhaps I could be excused...?)

Hi Neil

I think you are doing an excellent job with this topic and with this thread. You are carrying it very well, so don't be getting the hair up on the back of your neck over a couple of trades that didn't go to plan.

Look at the ones that did work out mate, and take a bow.

At this minute I am at work, so only have Bloomie to check currency prices. I can see that my 4H trade is well below its opening price too, so I would imagine, had I given the full parameters of the trade setup - SL and TP etc, I would probably be staring at a stopped out trade now, or an early profit - can't tell.

What I can see is that many setups appear, but few represent really good trades. I took a punt tonight (my time) because I just wanted some action - not a good way to build a nest egg - punting is doomed to bring pain eventually.

But even a punt can be profitable, or painless, if managed correctly. Perhaps that is one aspect we could focus on at some point.

I have found that I do best by following the advice in my own footnotes - don't look back, and stick to one thing until you get there. Unfortunately I am prone to the same whims as anyone else, and have to exercise discipline in my behaviour too - it is lack of discipline that makes me take "hunch" trades.

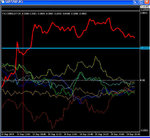

Ideally with the Corrie, I have found that if I wait until one of the pairs is well overbought/oversold, then the ride back to the middle of the pack (perhaps the zero line, but rarely) is the safest trade of all. Some call it "mean reversion" and it is a phenomenon that all currency pairs exhibit.

Maybe we can get some structure into the way we use the Corrie - at least on the thread - by waiting for the best trades, and trading them well. In time I hope to post a few more of mine - with better results than I have so far.

The other way to trade, is risky - and that is to pre-empt the convergence and divergence of pairs from early moves. A percentage of these fail, but good management and a willingness to cull trades that do not perform, will put us in the money, as the early entries do indeed go on to make their runs.

The Corrie is one of the better indicators, and very few forums dare to discuss Currency Correlation Trading.

The boldness with which you have opened up correlation trading on T2W is commendable, and I for one am very grateful for it. It is refreshing - and for me - it works.

Let's kick some butt!

Bring on the trades!

Best wishes - Ivan