You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi NVP and readers of this thread, I thought I would share my observations of three major FX pairs for Friday 6th January, the day of the US NFP and Unemployment Rate.

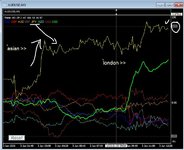

I attach three hourly charts for GBPUSD, EURGBP and EURUSD that form the triplet for arbitrage. The levels shown in the charts were calculated Thursday evening after the close in New York and were valid for the next 24 hours. The levels in the charts are calculated using a mapping between daily candlesticks for each FX pair. Chart times are London local time minus 4 hours.

From the charts you can see that:

You can also see that EURUSD was following GBPUSD. That means that trading EURUSD was impossible without taking into account that GBPUSD was taking the lead.

Finally the NFP news was essentially ignored by the markets and they continued with their buying GBP sentiment.

gka

I attach three hourly charts for GBPUSD, EURGBP and EURUSD that form the triplet for arbitrage. The levels shown in the charts were calculated Thursday evening after the close in New York and were valid for the next 24 hours. The levels in the charts are calculated using a mapping between daily candlesticks for each FX pair. Chart times are London local time minus 4 hours.

From the charts you can see that:

- GBPUSD made its low of the day at the level 1.1841 in the 07:00 hour. I have the GBPUSD low for the day as 1.18412

- EURGBP made its high of the day at the level 0.8871 in the 06:00 hour. I have the EURGBP high for the day as 0.88715

- The high and low for EURUSD were delayed and not about its predicted levels

You can also see that EURUSD was following GBPUSD. That means that trading EURUSD was impossible without taking into account that GBPUSD was taking the lead.

Finally the NFP news was essentially ignored by the markets and they continued with their buying GBP sentiment.

gka

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

interesting - thanks !Hi NVP and readers of this thread, I thought I would share my observations of three major FX pairs for Friday 6th January, the day of the US NFP and Unemployment Rate.

I attach three hourly charts for GBPUSD, EURGBP and EURUSD that form the triplet for arbitrage. The levels shown in the charts were calculated Thursday evening after the close in New York and were valid for the next 24 hours. The levels in the charts are calculated using a mapping between daily candlesticks for each FX pair. Chart times are London local time minus 4 hours.

From the charts you can see that:

The figures for the US NFP and the Unemployment Rate were both better than expected so one would assume that this would create a buy USD sentiment. Instead the GBPUSD continued to be bought and EURGBP continued to be sold. Friday was a buy GBP day.

- GBPUSD made its low of the day at the level 1.1841 in the 07:00 hour. I have the GBPUSD low for the day as 1.18412

- EURGBP made its high of the day at the level 0.8871 in the 06:00 hour. I have the EURGBP high for the day as 0.88715

- The high and low for EURUSD were delayed and not about its predicted levels

You can also see that EURUSD was following GBPUSD. That means that trading EURUSD was impossible without taking into account that GBPUSD was taking the lead.

Finally the NFP news was essentially ignored by the markets and they continued with their buying GBP sentiment.

gka

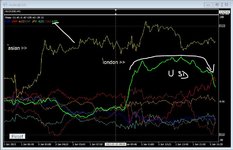

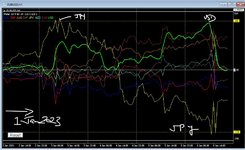

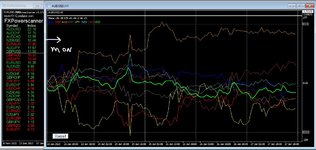

I put a fixstart onto the GU pair and retraced it back to that days trading - ive isolated just the green USD , blue Euro and the red GBP

I saw this on the day :-

GU hit days low at 11:45 GMT (maybe my platform)

NFP impact initially saw all 3 currencies fall slightly ...all correlated

then around 3pm GMT a real move ....GBP went Hot , USD went hard Bear and Euro stayed neutral

Sell USD against other currencies

Buy GBP against other currencies

BIG PLAY GBPUSD Buy

the Neutral Euro would not have been in play for me on any pair at the time

nice days action once it warmed up !

