You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

working working.......😢

hmm mixed bag really......GBP was drifting up and usd was drifting down .....but trading off the breach of the prev HH on the pairs is not yielding much dinaros as its whipsawing a little......

this is a trading method I currently use in a trending market....but its trading off of the front foot and of course by definition you've already had to move the price in trend direction a bit to hit the new HH (or LL) again.........

the method I want to focus on or going forward (and hopefully introduce into my real trading) is trading the prevailing trend off of the back foot.....ie when the market has retraced a little....but then signals a return to the trend....

i'm not really a fibs dude or anything.....just some good old channel lines will do and a bar confirmation on the pair involved.....this would be working today so far on the G/U bouncing it off of the 5m 20ma or whatever you like as we had guessed a bullish session with USD falling to help....

you can also see how this could work applying to the 1000/1 corries below.....draw some channel lines on (instead of/or alongside my S/R lines) and look to trade that currency in a pair when it bounces back into the trend after a retrace......see second chart below for an example........nothing is perfect though and watch the more volatile dudes like GBP and Yen (and cad actually) as they will break your heart on this stuff (Yen is notoriously parabolic actually like todays 5m action).........AUD,EURO and USD arnt to bad for this usually...even NZD at a pinch....swissies ok but that will be a pure consolidating horizontal channel mostly

hey - whatever gets you through the night....you can use any technical analysis on the corrie 1000/1.....channels, S/R , price action , even Fibs if you want ....just drop it down from the menu !

as for Ma's well its one big Ma indicator so just chose a MA that you want to watch re crossovers and use that on the corrie....i use the 20ma as you know a lot so set that up on a corrie and watch the crossovers on it for entry points.....our 3 duck hybrid is just the same....we use 3 corries set on a 60ma / Delta 1 settign and again watch the crossovers as these exactly match when that currency pair's chart is flagging a real price cross to the respective Ma being used.....not rocket science !

and by the way if you are a dude who trades say when the 5ma crosses the 20ma in pair charts for an entry signal then guess what.....set the corrie Ma to 20 and the Delta to 5 and you will get the same signal for crossovers as the pairs chart for the 5/20 👍

N

really busy today at work so poo............

hmm mixed bag really......GBP was drifting up and usd was drifting down .....but trading off the breach of the prev HH on the pairs is not yielding much dinaros as its whipsawing a little......

this is a trading method I currently use in a trending market....but its trading off of the front foot and of course by definition you've already had to move the price in trend direction a bit to hit the new HH (or LL) again.........

the method I want to focus on or going forward (and hopefully introduce into my real trading) is trading the prevailing trend off of the back foot.....ie when the market has retraced a little....but then signals a return to the trend....

i'm not really a fibs dude or anything.....just some good old channel lines will do and a bar confirmation on the pair involved.....this would be working today so far on the G/U bouncing it off of the 5m 20ma or whatever you like as we had guessed a bullish session with USD falling to help....

you can also see how this could work applying to the 1000/1 corries below.....draw some channel lines on (instead of/or alongside my S/R lines) and look to trade that currency in a pair when it bounces back into the trend after a retrace......see second chart below for an example........nothing is perfect though and watch the more volatile dudes like GBP and Yen (and cad actually) as they will break your heart on this stuff (Yen is notoriously parabolic actually like todays 5m action).........AUD,EURO and USD arnt to bad for this usually...even NZD at a pinch....swissies ok but that will be a pure consolidating horizontal channel mostly

hey - whatever gets you through the night....you can use any technical analysis on the corrie 1000/1.....channels, S/R , price action , even Fibs if you want ....just drop it down from the menu !

as for Ma's well its one big Ma indicator so just chose a MA that you want to watch re crossovers and use that on the corrie....i use the 20ma as you know a lot so set that up on a corrie and watch the crossovers on it for entry points.....our 3 duck hybrid is just the same....we use 3 corries set on a 60ma / Delta 1 settign and again watch the crossovers as these exactly match when that currency pair's chart is flagging a real price cross to the respective Ma being used.....not rocket science !

and by the way if you are a dude who trades say when the 5ma crosses the 20ma in pair charts for an entry signal then guess what.....set the corrie Ma to 20 and the Delta to 5 and you will get the same signal for crossovers as the pairs chart for the 5/20 👍

N

really busy today at work so poo............

