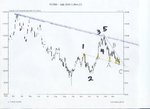

Price action was a disappointing day in Coffee. I was expecting a move up but the opposite happened. This sharp move down in price penetrated the upward sloping trendline drawn against the lows within the advance from 106.50 (Chart 1). So unless we see a dramatic reversal tomorrow, now I fear that odds favor the selloff in Coffee from 115.30 possibly continuing to below 106.50, putting the bullish case on hold.

In terms of the bigger picture I remain longer-term bullish on Coffee. The selloff from 128.50 may be a second wave. Although a move much below the 105.00 handle would increase the probabilities that the labeling in Chart 3 is the operative wave pattern - a Contracting Triangle.

I am still flat and still wonder how to play coffee without putting too much capital at risk. Options perhaps?

In terms of the bigger picture I remain longer-term bullish on Coffee. The selloff from 128.50 may be a second wave. Although a move much below the 105.00 handle would increase the probabilities that the labeling in Chart 3 is the operative wave pattern - a Contracting Triangle.

I am still flat and still wonder how to play coffee without putting too much capital at risk. Options perhaps?