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Inquisitor

Well-known member

- Messages

- 253

- Likes

- 107

What is the use of posting "after the event" comments about the forex market? It's as much use as stating what the lottery numbers were on a Monday for the previous Saturday. Just in case anyone is interested, the numbers were:

07 - 09 - 14 - 21 - 30 - 57 and the Bonus ball was 18

07 - 09 - 14 - 21 - 30 - 57 and the Bonus ball was 18

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

because understanding the past is very useful to predicting the future ....What is the use of posting "after the event" comments about the forex market? It's as much use as stating what the lottery numbers were on a Monday for the previous Saturday. Just in case anyone is interested, the numbers were:

07 - 09 - 14 - 21 - 30 - 57 and the Bonus ball was 18

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

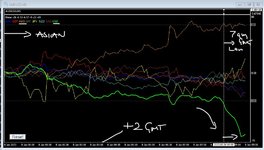

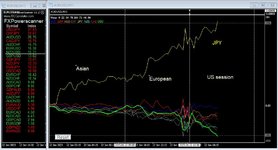

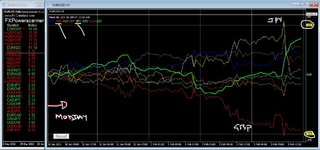

Forex Diary Week ending 3rd Feb 2023

Bulls

mainly dominated by yellow JPY, But Greenback USD coming fast .....

Bears

GBP the main Bear story in the week as even as increase in interest rates failed to support it....

on the Daily TF FX Powerscanner (left indicator) we see the best trending daily pairs in the 28 variations possible for G8 ....with the Bear GBP having 5 pairs in the top 7 .......

N

Bulls

mainly dominated by yellow JPY, But Greenback USD coming fast .....

Bears

GBP the main Bear story in the week as even as increase in interest rates failed to support it....

on the Daily TF FX Powerscanner (left indicator) we see the best trending daily pairs in the 28 variations possible for G8 ....with the Bear GBP having 5 pairs in the top 7 .......

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

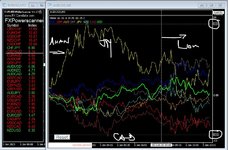

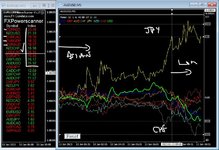

Forex Diary Week ending 10th Feb 2023

Bulls

Lots of interchangeable currencies in the week but ultimately Red GBP it the high spots on Thursday....Cad was a big finisher into Friday evening

Bears

Early yellow JPY sells on Monday quickly capitulated - Blue Euro took the main selling from late Tuesday

on the Daily TF FX Powerscanner (left indicator) we see the best trending daily pairs in the 28 variations possible for G8 ....with the Bull CAD dominating the top 3 pairs to trade ......

N

Bulls

Lots of interchangeable currencies in the week but ultimately Red GBP it the high spots on Thursday....Cad was a big finisher into Friday evening

Bears

Early yellow JPY sells on Monday quickly capitulated - Blue Euro took the main selling from late Tuesday

on the Daily TF FX Powerscanner (left indicator) we see the best trending daily pairs in the 28 variations possible for G8 ....with the Bull CAD dominating the top 3 pairs to trade ......

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

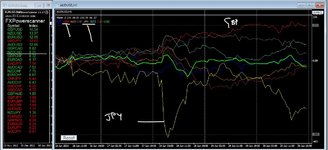

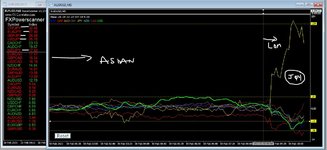

Forex Diary Week ending 17th Feb 2023

Bull

Red GBP initially , Blue Euro and Green USD at the end of week

Bear

Yellow JPY ...only brown CAD fell significantly later in week ....

on the Daily FX Powerscanner (left indicator) we see the best trending pairs in the 28 variations possible for G8 ....

on the Fix start indicator (right chart) we saw the big movers hitting highs and lows through the week ....

was a decent week if you followed the relative momentum in the market....mainly selling JPY in pairs

N 🙂

Bull

Red GBP initially , Blue Euro and Green USD at the end of week

Bear

Yellow JPY ...only brown CAD fell significantly later in week ....

on the Daily FX Powerscanner (left indicator) we see the best trending pairs in the 28 variations possible for G8 ....

on the Fix start indicator (right chart) we saw the big movers hitting highs and lows through the week ....

was a decent week if you followed the relative momentum in the market....mainly selling JPY in pairs

N 🙂

Attachments

Similar threads

- Replies

- 0

- Views

- 3K