Attachments

Last edited:

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Hi N,

Boo, hiss.... Wifey had day off work today so dragged me out kicking and screaming this morning so I duly sulked in all the shops she hauled me into and that worked. Yeah well, worked in as far as getting sent home on my own and to late for joining in on the morning session and, even worse, the promise of a good kicking when de boss gets home later!

Had a quick look at what the markets did this morning and saw some great short setups on GU and EU plus also noticed (for me) both pairs had an early long setup that would have ended in tears, but certainly a day when a definitive direction took a while to shine through.

Off to the dog house now as I know my excuse for this morning's bahaviour of "love charts; hate shops" just aint going to let me off the hook - think I might have booked myself a whole weekend's worth of misery!

Trade well and regards,

Simon.

Boo, hiss.... Wifey had day off work today so dragged me out kicking and screaming this morning so I duly sulked in all the shops she hauled me into and that worked. Yeah well, worked in as far as getting sent home on my own and to late for joining in on the morning session and, even worse, the promise of a good kicking when de boss gets home later!

Had a quick look at what the markets did this morning and saw some great short setups on GU and EU plus also noticed (for me) both pairs had an early long setup that would have ended in tears, but certainly a day when a definitive direction took a while to shine through.

Off to the dog house now as I know my excuse for this morning's bahaviour of "love charts; hate shops" just aint going to let me off the hook - think I might have booked myself a whole weekend's worth of misery!

Trade well and regards,

Simon.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi N,

Boo, hiss.... Wifey had day off work today so dragged me out kicking and screaming this morning so I duly sulked in all the shops she hauled me into and that worked. Yeah well, worked in as far as getting sent home on my own and to late for joining in on the morning session and, even worse, the promise of a good kicking when de boss gets home later!

Had a quick look at what the markets did this morning and saw some great short setups on GU and EU plus also noticed (for me) both pairs had an early long setup that would have ended in tears, but certainly a day when a definitive direction took a while to shine through.

Off to the dog house now as I know my excuse for this morning's bahaviour of "love charts; hate shops" just aint going to let me off the hook - think I might have booked myself a whole weekend's worth of misery!

Trade well and regards,

Simon.

ah....

Regretfully our resident pro trader had an important business meeting today so was not able to trade

Furthermore they may not be available for monday/tuesday sessions next week due to a possible hospital appointment to have a trading screen removed from their lower regions....😱

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

The world is a scary place.............

hey all.....

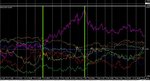

hope your coffers were filled this week from the obama political activty and the ensuing run on the risk averse tag team........heres a nice 4h 1000/1 corrie showing the action......notice how the swissie (grey) can also usually get some love as well when the brown stuff hits the fan...

my advice to Wall street Bankers is from Godfather 1............especially the scenes following the attempt on don corleone's life...and the mobsters advice to the young and green michael (pacino).

ey !....ya always get this every few years....a little blood letting between the familes.....we all go to the beds and gradualy things looseten up again.......but it has to happen every now and then ............

meanwhile the world may now go into medium term risk averse mode.....and how long will china be able to buy/sustain such aggressive growth ?.........is here any nation out there looking good ?

time for gold ?

hey.....wheres my mattress ?

N

hey all.....

hope your coffers were filled this week from the obama political activty and the ensuing run on the risk averse tag team........heres a nice 4h 1000/1 corrie showing the action......notice how the swissie (grey) can also usually get some love as well when the brown stuff hits the fan...

my advice to Wall street Bankers is from Godfather 1............especially the scenes following the attempt on don corleone's life...and the mobsters advice to the young and green michael (pacino).

ey !....ya always get this every few years....a little blood letting between the familes.....we all go to the beds and gradualy things looseten up again.......but it has to happen every now and then ............

meanwhile the world may now go into medium term risk averse mode.....and how long will china be able to buy/sustain such aggressive growth ?.........is here any nation out there looking good ?

time for gold ?

hey.....wheres my mattress ?

N

Attachments

Last edited:

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Re: The world is a scary place.............

