You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

still in it on falling candles 🙂

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

out for +40c when stopped out on usual rule

will post chart elsewhere

this is your thread so I'll go quiet ! 🙂

Richard

will post chart elsewhere

this is your thread so I'll go quiet ! 🙂

Richard

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

you're welcome to post the chart here 🙂

HGSI has changed. In my early days, I enjoyed HGSI. It would give nice modest profits while also moving slowly and rhythmically. Nowadays, it's just wild with wide spreads and hard to follow movements in the bid/offer.

HGSI has changed. In my early days, I enjoyed HGSI. It would give nice modest profits while also moving slowly and rhythmically. Nowadays, it's just wild with wide spreads and hard to follow movements in the bid/offer.

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Thanks but we can talk eleswhere 😉

Richard

Richard

ProfessorK

Junior member

- Messages

- 16

- Likes

- 1

Long time lurker on T2W and first time poster!

Amit,

I have enjoyed reading this thread, It seems to me that you have a good understanding of market maker shenanigans portrayed in level 2 quotes.

You also seem to understand the correlations between support / resistance levels in charts and relative effects on prices showing potential setups.

I had day traded using time and sales, level 2 quotes, and basic support resistance for quite some time in 2009 and had good success. I have been working full time since then and have not traded in almost 2 years. Looking to get back into the swing of things and reading good threads like these is always inspirational.

Looking foreward to following your thread and I wish you the best in your trading.

Amit,

I have enjoyed reading this thread, It seems to me that you have a good understanding of market maker shenanigans portrayed in level 2 quotes.

You also seem to understand the correlations between support / resistance levels in charts and relative effects on prices showing potential setups.

I had day traded using time and sales, level 2 quotes, and basic support resistance for quite some time in 2009 and had good success. I have been working full time since then and have not traded in almost 2 years. Looking to get back into the swing of things and reading good threads like these is always inspirational.

Looking foreward to following your thread and I wish you the best in your trading.

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

Long time lurker on T2W and first time poster!

Amit,

I have enjoyed reading this thread, It seems to me that you have a good understanding of market maker shenanigans portrayed in level 2 quotes.

You also seem to understand the correlations between support / resistance levels in charts and relative effects on prices showing potential setups.

I had day traded using time and sales, level 2 quotes, and basic support resistance for quite some time in 2009 and had good success. I have been working full time since then and have not traded in almost 2 years. Looking to get back into the swing of things and reading good threads like these is always inspirational.

Looking foreward to following your thread and I wish you the best in your trading.

Thanks for the kind words, ProfessorK. I actually hadn't posted on this thread for a while, but decided to post that one trade. Glad to know people are finding it useful.

I'm still learning how to read level 2, having only been at it for just over an year now. I have improved significantly, but still feel there is a lot more to learn.

Best of luck with your trading. 🙂

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

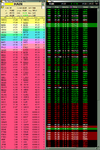

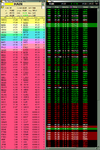

A different sort of level 2 trade with less chart and more level 2 reading. The chart shows resistance at the $41 level after it broke out and then came back down. It tried to get back above the whole number but failed. I could see strong resistance on level 2 and decided to short my first lot at 40.95, whilst keeping a stop just above the whole number. It then went up, resistance appeared again, and I shorted another lot at 40.98.

After chopping around for a few minutes, it finally started falling and steadily ticked down with obvious selling pressure on level 2 and t&s. At one point, that behavior changed, buyers started taking over, so I covered my position.

Average short entry price: 40.965

Exit price: 40.78

Net profit: +19 cents per share

The key to this trade was that since I had used level 2 for entry, I was not going to use chart for an exit - I was watching level 2 and watching it evolve. If the behavior changes and it no longer does what it should be doing or what it was doing, then I get out.

I have attached the level 2 screen as well near my time of exit. Notice the strength on the bid side and the weak offer side. Often times, this is false - designed to make all the current shorts cover their positions. However, the purpose of my trade was to take advantage of the obvious selling pressure building near the whole number. Once that selling pressure evaporated, I had no further reason to stay in the trade.

Amit

After chopping around for a few minutes, it finally started falling and steadily ticked down with obvious selling pressure on level 2 and t&s. At one point, that behavior changed, buyers started taking over, so I covered my position.

Average short entry price: 40.965

Exit price: 40.78

Net profit: +19 cents per share

The key to this trade was that since I had used level 2 for entry, I was not going to use chart for an exit - I was watching level 2 and watching it evolve. If the behavior changes and it no longer does what it should be doing or what it was doing, then I get out.

I have attached the level 2 screen as well near my time of exit. Notice the strength on the bid side and the weak offer side. Often times, this is false - designed to make all the current shorts cover their positions. However, the purpose of my trade was to take advantage of the obvious selling pressure building near the whole number. Once that selling pressure evaporated, I had no further reason to stay in the trade.

Amit

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

Haven't posted here for a while, but got a couple of emails from members wanting to see more updates in this journal. So, here's a trade from the wee hours of this morning. Chart setup is as described by Mr. Charts' thread on rising candles.

Take a look at the chart and note how strong the initial two 1-minute candles are, with very little in the way of wicks. The slope is also very high, indicating desperation on the part of buyers to pick up the stock. These two factors - a strong initial rise and clean, almost-full candles - suggest that the uptrend is likely to continue.

Further confirmation of trend continuation came from the very minor retracement. I actually went long as soon as it broke, but the stock was thin and I got filled approximately 10 cents higher than my desired entry, but the stock kept moving higher. I was about to close it out as it started ticking back down (5th 1-minute candle), but I could see a buyer on level 2 holding the 50 cent level. So I decided that if the 50-cent level doesn't hold, I'll get out for a small loss. It then continued its ascent higher until it just stopped moving up, sellers got stronger on the offer side, and when they weren't getting filled, moved to hit the bids. I then covered my long.

It's as simple as that. Could have gone higher, but no one knows the future. By relying on the order flow, I won't be able to pick tops and bottoms 100% of the time, but it allows me to consistently rake in profits, which is the goal of trading.

Entry: 13.49

Exit: 14.17

Net profit after commissions: +66 cents per share

Another note to make here is the fact that this stock gapped down on the open. This setup is stronger if the trend is in the same direction as the morning gap, but can also work as in this case. Due to the gap down, I was actively managing it on level 2, knowing full well sellers could appear and starting selling into strength.

Take a look at the chart and note how strong the initial two 1-minute candles are, with very little in the way of wicks. The slope is also very high, indicating desperation on the part of buyers to pick up the stock. These two factors - a strong initial rise and clean, almost-full candles - suggest that the uptrend is likely to continue.

Further confirmation of trend continuation came from the very minor retracement. I actually went long as soon as it broke, but the stock was thin and I got filled approximately 10 cents higher than my desired entry, but the stock kept moving higher. I was about to close it out as it started ticking back down (5th 1-minute candle), but I could see a buyer on level 2 holding the 50 cent level. So I decided that if the 50-cent level doesn't hold, I'll get out for a small loss. It then continued its ascent higher until it just stopped moving up, sellers got stronger on the offer side, and when they weren't getting filled, moved to hit the bids. I then covered my long.

It's as simple as that. Could have gone higher, but no one knows the future. By relying on the order flow, I won't be able to pick tops and bottoms 100% of the time, but it allows me to consistently rake in profits, which is the goal of trading.

Entry: 13.49

Exit: 14.17

Net profit after commissions: +66 cents per share

Another note to make here is the fact that this stock gapped down on the open. This setup is stronger if the trend is in the same direction as the morning gap, but can also work as in this case. Due to the gap down, I was actively managing it on level 2, knowing full well sellers could appear and starting selling into strength.

Attachments

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Nice one, Amit 😉

Richard

Richard

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

Where do I start...

1. What's the best platform for stock trading using level 2 and the tape? You use eSignal platform and datafeed? Can you use ninjatrader?

2. What is the best stock broker? Interactive?

1) I find IB's TWS suffficient for my needs. For those starting out, there is no need to go with expensive software like eSignal. Not sure about ninjatrader as I have never used it. Any broker software should do the job as long as it comes with the level 2 feed and time and sales screen.

2) I've only used IB, so cannot compare. I do find them very good. Though lately, my TWS workstation has been freezing and shutting down itself, which is really frustrating - especially when I am in a trade.

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Amit,

You have a message YKW

Richard

You have a message YKW

Richard

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

Amit,

You have a message YKW

Richard

Got it, thanks. Replied back 🙂

Check out this video: YouTube - Boris Schlossberg Millionaire Traders

This is just one of the traders in the book Millionaire Traders. The guy interviewed in the video, Steven Ickow, trades off the level 2 screen. It's clear tape reading works now as much as it did before.

Thanks for the video. Very inspirational. There is an article about him, its really good. Have you read it?:Steven Ickow - Black Box Trader

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

Thanks for the video. Very inspirational. There is an article about him, its really good. Have you read it?:Steven Ickow - Black Box Trader

Yes, that is the interview from the book Million Dollar Traders. He's a classic example of a trading edge. He was actually on the pit of the CME, so the experience he gathered there would definitely have helped him in how he trades now.

1) I find IB's TWS suffficient for my needs. For those starting out, there is no need to go with expensive software like eSignal. Not sure about ninjatrader as I have never used it. Any broker software should do the job as long as it comes with the level 2 feed and time and sales screen.

2) I've only used IB, so cannot compare. I do find them very good. Though lately, my TWS workstation has been freezing and shutting downy trade itself, which is really frustrating - especially when I am in a trade.

Does a person need 25K to daytrade like this? I read if you make more than 4 trades in 5 days you are a pattern day trader and you need to have 25k account.

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

Does a person need 25K to daytrade like this? I read if you make more than 4 trades in 5 days you are a pattern day trader and you need to have 25k account.

Yes, to day trade U.S. stocks more than 4 times in 5 days, you need at least 25K. Though, if you are just starting out, it is likely you will incur some losses. So, I often advise people open an account with 30K.

There are also umbrella accounts you can look into, but I am not too sure of the details.

In the level 2 do you only want to see Market Makers and hide ECN's? Is my level 2 set up right? I dont see goldman sachs or morgan stanley. On the level 2 quantity column there is only numbers like 4, 2, 1...Is that in thousands of shares?(4 = 4,000 shares). On the tape under size it shows 100, is that mean 100,000 shares? The market column shows EDGX, ADEN, NSDQ, are those the people who hit the bid or offer? If you dont want me to write in your journal just say so.

Similar threads

- Replies

- 512

- Views

- 69K

- Replies

- 9

- Views

- 6K