Rest of my trades from 7/19/2012 (Didn't trade on 7/20):

Charts are in GMT.

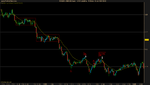

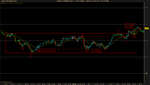

S1: Skipped DD setup. There seems to be some strong resistance at the 40 level with the bears trying three times to pierce the level (1). That pullback was more horizontal then diagonal. Though perhaps a more aggressive scalper could trade this given the strong trend.

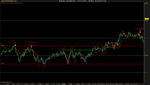

E2: Failed DD setup. The with trend move and that 50% retracement are textbook. Prices pullback into former resistance area at (1) which coincided with the 20EMA. A setup like this isn't guaranteed to work out but the odds do favor it. Textbook setups can fail from time to time and this was one of those times. Oh well.

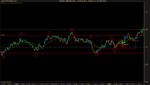

E3: Countertrend RB. After a strong down trend, prices swung violently and ranged around the 40 level. The bears have the advantage but the bulls aren't just going to take it. They manage to form a mini double bottom (1,2) as the bears try to push prices below the 40 level; the bears were doing a decent job too since they capped prices under the 20 EMA. From this base of support, the bulls gradually bring prices back up the 40 level. There's a lot contracts being exchanged here given the slow manner the prices came back up, which shows the bulls struggling. The bears whack the bulls back down at (3) in a strong move, but the bulls counter with an equally strong move, forming an equal high (4). The bears are eager to defend this level of resistance but sideline bulls come in a buy up at a higher price (5). Things are getting interesting.

One could draw their top barrier where the green line is given the amount of resistance there. The bears yet again sell off heavily at resistance (6), breaking that low of (5), but still printing a higher low overall. The pressure inside this range isn't too obvious. It looks like the bulls and bears are locked in a stalemate between swinging prices up and down, so we have to look for subtle clues to determine what the future direction of price action is likely to be. After being slammed down yet again (6), the bulls pushed their way through that heavy resistance (green line), perhaps surprising the bears. We can redraw the upper barrier after the high of (7) formed. The bears may have been surprised but they try to redeem themselves and bring prices below the broken resistance (dotted block, 8). The subsequent bullish response however shows us who's really in charge. With a false break to the downside, the bulls have made it clear that they are going to push prices even higher.

This is not the best of range breaks. My preferred stop would have been at the green line or even the low of (8) but that's an extra 3-5 pip for insurance. I forgo this insurance only to see my trade get stopped in a false counter move.

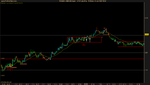

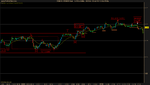

E4: I did not throw in the towel after that false break move stopped out my trade. That bullish response encouraged me to look for another way in the market. The bulls brought prices back to resistance (red segment), where we had some pre-breakout tension from those three dojis. This wasn't a good looking clustering ARB but was valid nonetheless. We have some hesitation after a range break, which forms some clustering and a signal line to trade the break of. I end up closing out 2 pip short of target after prices stall because I was really hungry and wanted to grab something to eat.