Hi N and all,

Thats an interesting point over risk averse western policy makers. I was watching el presidente Obarmy's speech and saw that his various lapdogs around the globe all mumbled their agreement, the thing that got me thinking and reaching for the sick bucket was what will these new restrictions mean for liquidity in the markets, in particular our own fx market?

If the west clamps down on specific financial institutions involvement with risk instruments, where will the liquidity be sourced from? Is this clamp down a first step towards tightening markets which rely upon unshackled freedom to function correctly? Food for thought there especially when we consider the fact that the CFTC's proposals for limiting leverage to 10:1 in fx markets, offered by USA domiciled brokers in the first instance, will be up for decision within the next two months....

We all have to keep a watching brief on these rather draconian measures as they will have a detrimental effect on markets in general and, in my bitter experience, its always us small time traders that suffer first and worst - stormy days ahead.

Have a great weekend,

Simon.

Hi N and all,

Thats an interesting point over risk averse western policy makers. I was watching el presidente Obarmy's speech and saw that his various lapdogs around the globe all mumbled their agreement, the thing that got me thinking and reaching for the sick bucket was what will these new restrictions mean for liquidity in the markets, in particular our own fx market?

If the west clamps down on specific financial institutions involvement with risk instruments, where will the liquidity be sourced from? Is this clamp down a first step towards tightening markets which rely upon unshackled freedom to function correctly? Food for thought there especially when we consider the fact that the CFTC's proposals for limiting leverage to 10:1 in fx markets, offered by USA domiciled brokers in the first instance, will be up for decision within the next two months....

We all have to keep a watching brief on these rather draconian measures as they will have a detrimental effect on markets in general and, in my bitter experience, its always us small time traders that suffer first and worst - stormy days ahead.

Have a great weekend,

Simon.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

..........10:1 leverage ?

I may a well forget my trading dream and start being nice to my boss again ! 😱

jees.........however there is always a glimmer of light in even the darkest of times and lets be honest the one thing we do know about this industry is that the big dogs normally can stay 2 steps ahead of any global government plans to stifle its creativity and its innovations in creating new markets, products and any loopholes to make a buck...........which kinda got us here in the first place by them inventing new products to repackage western debt 😱

fingers crossed the magic filters down to the brokers that we rely on......😏

aside from the prohibitive u.s. legislation (which is stifling ailready for our equivalents trading across the pond anyway) how big do you see this as a risk to UK traders re the products and services we enjoy at the moment ?

........and should I give up my day job ? :whistling

N

I may a well forget my trading dream and start being nice to my boss again ! 😱

jees.........however there is always a glimmer of light in even the darkest of times and lets be honest the one thing we do know about this industry is that the big dogs normally can stay 2 steps ahead of any global government plans to stifle its creativity and its innovations in creating new markets, products and any loopholes to make a buck...........which kinda got us here in the first place by them inventing new products to repackage western debt 😱

fingers crossed the magic filters down to the brokers that we rely on......😏

aside from the prohibitive u.s. legislation (which is stifling ailready for our equivalents trading across the pond anyway) how big do you see this as a risk to UK traders re the products and services we enjoy at the moment ?

........and should I give up my day job ? :whistling

N

Last edited:

phreddyinbg

Member

- Messages

- 84

- Likes

- 3

Hi All,

Sorry for the absence.

Had to take a trip to Indonesia, couldn't tell you before - internet playing up!

Couldn't post while I was there - internet too slow!

Sunday today, well here it is. Be here bright and early tomorrow to greet you all again and take a guess on what the charts are telling me. If the internet holds up!!!

Sorry for the absence.

Had to take a trip to Indonesia, couldn't tell you before - internet playing up!

Couldn't post while I was there - internet too slow!

Sunday today, well here it is. Be here bright and early tomorrow to greet you all again and take a guess on what the charts are telling me. If the internet holds up!!!

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Hi N,

Potentially enormous, as what starts that side of the pond invariably rows its boat over to our side of the pond. Dont forget its policy makers who "think" they are on the right track here with silly nanny ideas that might appeal to voters, what they dont realise is the "beast" (aka '08 financial meltdown) has already left the building!

And a hi to phreddy - welcome back! Go for the gap your local time today when fx opens, then pump prime us limeys ready for the Monday morning session.

Simon.

