Krzysiaczek99

Well-known member

- Messages

- 430

- Likes

- 1

so which algorithm from ensemble learning you are using to switch between strategies ??

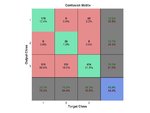

Did you convert your strategies to have output compatibile with this algorithm i.e. to output all elements of confusion matrix ??? How ??

Or you just feed results (success/failure) from trading strategies to ensemble without any preprocesing ??

Did you convert your strategies to have output compatibile with this algorithm i.e. to output all elements of confusion matrix ??? How ??

Or you just feed results (success/failure) from trading strategies to ensemble without any preprocesing ??

Last edited: