in case it had'nt escaped anyones notice .....the Dow has lost some 8% of its value in October ....moving smoothly from hero to Zero in 4 brief weeks .......and in the process also selling a mega fake interim bounce to all the believers burying them all firmly..........more fool them .....cheap money is no more ......markets dont go up in straight line any more ....welcome to trading

when i started this thread way over 10 years ago ..........i used to be much more heavily into intermarket analysis ..........john murphy and his followers etc etc .....I also remember talking at length to Ashraf Laidi at a forex conference who was also heavily selling his own intermarket work .....interesting times ......

basically here I used to follow the equity markets and if the Dow fell I was straight into buying yen , Swissie and USD and devil take the hindmost.........

theses days i am more relaxed on the subject ........i dont need to worry about what gold , Equities , bonds or even crude oil is doing .......I just watch the 8 forex currencies and trade where my indicators tell me ...........i dont need the blanket of intermarket correlations .....if they happen they happen ....i make money whatever .......

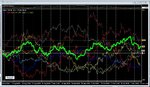

even so ............heres that Dow falling in October and equivalent G8 action for same period ......look at that Yellow Yen climb.......thats over 300 pips for buying yen alone before you add in the partner/pair currency falls (like Euro falling 90 pips = 400 pip selloff of E/J in Oct so far )

The yen is the most sensitive to global equities i have found over time .......so its a pretty good result for the intermarket crew .......hey more books sold .....(ignore the times it doesnt work)

or you do what i simply do .....buy the currencies rising in a period and sell the ones falling ......too simple ?....depends .....all we have to do is follow what the market is telling us ..............screw the fundamentals .....screw the experts .........just listen to the one person worth following ......the market itself !

who needs the extra complexity and layer of intermarket analysis ?.....well the booksellers do .....thats for sure !

N 🙂