Potentially enormous, as what starts that side of the pond invariably rows its boat over to our side of the pond. Dont forget its policy makers who "think" they are on the right track here with silly nanny ideas that might appeal to voters, what they dont realise is the "beast" (aka '08 financial meltdown) has already left the building!

And a hi to phreddy - welcome back! Go for the gap your local time today when fx opens, then pump prime us limeys ready for the Monday morning session.

Simon.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi All,

Sorry for the absence.

Had to take a trip to Indonesia, couldn't tell you before - internet playing up!

Couldn't post while I was there - internet too slow!

Sunday today, well here it is. Be here bright and early tomorrow to greet you all again and take a guess on what the charts are telling me. If the internet holds up!!!

hey phreddy :clap:

I new our third musketeer had not deserted us 👍

are you still happy to follow the T60 for us ?

if you are... could I ask a favour please ?.....can you expand the 4h and the 1h a little more on your posts so that I can see a little history on both ?.....allows me to give more feedback and analysis

meanwhile heres the amazing trade that following the 2 higher TF's on this system (1h and 4h) has generated recently......as you can see the Euro / USD would have worked as well !

ok the 3rd 5m 60/1 "trigger" chart would have been jumping in and out......but thats the nature of trading the longer term trend......you need to develop your own strategies and identify what you are trying to achieve with the 3 ducks and any other of the many variations on this......(vary TF and/or vary MA)

remember I have also mentioned before that the 3 ducks is much to slow on the higher TF's for me to call the intraday scalps with............so horses for courses :smart:

thks 👍

Neil

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi N,

Potentially enormous, as what starts that side of the pond invariably rows its boat over to our side of the pond. Dont forget its policy makers who "think" they are on the right track here with silly nanny ideas that might appeal to voters, what they dont realise is the "beast" (aka '08 financial meltdown) has already left the building!

And a hi to phreddy - welcome back! Go for the gap your local time today when fx opens, then pump prime us limeys ready for the Monday morning session.

Simon.

hi jrp..........hmmm i'll pm you on this......

meanwhile phreddy.........if nikkei opens down later and then follows through buy tag and sell everythng else..........(but you knew that !) 👍

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Goldwatch

Hi all

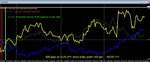

another little tool I have is a very simple Gold corrie that I look at from time to time

all it does is drops gold into the G8 mix and I value it as just another currency.... in effect you are looking at a G9 fxcorrelator on whatever settings you choose

Gold is set at a core base of $1100 in this version......and to be honest for what I use it for thats good enough re the crossovers and movements etc etc

so all usual rules apply ...............if you lived in England and saw the Gold (purple) line crossover the red line going north fast.... you should offload some sterling and buy some Gold to protect your wealth ! (or at least til those lines stated to converge fast again..then you would exit the trade wth a few extra Quid in your pocket.....

but NVP I hear you say what am I buying as the other pair currency ?

no no no ...............you dont understand what I am saying 😛

trading currency pairs is another matter.....I am saying buy Gold in sterling (which I think is possible on some indexs ??).....dont fuss about using usd as that is another variable/trade you are introducing to the mix...

yes I know I say that Gold is opposite to the USD most of the time......so what would be the point of selling GBP into USD and then buying gold on the standard Gold in usd charts...............that in effect is a sell GBP hedge praying that USD and Gold move opposite to one another....overall the effect will possibly be ok but why introduce an extra trade (with its own volatility) and spead/costs when the play was sell GBP buy Gold :smart:

cmon.....I know you are all dieing to correct me here.......:whistling

heres a 1000/1 setting for the gold correlator on he 4h charts...I challenge you to show me any currency pair/combination that delivers more samolies that just buying gold in any currency between those green verts.......you cant use the USD/Gold relationship.....look usd was weak....but it was pretty flat and not falling really ...... basically everyone lost faith in paper currencies and went to the oldest currency on earth

N

Hi all

another little tool I have is a very simple Gold corrie that I look at from time to time

all it does is drops gold into the G8 mix and I value it as just another currency.... in effect you are looking at a G9 fxcorrelator on whatever settings you choose

