Giorrgi

Well-known member

- Messages

- 253

- Likes

- 0

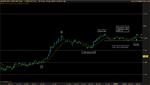

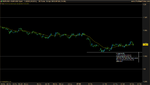

Two trades.

The second one was a little bit premature. One thing that seems to happen to me is that I'm too careful with IRBs/RBs etc and not careful enough with continuation BBs after a pullback or a consolidation mid-trend. I think these BBs, at least in my case, require a better assessment of the conditions AND of the setup. On the other hand RBs seem to break all over the place without much trouble if the setup fits the basic requirements.

That is of course just my observations based on the trades that I take.

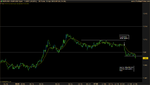

Today I was still sort of affected and when I imagined myself posting these trades before coming back home it was unpleasant thinking that I'll have to trade again tomorrow. But this forum really helps !

The second one was a little bit premature. One thing that seems to happen to me is that I'm too careful with IRBs/RBs etc and not careful enough with continuation BBs after a pullback or a consolidation mid-trend. I think these BBs, at least in my case, require a better assessment of the conditions AND of the setup. On the other hand RBs seem to break all over the place without much trouble if the setup fits the basic requirements.

That is of course just my observations based on the trades that I take.

Today I was still sort of affected and when I imagined myself posting these trades before coming back home it was unpleasant thinking that I'll have to trade again tomorrow. But this forum really helps !