BS, I take your point but I still can't accept they're a good company.

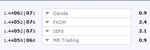

Their spreads are typically 2 or 3 times that of CMC (and others)

If you look at their day's high and low prices (and each swing) is usually at least a point higher or lower than IG - which have a similar spread. I know this can be a good thing (depending on your trade direction) but this also has an impact on stop distances - so you have to add the additional spread AND the additional movement to your stops.

I found their customer service very bad - I didn't hang around there too long so maybe I just got unlucky on this point. I also believe there's a massive class action going on against them - maybe this isn't uncommon but it certainly taints them imo.

Their spreads are typically 2 or 3 times that of CMC (and others)

If you look at their day's high and low prices (and each swing) is usually at least a point higher or lower than IG - which have a similar spread. I know this can be a good thing (depending on your trade direction) but this also has an impact on stop distances - so you have to add the additional spread AND the additional movement to your stops.

I found their customer service very bad - I didn't hang around there too long so maybe I just got unlucky on this point. I also believe there's a massive class action going on against them - maybe this isn't uncommon but it certainly taints them imo.