Gold is set at a core base of $1100 in this version......and to be honest for what I use it for thats good enough re the crossovers and movements etc etc

so all usual rules apply ...............if you lived in England and saw the Gold (purple) line crossover the red line going north fast.... you should offload some sterling and buy some Gold to protect your wealth ! (or at least til those lines stated to converge fast again..then you would exit the trade wth a few extra Quid in your pocket.....

but NVP I hear you say what am I buying as the other pair currency ?

no no no ...............you dont understand what I am saying 😛

trading currency pairs is another matter.....I am saying buy Gold in sterling (which I think is possible on some indexs ??).....dont fuss about using usd as that is another variable/trade you are introducing to the mix...

yes I know I say that Gold is opposite to the USD most of the time......so what would be the point of selling GBP into USD and then buying gold on the standard Gold in usd charts...............that in effect is a sell GBP hedge praying that USD and Gold move opposite to one another....overall the effect will possibly be ok but why introduce an extra trade (with its own volatility) and spead/costs when the play was sell GBP buy Gold :smart:

cmon.....I know you are all dieing to correct me here.......:whistling

heres a 1000/1 setting for the gold correlator on he 4h charts...I challenge you to show me any currency pair/combination that delivers more samolies that just buying gold in any currency between those green verts.......you cant use the USD/Gold relationship.....look usd was weak....but it was pretty flat and not falling really ...... basically everyone lost faith in paper currencies and went to the oldest currency on earth

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

nope.........I dont use it to scalp but will drop you a line here sometimes if I think theres a decent gold trade going or that the relative price of gold is useful to our forex plays

referring back to the 4h chart in last post you can see that slowly the currencies are fighing back and that gold is gradually being revalued downwards again.........

Gold is seen to fall when the next best thing (USD) is rising so we can use that as evidence currently......but I am a little nervous of the overall (poor) quality/strength of global currencies generally to say it will fall right back into the pack at present.............plus I am not an economist or financial guru / wizard anyway............ I just look for correlation patterns and principles in markets and try to see how money can be made exploiting/trading them......nothing more nothing less......

if gold turns in generic terms l promise to shout !

N

referring back to the 4h chart in last post you can see that slowly the currencies are fighing back and that gold is gradually being revalued downwards again.........

Gold is seen to fall when the next best thing (USD) is rising so we can use that as evidence currently......but I am a little nervous of the overall (poor) quality/strength of global currencies generally to say it will fall right back into the pack at present.............plus I am not an economist or financial guru / wizard anyway............ I just look for correlation patterns and principles in markets and try to see how money can be made exploiting/trading them......nothing more nothing less......

if gold turns in generic terms l promise to shout !

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hmmmm

I like the bkforex team......always bright punchy stuff based on market fundamentals, Economic News releases plus some technicals thrown in for good luck....

heres a recent one.............Boris are you trying to claim our 7am 15m bar play ?

seriously you hear me talk a lot about S/R levels on the corrie and the breaches that can indicate major moves

perhaps we should watch those High/Low channels (and eventual breaches) a little closer on the ovenight session from now on longside our 7am play (ie if the 15m bar is breached and move is also breaching the overnight High/low then thats even better trade confirmation ) 👍

good luck to all on the Far East session :clover:

N

I like the bkforex team......always bright punchy stuff based on market fundamentals, Economic News releases plus some technicals thrown in for good luck....

heres a recent one.............Boris are you trying to claim our 7am 15m bar play ?

seriously you hear me talk a lot about S/R levels on the corrie and the breaches that can indicate major moves

perhaps we should watch those High/Low channels (and eventual breaches) a little closer on the ovenight session from now on longside our 7am play (ie if the 15m bar is breached and move is also breaching the overnight High/low then thats even better trade confirmation ) 👍

good luck to all on the Far East session :clover:

N

Last edited:

Boilersuit

Junior member

- Messages

- 27

- Likes

- 6

Re: The world is a scary place.............

Hmm, there are some troubling things being talked about/ happening in forex.

FIFO and anti-hedge regulations, and now this 10-1 nonsense.

I've read something that the CFTC proposal of 10-1 would ONLY apply to non-exchange products ie OTC products. In other words, it would force forex, and credit derivatives etc into an exchange arena.

I didn't bother to research this further.

