I did not mean that he was pumping or anything like that , in fact I appreciate posters time and effort to help other members and I ordered this book days ago from Amazon.The guy has been sending us charts for months now. He doesn't like to advertise at all (see BigMike's trading forum on this), his book is very unknown, there is absolutely no online publicity for it and everything otherwise shows that he could care less about pumping his book. Frankly, there is always a chance that's someone is lying / masquerading, but in this case it seems very, very, very unlikely.

Oh and one other thing: most of us see half of these setups WHILE TRADING, then this gets confirmed when he sends us charts.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Giorrgi

Well-known member

- Messages

- 253

- Likes

- 0

I did not mean that he was pumping or anything like that , in fact I appreciate posters time and effort to help other members and I ordered this book days ago from Amazon.

well if he marks trades in hindsight that would mean that his method doesn't work and he's lying to us. what motive could there be in such case ? = sell the book. or advertise prorealtime trading.

This is not the case.

Marking possible setups in hindsight DOES NOT mean lying and DOES NOT mean his method does not work. What I mean is that it's easy to do compared to real time setup recognition.well if he marks trades in hindsight that would mean that his method doesn't work and he's lying to us. what motive could there be in such case ? = sell the book. or advertise prorealtime trading.

This is not the case.

I will study this book and learn es much as I can from it . To me a real test and proof s a "myfxbook" or similar funded account at least 6 months back. As far as I know not a single forex educator in the world can back his

teachings that way.

Last edited:

Giorrgi

Well-known member

- Messages

- 253

- Likes

- 0

And yet there are lots of people who earn their living trading forex. none of the will show you their account. But I haven't seen anyone put so much effort into helping other people as I have seen from Bob. Everything from his book to the way he (apparently) answers emails and the fact that he sends us charts every week show that he wants to help.

Once you go through the book a couple of times you'll be seeing a lot of the patterns that Bob shares with us week after week.

Also, I don't know how my messages have been perceived, but none of them were meant be agressive in any way. 🙂

Once you go through the book a couple of times you'll be seeing a lot of the patterns that Bob shares with us week after week.

Also, I don't know how my messages have been perceived, but none of them were meant be agressive in any way. 🙂

You don't need to show your account, why don't you just check out my fxbook.com and you can see what kind of service it offers? Even if you don't want to prove anything , it could be a valuable tool.And yet there are lots of people who earn their living trading forex. none of the will show you their account. But I haven't seen anyone put so much effort into helping other people as I have seen from Bob. Everything from his book to the way he (apparently) answers emails and the fact that he sends us charts every week show that he wants to help.

Once you go through the book a couple of times you'll be seeing a lot of the patterns that Bob shares with us week after week.

Also, I don't know how my messages have been perceived, but none of them were meant be agressive in any way. 🙂

virtuesoft

Member

- Messages

- 94

- Likes

- 2

Today was my first day back after the holidays. There was a bit of movement but I didn't spot any good setups so I stayed on the sidelines. Did anyone else trade?

stehlikpetrmsncom

Active member

- Messages

- 194

- Likes

- 3

Today was my first day back after the holidays. There was a bit of movement but I didn't spot any good setups so I stayed on the sidelines. Did anyone else trade?

I did, after some time off, but I didn't spot much either.

Attachments

I was guilty of over-trading the past couple of trading days. Today I only took 2 trades and had 2 winners. When I start to over-trade my method of getting back on track is to say to myself in my mind that hypothetically I am only allowed to have one trade in the whole week so given all factors would this be the best trade I could take in the whole week. It seems to make it easier for me as even an inkling of doubt = no trade. So the trades that I took today were textbook examples of my strategy trades. Don't know if that is a useful tip for anyone, interested to hear how others cope with itchy trigger fingers...

M

M

Hi guys,

I know we have all noticed the lack of volatility, but a few facts to back it up:

I have monitored the daily ranges (and averaged them on a rolling six month basis) since 1999, and the Yen, Cable, Swissy and Loonie are all at historical lows in terms of that six month average. The Euro is 16% from the historical low to its historical high, and the Aussie is at 23% on the same measure.

(By the way, if you take the latest six month average daily range and divide it by the spread on each of the six majors (plus brokerage if you use an ECN), it gives you a proxy ratio for which pair is the best to scalp with. It still supports the Euro in this regard, by quite a margin.)

Secondly, I also record the monthly volume announcements from ICAP, and FX volumes traded dropped by 29.4% for the year (volumes dropped 37.3% in 2009, but recovered by 13.2% and 4.6% in 2010 and 2011 respectively). ICAP's volumes are almost half what they were in its peak year, 2008. It is tough out there.

All this doesn't help us select winning trades, but does give us some evidence of how tough market conditions are out there. In my opinion, if we can make a fist of scalping in these conditions, it will be a breeze when it eventually normalises a little.

Like you guys, I found Monday's European session a bit tough, particularly for the first day of a new year with all the positive vibes and expectations. I didn't take one trade. Best of luck to all you "Volmanites" for a better year ahead. "May the odds be ever in your favor".

Cheers, Jeremy

I know we have all noticed the lack of volatility, but a few facts to back it up:

I have monitored the daily ranges (and averaged them on a rolling six month basis) since 1999, and the Yen, Cable, Swissy and Loonie are all at historical lows in terms of that six month average. The Euro is 16% from the historical low to its historical high, and the Aussie is at 23% on the same measure.