Gordon Brown was reported to have proposed a Tobin tax on financial transactions- which would kill liquid markets. Again, this was never likely to have happened. I feel that someone just wanted to harm him by recommending a bull**** idea to him ( which he gullibly got associated with).

----------------------------------------

Anyway, back to Correlation/ Divergence, I'm currenly looking at strategies that feed soley on Correlation Analysis. Not easy tho..

Hi N and all,

Thats an interesting point over risk averse western policy makers. I was watching el presidente Obarmy's speech and saw that his various lapdogs around the globe all mumbled their agreement, the thing that got me thinking and reaching for the sick bucket was what will these new restrictions mean for liquidity in the markets, in particular our own fx market?

If the west clamps down on specific financial institutions involvement with risk instruments, where will the liquidity be sourced from? Is this clamp down a first step towards tightening markets which rely upon unshackled freedom to function correctly? Food for thought there especially when we consider the fact that the CFTC's proposals for limiting leverage to 10:1 in fx markets, offered by USA domiciled brokers in the first instance, will be up for decision within the next two months....

We all have to keep a watching brief on these rather draconian measures as they will have a detrimental effect on markets in general and, in my bitter experience, its always us small time traders that suffer first and worst - stormy days ahead.

Have a great weekend,

Simon.

Hmm, there are some troubling things being talked about/ happening in forex.

FIFO and anti-hedge regulations, and now this 10-1 nonsense.

I've read something that the CFTC proposal of 10-1 would ONLY apply to non-exchange products ie OTC products. In other words, it would force forex, and credit derivatives etc into an exchange arena.

I didn't bother to research this further.

Gordon Brown was reported to have proposed a Tobin tax on financial transactions- which would kill liquid markets. Again, this was never likely to have happened. I feel that someone just wanted to harm him by recommending a bull**** idea to him ( which he gullibly got associated with).

----------------------------------------

Anyway, back to Correlation/ Divergence, I'm currenly looking at strategies that feed soley on Correlation Analysis. Not easy tho..

phreddyinbg

Member

- Messages

- 84

- Likes

- 3

Re: Correlation Trading - Beginners corner

Good Morning campers!!!

10am here in sunny Malaysia and here is the news:

Japan's Nikkei 225 was down 1.2% at 10460.10 in Tokyo Monday morning after tapping a more than three-week low of 10449.83 as strength ...

The new T60 re-designed for the boss!!

"And a hi to phreddy - welcome back! Go for the gap your local time today when fx opens, then pump prime us limeys ready for the Monday morning session." Gaps were good this morning: would have 30 pip opportunity on $Y, but 50 pip on £Y, €Y all done and dusted by this time. When I go LIVE, I will make the effort and get up at 0600 on a Monday morning.

BTW I am a limey as well Simon, I just come here for the winter.

Good Morning campers!!!

10am here in sunny Malaysia and here is the news:

Japan's Nikkei 225 was down 1.2% at 10460.10 in Tokyo Monday morning after tapping a more than three-week low of 10449.83 as strength ...

The new T60 re-designed for the boss!!

"And a hi to phreddy - welcome back! Go for the gap your local time today when fx opens, then pump prime us limeys ready for the Monday morning session." Gaps were good this morning: would have 30 pip opportunity on $Y, but 50 pip on £Y, €Y all done and dusted by this time. When I go LIVE, I will make the effort and get up at 0600 on a Monday morning.

BTW I am a limey as well Simon, I just come here for the winter.

Attachments

Last edited:

phreddyinbg

Member

- Messages

- 84

- Likes

- 3

1400 here and 0600 UK

Here is the latest: Dollar going down? Pound going up?

Got tolook at my breakout now I prefer the 0600 x 15 min as the range. Problem, as ever, is price just popping out and triggering the trade then popping back in again. I am thinking of using a SMA as a trigger, by the time we get triggered it should have stopped wriggling about.

What is your strategy Neil?

Here is the latest: Dollar going down? Pound going up?

Got tolook at my breakout now I prefer the 0600 x 15 min as the range. Problem, as ever, is price just popping out and triggering the trade then popping back in again. I am thinking of using a SMA as a trigger, by the time we get triggered it should have stopped wriggling about.

What is your strategy Neil?

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Re: The world is a scary place.............