(By the way, if you take the latest six month average daily range and divide it by the spread on each of the six majors (plus brokerage if you use an ECN), it gives you a proxy ratio for which pair is the best to scalp with. It still supports the Euro in this regard, by quite a margin.)

Secondly, I also record the monthly volume announcements from ICAP, and FX volumes traded dropped by 29.4% for the year (volumes dropped 37.3% in 2009, but recovered by 13.2% and 4.6% in 2010 and 2011 respectively). ICAP's volumes are almost half what they were in its peak year, 2008. It is tough out there.

All this doesn't help us select winning trades, but does give us some evidence of how tough market conditions are out there. In my opinion, if we can make a fist of scalping in these conditions, it will be a breeze when it eventually normalises a little.

Like you guys, I found Monday's European session a bit tough, particularly for the first day of a new year with all the positive vibes and expectations. I didn't take one trade. Best of luck to all you "Volmanites" for a better year ahead. "May the odds be ever in your favor".

Cheers, Jeremy

Last edited:

stehlikpetrmsncom

Active member

- Messages

- 194

- Likes

- 3

Hi guys,

I know we have all noticed the lack of volatility, but a few facts to back it up:

I have monitored the daily ranges (and averaged them on a rolling six month basis) since 1999, and the Yen, Cable, Swissy and Loonie are all at historical lows in terms of that six month average. The Euro is 16% from the historical low to its historical high, and the Aussie is at 23% on the same measure.

(By the way, if you take the latest six month average daily range and divide it by the spread on each of the six majors (plus brokerage if you use an ECN), it gives you a proxy ratio for which pair is the best to scalp with. It still supports the Euro in this regard, by quite a margin.)

Secondly, I also record the monthly volume announcements from ICAP, and FX volumes traded dropped by 29.4% for the year (volumes dropped 37.3% in 2009, but recovered by 13.2% and 4.6% in 2010 and 2011 respectively). ICAP's volumes are almost half what they were in its peak year, 2008. It is tough out there.

All this doesn't help us select winning trades, but does give us some evidence of how tough market conditions are out there. In my opinion, if we can make a fist if scalping in these conditions, it will be a breeze when it eventually normalises a little.

Like you guys, I found Monday's European session a bit tough, particularly for the first day of a new year with all the positive vibes and expectations. I didn't take one trade. Best of luck to all your "Volmanites" for a better year ahead. "May the odds be ever in your favor".

Cheers, Jeremy

Thanks for sharing that, these are some interesting stats.

Hi guys,

I know we have all noticed the lack of volatility, but a few facts to back it up:

I have monitored the daily ranges (and averaged them on a rolling six month basis) since 1999, and the Yen, Cable, Swissy and Loonie are all at historical lows in terms of that six month average. The Euro is 16% from the historical low to its historical high, and the Aussie is at 23% on the same measure.

Like you guys, I found Monday's European session a bit tough, particularly for the first day of a new year with all the positive vibes and expectations. I didn't take one trade. Best of luck to all you "Volmanites" for a better year ahead. "May the odds be ever in your favor".

Cheers, Jeremy

Nice post, ta

BLS

Established member

- Messages

- 642

- Likes

- 229

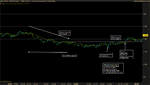

I've been a bit lazy with posting my charts. I'll try to post more detailed charts since it forces me to think more critically about my live session decision making.

Attachments

BLS

Established member

- Messages

- 642

- Likes

- 229

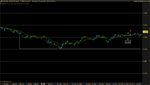

Hey guys,

I am new in trading bob´s strategy, so any comments are welcomed. These setups appeared yesterday. First is nice ARB, however I was checking my Facebook, so I missed it. The second one is kinda aggresive BB, but imo tradable.

Thought the goal is to recognize setups in a live environment, recognizing setups in hindsight is still a step forward. The ARB looks good. I agree that the BB is quite aggressive but I'd be more inclined to skip it.

Took two trades today. Another big bullish spike like yesterday without seeing any opportunities to trade. I eventually saw a setup against the overall bullish pressure (though the 70 tick chart at the time doesn't show it) and took it even though I was a bit uncomfortable with it. I lost confidence in the trade when I saw it stall in the 40 area so I bailed early.

E2 looks good to me but seeing it fail has made me question whether the range formation was favorable or not given the earlier bear move (after my E1). This could be view as a range reversal . If that were the case then it would be better to see a Ww pattern before trading. Or it's a valid setup that just didn't work out.

Attachments

Last edited:

More charts from Bob

Thank you and Bob

matty_dunn

Active member

- Messages

- 188

- Likes

- 17

More charts from Bob

Thank you Bob and BLS. Look forward to this every week.

I know Bob Volman trades spot forex, but I trade futures.

Since spot is different by the amount of forward points, I add the 00, 20, and 50 lines from spot forex on my chart.

So the purple lines on the chart are what the corresponding price would be on the spot market ( adding the forward points ).

Do anyone else do something like this ?

Since spot is different by the amount of forward points, I add the 00, 20, and 50 lines from spot forex on my chart.

So the purple lines on the chart are what the corresponding price would be on the spot market ( adding the forward points ).

Do anyone else do something like this ?

Attachments

Similar threads

- Replies

- 15

- Views

- 8K