Richard......you aint wrong there......let me know PM if any ideas sharing needed on the con/div..........I apologise again for my lack of focus there reecently (work,systems probs,sickness,etc etc)

N

Hmm, there are some troubling things being talked about/ happening in forex.FIFO and anti-hedge regulations, and now this 10-1 nonsense.

I've read something that the CFTC proposal of 10-1 would ONLY apply to non-exchange products ie OTC products. In other words, it would force forex, and credit derivatives etc into an exchange arena.

I didn't bother to research this further.

Gordon Brown was reported to have proposed a Tobin tax on financial transactions- which would kill liquid markets. Again, this was never likely to have happened. I feel that someone just wanted to harm him by recommending a bull**** idea to him ( which he gullibly got associated with).

----------------------------------------

Anyway, back to Correlation/ Divergence, I'm currenly looking at strategies that feed soley on Correlation Analysis. Not easy tho..

Richard......you aint wrong there......let me know PM if any ideas sharing needed on the con/div..........I apologise again for my lack of focus there reecently (work,systems probs,sickness,etc etc)

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hi all

and welcome back phreddy 👍

firstly heres overnight action......nikkei rose overnight generally but consolidation now on futures prices.....yen fell oblgingly feeding mostly off the australasian twins (not shown)....gold futures have been very positive above 20mas overnight so a lot of pressure on tag down......

I see Yen and GBP already breaching their overnight channels but to early to bite yet as usd is very flat on scalping scene......the 7am bar will sort men out from the boys 😉

next post for phreddy and the 3 duck gang......phreddy I also recommend you watch the captain currency thread and his blogs as you are our T60 guru

N

and welcome back phreddy 👍

firstly heres overnight action......nikkei rose overnight generally but consolidation now on futures prices.....yen fell oblgingly feeding mostly off the australasian twins (not shown)....gold futures have been very positive above 20mas overnight so a lot of pressure on tag down......

I see Yen and GBP already breaching their overnight channels but to early to bite yet as usd is very flat on scalping scene......the 7am bar will sort men out from the boys 😉

next post for phreddy and the 3 duck gang......phreddy I also recommend you watch the captain currency thread and his blogs as you are our T60 guru

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

3 ducks and the corrie 25th

hi all

heres my 3 ducks spread out left to right.......4h , 1h . 5min trigger

firstly the strict rules that apply tell us today that ONLY these trades will be allowed based on the 4h setup......remember I like the 3 ducks but its a very traditional trend following system and when you trade boy are you trading with the long term trend !

BUY YEN USD AND SOON GBP (as high in 4h)

SELL CAD EURO AND NZD (as low in 4h)

wait for these to confirm/align in the 1h and 5min re entries......this is currently against my scalping predictions so far except possibly a Buy GPB sell Euro call

current trades on ?..because theres a big G8 shift occuring (tag returning south for a while from the big push north last week) the lagging 4h will freeze any trades shorting the tag for a while yet.....not a bad thing if you follow this system as of course the tag could possibly fire up again and the 3 ducks would be in clover !

PS go back a few posts and see my comments re the 600 pips made on the 3 ducks

E/J.............

later all.....phreddy keep on those duck charts and make calls when you see them !

N

hi all

heres my 3 ducks spread out left to right.......4h , 1h . 5min trigger

firstly the strict rules that apply tell us today that ONLY these trades will be allowed based on the 4h setup......remember I like the 3 ducks but its a very traditional trend following system and when you trade boy are you trading with the long term trend !

BUY YEN USD AND SOON GBP (as high in 4h)

SELL CAD EURO AND NZD (as low in 4h)

wait for these to confirm/align in the 1h and 5min re entries......this is currently against my scalping predictions so far except possibly a Buy GPB sell Euro call

current trades on ?..because theres a big G8 shift occuring (tag returning south for a while from the big push north last week) the lagging 4h will freeze any trades shorting the tag for a while yet.....not a bad thing if you follow this system as of course the tag could possibly fire up again and the 3 ducks would be in clover !

PS go back a few posts and see my comments re the 600 pips made on the 3 ducks

E/J.............

later all.....phreddy keep on those duck charts and make calls when you see them !

N

Attachments

Similar threads

- Replies

- 0

- Views

- 3K